Help and support the creative community

Learn the Ins and Outs of Business and Finance

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Subscribe to our Newsletter

The earth is fair, mourning is not a burden, the pillow is a meal.

Popular Categories

The Chweya Room Podcasts

What Is Zidii Trader?

March 4, 2026 | by Vincent Nyagaka

Zidii Trader is a digital investment platform offered by Safaricom in Kenya that allows individuals to invest money directly from...

Read More →

How to File Nil Tax Returns in Kenya (Step-by-Step Guide)

January 17, 2026 | by Vincent Nyagaka

If you are registered with the Kenya Revenue Authority (KRA) but earned no income in a given year, you are...

Read More →

How to Check Your 2025 KCSE Results

January 9, 2026 | by Vincent Nyagaka

Knowing how to check your 2025 KCSE results is an important step for every candidate, as the results determine your...

Read More →

FXPesa vs Exness: Which Forex Broker Is Better for Kenyan Traders in 2026?

January 2, 2026 | by Vincent Nyagaka

Choosing between FXPesa and Exness can feel challenging, especially when both brokers appear strong on the surface. This FXPesa vs...

Read More →

FXPesa Review 2026: Regulation, Fees, Trading Platforms, Pros and Cons

January 2, 2026 | by Vincent Nyagaka

In this FXPesa review, we take a deep, unbiased look at the broker’s regulation, trading platforms, fees, account types, safety,...

Read More →

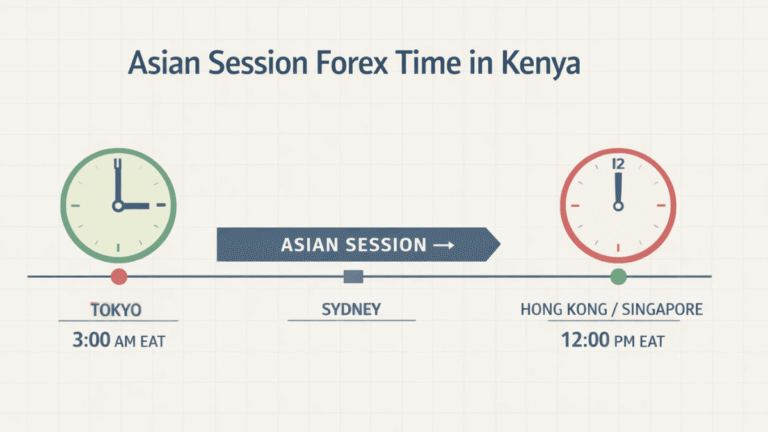

Asian Session Forex Time in Kenya

January 2, 2026 | by Editorial Staff

Asian Session Forex Time in Kenya is one of the most searched topics among traders who want to understand when...

Read More →