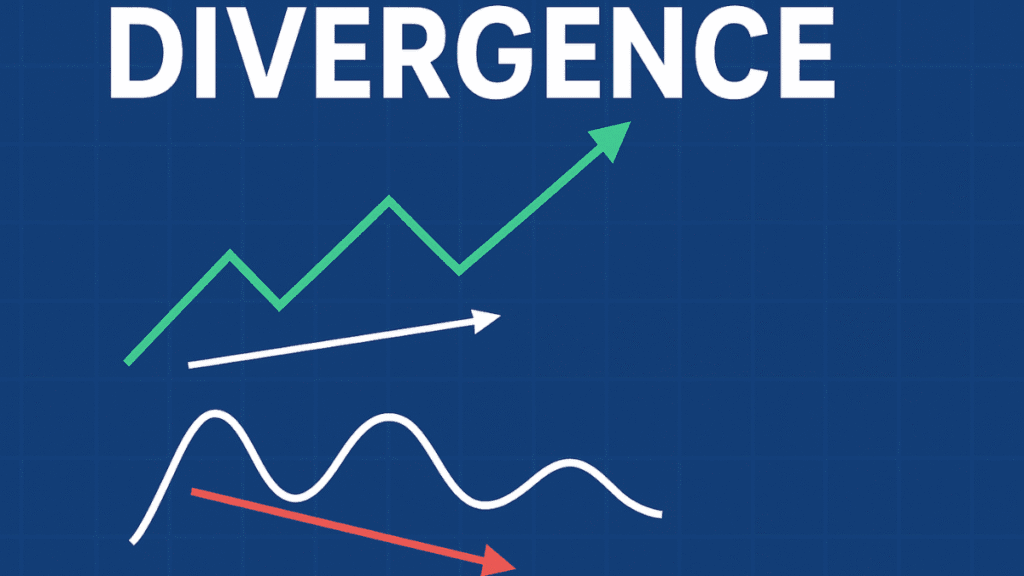

In technical analysis, divergence occurs when an asset’s price moves in one direction while a related indicator moves in the opposite direction. This divergence between price action and a technical indicator can serve as a leading signal that momentum is shifting — often before the price itself reflects that shift.

Because divergence can highlight underlying weakness in a trend or hint at its continuation, it has become a key tool for traders seeking an edge. In this article, we’ll dive into the concept of divergence, explore its types (regular and hidden), examine how to spot them, discuss which indicators to use, review limitations, and offer practical trading-tips to improve reliability. By the end you’ll have a clear, actionable understanding of how divergence fits into your trading toolkit.

Key takeaways:

- Always compare price pivots (highs/lows) with indicator pivots.

- Use divergence as an early warning tool, not a standalone trigger.

- Confirm with other technical evidence (volume, trendlines, support/resistance).

- Manage risk—but don’t ignore divergence because of its limitations.

- Track your setups, review outcomes, and refine your approach over time.

Why Divergence Matters

When you trade based solely on price, you may miss early warning signs. Divergence helps by showing that price momentum — as captured by an indicator — is not confirming the price move. For example:

- Price is making new highs, but the indicator is failing to make new highs: that suggests the up-trend may be weakening.

- Price is making new lows, but the indicator is making higher lows: that hints at waning selling pressure and potential reversal.

Because divergence is often a leading sign (rather than lagging), it gives you more time to act — whether that means exiting a position, tightening a stop-loss, or preparing for a trend reversal.

In short: divergence enhances your awareness of trend strength and possible exhaustion, making it a valuable addition to a disciplined trading framework.

Types of Divergence: Regular vs Hidden

Understanding that not all divergences mean the same thing is vital. There are two main types: regular and hidden. Each can have either a bullish or bearish bias.

Regular Divergence

- Regular bullish divergence: Price makes lower lows (LL) while an oscillator makes higher lows (HL). This suggests the down-trend may be weakening and a reversal to the upside is possible.

- Regular bearish divergence: Price makes higher highs (HH) while the oscillator makes lower highs (LH). This signals the up-trend’s momentum is fading and a reversal to the downside may be near.

Interpretation: Regular divergence is typically used to signal a trend reversal.

Hidden Divergence

Hidden divergence is less obvious but equally important in trend analysis: it signals that the current trend may continue rather than reverse.

- Hidden bullish divergence: In an up-trend, price makes a Higher Low (HL) but the oscillator makes a Lower Low (LL). This indicates underlying strength in the up-trend and suggests continuation.

- Hidden bearish divergence: In a down-trend, price makes a Lower High (LH) but the oscillator makes a Higher High (HH). This shows underlying weakness still driving the down-trend, hinting the down-trend will persist.

Interpretation: Hidden divergence = trend continuation; Regular divergence = possible reversal.

Common Indicators That Produce Divergence Signals

Divergence is most often applied between price and momentum or trend-strength indicators. Some widely used ones:

- Relative Strength Index (RSI): Measures speed and change of price movements. Divergence between price and RSI often signals turning points.

- Moving Average Convergence Divergence (MACD): Shows relationship between two moving averages and their difference. Divergence with price may be telling.

- Stochastic Oscillator: Compares closing price to its price range over a period. Useful for spotting divergence in overbought/oversold conditions.

- Volume or volume-based indicators: E.g., if price rises but volume falls, that is a type of divergence signalling weak demand.

Choosing which indicator to use depends on your trading style, time-frame, and the asset. But the key is always: watch for mismatch between price pivots (highs/lows) and indicator highs/lows.

How to Identify Divergence Step-by-Step

Here’s a simple checklist you can follow:

- Choose your time-frame and asset (e.g., daily chart of a stock or currency pair).

- Plot your chosen indicator (RSI, MACD, Stochastic etc.).

- Identify recent price pivots: highs and lows (e.g., the last two major peaks or troughs).

- Identify the corresponding pivots on the indicator (two highs or two lows) matching the time-frame of step 3.

- Compare directions:

- For regular bullish: price → LL; indicator → HL

- For regular bearish: price → HH; indicator → LH

- For hidden bullish: price → HL; indicator → LL

- For hidden bearish: price → LH; indicator → HH

- Confirm the divergence: Look for other signals (trendline break, candlestick patterns, support/resistance, volume, etc). Divergence alone is rarely sufficient.

- Define your trade plan: entry zone, stop-loss, target. Use risk management.

- Monitor price action after signal: If price moves into consolidation or clear reversal, the divergence was effective; if not, accept the risk, possibly exit.

Practical Examples and Interpretation

Here are two illustrative examples:

Example 1: Regular Bearish Divergence

Imagine a stock rising and making a new high. The RSI indicator, however, makes a lower high compared to its previous high. This mismatch suggests the rally lacks momentum. The trader might then:

- Use the divergence as an early warning.

- Look for price to break a trendline or support level.

- Set a stop-loss above the recent high.

- Consider exiting long positions or entering a short-sell.

Example 2: Hidden Bullish Divergence

In an up-trend, price pulls back and makes a higher low. The MACD, however, makes a lower low — indicating underlying momentum is still positive. This suggests the up-trend is likely to resume. The trader might:

- Consider adding to a long position or initiating one.

- Use support zone as entry.

- Place stop-loss below the higher low.

- Target next resistance level.

Interpreting these correctly requires discipline, proper confirmation, and risk management.

Strengths and Limitations of Divergence

Strengths

- Provides early warning of weakening trends.

- It works across different markets: stocks, forex, commodities, crypto.

- Easy to apply visually once you’re familiar with price/indicator pattern mismatches.

Limitations

- Divergence signals can appear early and the trend may continue for a while before reversing — false signals are possible.

- In strong trends, divergence may not lead to immediate reversal and can simply mark a pause.

- Divergence does not specify timing of reversal — you may see divergence but price may keep moving for a long time.

- Doesn’t replace other technical tools — confirmation is key.

In short: divergence is a valuable tool, but it must be used within a full trading framework — not as a standalone signal.

Practical Trading Tips and Best Practices

Here are some actionable tips to increase the usefulness of divergence in your trading.

- Use higher time-frames (e.g., 4-hour, daily) for more reliable signals; lower time-frames often contain noise.

- Combine divergence with support/resistance levels, trendlines, candlestick patterns and volume confirmation.

- Watch for hidden divergence in trending markets — it allows you to trade the trend rather than fight it.

- For reversal signals (regular divergence), be patient: wait for price confirmation (break of structure, pattern completion) before committing.

- Use proper risk management: define stop-loss, position size, reward-to-risk ratio. Divergence may increase odds but does not ensure success.

- Maintain a trading journal: record divergence setups (type, indicator, chart, outcome) to build experience and filter what works for your style.

- Be aware of market context: fundamental news, macro factors, volatility regimes can affect how divergence plays out.

- Avoid over-trading: not every divergence leads to a trade. Let the signal mature, confirm, then act.

When to Use Divergence (and When Not)

Good moments to use divergence

- Near the end of a strong up-trend or down-trend: momentum may fade, divergence may signal a turn.

- During consolidations where price movement slows down: divergence may hint when a breakout or reversal is coming.

- In trending markets for hidden divergence: to identify continuation and possibly capture more of the trend.

Situations to be cautious

- Highly volatile, choppy markets: many false divergence signals.

- Very strong trend without signs of exhaustion: divergence may appear but trend may still continue strongly.

- When the indicator is lagging badly or unsuited to the time-frame you’re trading.

By being selective and patient you increase the probability that your divergence signal aligns with actual market behaviour.

Summary

Divergence is a powerful concept in technical analysis. When price moves in one direction while an indicator moves differently, this mismatch signals a potential change in momentum. Understanding both regular divergence (for possible reversals) and hidden divergence (for trend continuation) gives traders a richer framework for decision-making.

By combining divergence with a robust trading plan, you can bolster your awareness of trend strength and enhance your timing. Properly applied, divergence becomes one of the high-quality tools in your trading arsenal.