Safaricom M-PESA rate changes are shared with the general public periodically. The mobile money service by Safaricom enables Kenyans to make seamless transactions.

M-PESA customers can send money, pay bills, or access loans by using the Safaricom SIM toolkit manually or by dialing the USSD code *334#, selecting the desired service, and following the prompts. They can also access M-PESA through the M-Pesa App and the MySafaricom App on iOS and Android.

Users can send money and pay bills to other mobile money platforms in Kenya, such as Airtel Money and T-Kash by Telkom Kenya.

The maximum amount per M-Pesa transaction is Ksh 250,000, which is the same as for withdrawals via agents.

The maximum balance that can be held in the account is Ksh. 500,000.

Safaricom M-PESA has harmonized the charges for sending money to other mobile money platforms.

1) Mpesa transfers made using registered mobile money users (M-Pesa, Airtel Money, and T-Kash) – rates

The rates in the table below apply to anyone when sending money from M-Pesa. This is not limited to registered Mpesa users and to other networks.

Transaction Range (Kshs) | Mpesa charges |

1-49 | FREE |

50-100 | FREE |

101-500 | 7 |

501-1,000 | 13 |

1,001-1,500 | 23 |

1,501-2,500 | 33 |

2,501-3,500 | 53 |

3,501-5,000 | 57 |

5,001-7,500 | 78 |

7,501-10,000 | 90 |

10,001-15,000 | 100 |

15,001-20,000 | 105 |

20,001-35,000 | 108 |

35,001-50,000 | 108 |

50,001-250,000 | 108 |

2) Withdrawal rates from registered M-PESA agents in Kenya

If planning to withdraw money from M-Pesa, the table below can offer the rates charged.

It defines withdrawal charges from Mpesa agents for amounts ranging between 50 and 150,000.

Transaction Range (Kshs) | Withdrawal Charges |

50-100 | 11 |

101-500 | 29 |

501-1,000 | 29 |

1,001-1,500 | 29 |

1,501-2,500 | 29 |

2,501-3,500 | 52 |

3,501-5,000 | 69 |

5,001-7,500 | 87 |

7,501-10,000 | 115 |

10,001-15,000 | 167 |

15,001-20,000 | 185 |

20,001-35,000 | 197 |

35,001-50,000 | 278 |

50,001-250,000 | 309 |

3) Mpesa ATM withdrawal rates

The illustration below provides an overview of the fees related to making withdrawals from an ATM using your M-PESA account.

Just like other transaction types, it’s essential to be informed about the costs to manage your finances effectively.

Range (Ksh.) | ATM Withdrawal Fees (Ksh.) |

200-2,500 | 35 |

2,501-5,000 | 69 |

5,001-10,000 | 115 |

10,001-35,000 | 203 |

4) Business Till – Customer and Pochi la Biashara rates

The rates apply to you when:

- Transacting from M-Pesa to Pochi la Biashara.

- Sending money from the M-Pesa Business Till to a customer’s phone number

Transaction Range (Kshs) | Mpesa charges |

1-49 | FREE |

50-100 | FREE |

101-500 | 7 |

501-1,000 | 13 |

1,001-1,500 | 23 |

1,501-2,500 | 33 |

2,501-3,500 | 53 |

3,501-5,000 | 57 |

5,001-7,500 | 78 |

7,501-10,000 | 90 |

10,001-15,000 | 100 |

15,001-20,000 | 105 |

20,001-35,000 | 108 |

35,001-50,000 | 108 |

50,001-250,000 | 108 |

5) Free M-Pesa transactions

Despite Mpesa increasing its rates to address tax obligations, some transactions continue to remain free to users.

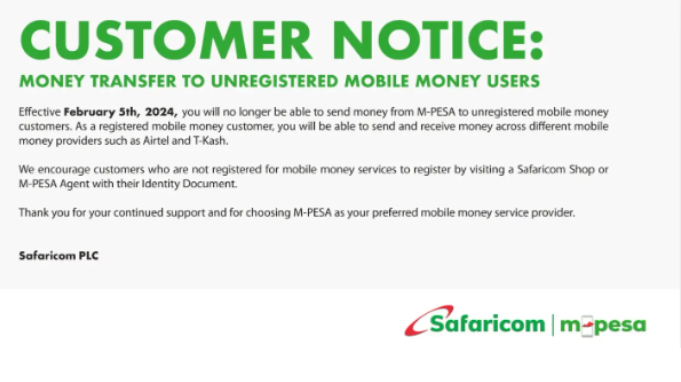

6) Mpesa transfer charges for unregistered users.

Note that Safaricom discontinued the ability to transact from M-Pesa to unregistered users.

This was taken into effect through a public notice that was released on 5th February, 2024.

You only receive money via M-Pesa if all users adhere to the public notice guidelines.

An unregistered user refers to a phone number that is not fully registered for mobile money services, such as with Mpesa, Airtel Money, or T-Kash.

Transaction Range (Kshs) | Transfer to unregistered users to all networks(Kshs) |

1-49 | N/A |

50-100 | N/A |

101-500 | 47 |

501-1,000 | 51 |

1,001-1,500 | 61 |

1,501-2,500 | 76 |

2,501-3,500 | 115 |

3,501-5,000 | 139 |

5,001-7,500 | 171 |

7,501-10,000 | 211 |

10,001-15,000 | 273 |

15,001-20,000 | 296 |

20,001-35,000 | 318 |

35,001-50,000 | 318 |

50,001-250,000 | 318 |

The user will not be able to transact from Mpesa to customers from other networks who have not complied.

Previously, one could transact via Mpesa to unregistered end users. They would receive a voucher notification to use for claiming cash at any M-Pesa registered agents nationwide.

Here are the rates that were previously applied for sending money to unregistered users.

Bonus Tips

- Maximum Mpesa account balance: Kshs. 500,000

- Maximum daily transaction: Kshs. 500,000

- Maximum amount per transaction: Kshs. 250,000

- The minimum amount for withdrawal at M-PESA agent is Kshs 50

Conclusion

By understanding these rates, one can plan better when dealing with M-PESA transactions as well as getting the most value from this innovative financial service.

Transaction rates are also applied by various platforms such as banks, mobile lending apps, insurance and investment platforms.

Content Strategist with copywriting skills cultivated over five years. I have accomplished multiple projects that have yielded valuable results. I am enthralled by business, fintech, and global eco-politics practices that ensure sustainability.