Have you ever found yourself in a challenging financial situation and wondered how to access quick mobile loans? Worry no more; the Koro Loan app review and application guide will walk you through the registration, application, and repayment process and how to raise issues.

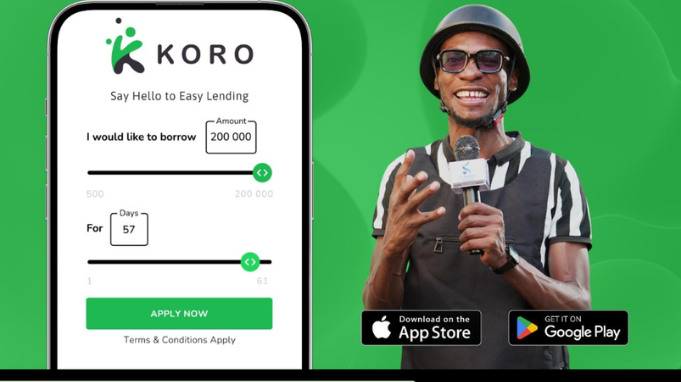

The mobile app offers quick access to funds and flexible payment terms.

The app is available for download and installation on your smartphone from the Google Play Store.

Koro Loan App Features

1.) Efficient Loan Application and Disbursement

Loan approvals and disbursements occur within minutes, enabling efficient mobile financial solutions.

Additionally, the app offers a streamlined application process that requires minimal personal information.

2.) Flexible Loan Management

Top-ups and loan extensions on the app enable users to manage their loans according to their individual needs.

3.) Clear Loan Terms and Conditions

The interest rates and related information are displayed on the app for users to read and understand.

4.) Wider Options for Loan Products

The loan is available to all Kenyan adults with a Safaricom line and national ID, ensuring broad reach.

How the Koro Loan App Works

Koro Loan App in Kenya provides the general public with a platform to access quick and flexible loans via mobile devices.

Users can download the app, register, make an application, and receive funds directly to their M-Pesa accounts.

Koro Loan App utilizes internal credit policies and algorithms to assess creditworthiness and manage loan disbursements.

Application process simplified

1.) Registration and Application

Download the Koro app from the Google Play Store or App Store. Register on the app and provide the necessary personal and financial information.

Koro loan app uses the information, along with data from your device, to assess your creditworthiness and determine your eligibility for a loan.

2.) Loan Approval and Disbursement

Once your application is approved, the loan amount is disbursed directly to your M-Pesa account.

This process can be speedy, sometimes taking only a few minutes, according to the app.

3.) Repayment and Period Extensions

The Koro Loan App offers flexible repayment options, and users can make repayments at any time.

It’s good to note that loan extensions of 7, 14, or 30 days are also available.

4.) Other Notable Features

Koro Loan App offers a “Member Get Member” marketing program where existing borrowers can earn bonuses when they refer new users.

The app also features a top-up option for existing loans, allowing users to add additional funds.

Zenka Digital Limited operates Koro and is a digital credit provider.

Requirements for Applying for the Koro Loan

To apply for a Koro loan, you need to download the Koro Loan App, fill out a short application form, and provide your M-Pesa details. Koro evaluates your application based on your creditworthiness, which is determined by analyzing your M-Pesa transaction history using accessibility services.

1.) Download and Install the App

Download the Koro Loan App from the Google Play Store.

2.) Registration process

Sign up with Koro and provide the necessary information.

3.) Loan Application

Specify the desired loan amount, and the app will request permission to access your MPESA transaction data via USSD to determine creditworthiness.

You will temporarily need to enter your M-PESA PIN to verify your bank statement.

4.) Loan Approval and Disbursement:

Koro will evaluate your application, and if you get approved, the loan amount will be disbursed to your M-PESA account.

What limits one from accessing Koro loans?

1.) Negative repayment history

When users have poor credit scores with Koro or other lenders, this is a factor considered during the loan appraisal.

2.) Incomplete or inaccurate personal information

If key facts are omitted during the registration process, it may not be easy to assess the loan applications.

3.) Inconsistent or insufficient phone usage data

Koro also uses this to analyze and determine creditworthiness.

4.) Multiple active loans

If this is the case and clients exceed the set credit limit, it becomes an issue that requires consideration.

5.) Unregistered or inactive M-Pesa account

This means that there may be limited information available for review regarding the loan applicant.

6.) Failure to repay previous Koro loans on time

A poor credit history can affect eligibility for future loans.

7.) Using a non-Safaricom line

This is a significant challenge because Koro currently supports only Safaricom users.

How to verify users’ status on the Koro Loan app

One can verify the status on the Koro Loan app interface. The app achieves this by using a combination of methods, including reviewing submitted information, accessing financial data via USSD, and potentially checking with mobile money providers as well as the Integrated Population Registration System (IPRS).

This process helps determine the user’s identity, creditworthiness, and eligibility for a loan.

Koro Loan Limit and Interest Rate

The Koro loan app offers loan amounts ranging from KSh 500 to KSh 200,000. The interest rate on Koro loans ranges from 2.45% to 39%* of the principal amount. New users can access a fixed-term loan of 61 days for their first loan. Koro allows customers to build their loan limit up to KSh 200,000 by making timely repayments.

More information is shared below:

Loan Amounts: Koro provides loans from KSh 500 to KSh 200,000.

Interest Rates: The interest fee ranges from 2.45% to 39%* of the principal amount.

First Loan Term: New users are typically offered a fixed-term loan of 61 days.

Building Your Limit: Koro allows you to increase your loan limit with each successful repayment, potentially reaching KSh 200,000.

Example: For a 61-day loan of KSh 1,000, the interest fee would be KSh 390, and the total amount due would be KSh 1,390.

Repayment Flexibility: There’s no minimum repayment period; you can make payments toward the principal at any time after disbursement.

Minimum Effective Annual Percentage Rate (MEAPR): 30%*

Maximum Effective Annual Percentage Rate (MEAPR): 4432%*

How to repay Koro Loan

The Koro loan app offers loan amounts ranging from KSh 500 to KSh 200,000. The interest rate on Koro loans ranges from 2.45% to 39%* of the principal amount. New users can access a fixed-term loan of 61 days for their first loan. Koro allows customers to build their loan limit up to KSh 200,000 by making timely repayments.

Koro Loan Default Fees

Koro Loan’s default fees include a daily late payment interest charge of 1.5% on the outstanding principal, up to the total principal amount. This fee is applied if payments are sorted within the agreed repayment period.

Facts about the Koro Loan App

Borrowers need to understand the other adverse impacts of using the application, such as;

1.) CRB Listing Risk

Non-payment quickly leads to a negative credit listing, which can affect future loan access from other platforms as well.

2.) High Interest Rates

Interest rates can go as high as 4432% APR, making it expensive for some borrowers.

3.) Penalty Charges Accumulation

Penalties (of up to 2.5%) accrue daily, which can greatly increase the debt load for missed payments.

It can be expensive to settle in the long run, and borrowers may end up paying more for the interest on loans

4.) Limited Loan Amounts for New Users

Initial loan limits are low, requiring a longer time and a proven repayment history to access higher amounts.

5.) Dependence on Safaricom Network: Exclusivity to Safaricom users limits access for individuals using other mobile networks.

6.) Potential for Rejection Without Explanation: Koro reserves the right to decline loan applications without providing specific reasons.

It may be based on the evaluation of material facts that cannot be ignored and may seem to have a direct impact on future repayments.

How to Mitigate Default Risks

Borrowers can consider restructuring loans by modifying repayment terms or extending maturity dates.

It reduces the interest rates, therefore giving borrowers the space needed to regain financial stability.

Defaulting is usually a serious issue that borrowers need to avoid to have a stress-free loan repayment experience.

Frequently Asked Questions

The brand name Koro, along with its logo, is owned by Zenka Digital Limited.

Get Instant Loans Online in Kenya with the Koro Loan App. The application process is clear and efficient, allowing you to request a loan online.

You are required to present proof of income and a valid ID. You need to fill out the application form (online) with the desired loan amount and preferred loan repayment terms, and then press ‘Submit.’

First, users need to verify the process and procedures for disbursement. Secondly, verify whether proper documentation is required and if they adhere to their established policies.

Consider the ownership and reputation of the loan app to help you make informed decisions.

No, a loan app generally cannot access your contacts after installation, assuming you have revoked all permissions and the app doesn’t have independent access to your device’s contact list.

However, kindly note that data collected during the app’s use may still be stored on the app’s servers.

Watch out for the following;

a.) Approval is guaranteed without proper verification.

b.) The lender is charging advance fees.

c.) The lender pressures you to apply “immediately.”

d.) The lender is contacting you first.

e.)The lender’s terms appear unusual.

f.) The lender is missing out on contact information and physical location.

Conclusion

I hope the guide was helpful and informative, assisting you in making informed decisions about mobile loan uptake.

There are numerous loan app alternatives and mobile lending apps available in the market that offer mobile financial solutions. It can be the first step on your journey to financial freedom.

I hope this review helped you understand how the Koro loan app works and what makes it unique. You may also want to see my ultimate guide to the best loan apps in Kenya or check out my reviews of Kashbean and Branch for similar mobile lending options.

Content Strategist with copywriting skills cultivated over five years. I have accomplished multiple projects that have yielded valuable results. I am enthralled by business, fintech, and global eco-politics practices that ensure sustainability.