If you’re a freelancer, affiliate marketer, or online business owner in Kenya, you’ve probably asked yourself how to withdraw money from Payoneer to M-Pesa. The process used to be complicated, but today there are reliable, safe ways to move your Payoneer funds directly into your M-PESA wallet or a Kenyan bank account linked to M-PESA.

This article is a detailed guide explaining exactly how to transfer Payoneer money to M-PESA step by step, the options available, and how to make your withdrawals faster and cheaper.

What is Payoneer?

Payoneer is a global online payment platform that allows freelancers, businesses, and professionals to receive and send payments across borders. It’s popular among remote workers and companies working with international clients, especially on platforms like Upwork, Fiverr, Amazon, and Airbnb.

With Payoneer, users get a virtual USD, EUR, or GBP account to receive payments. The challenge for Kenyan users has always been how to access those funds locally, which brings us to the Payoneer M-PESA solution.

Can You Withdraw from Payoneer to M-PESA Directly?

Currently, Payoneer does not support direct withdrawals to M-PESA. However, you can still transfer money from Payoneer to M-PESA indirectly through trusted intermediaries or by linking your Payoneer account to a Kenyan bank account that supports M-PESA withdrawals.

Let’s go through both options in detail.

Option 1: Withdraw from Payoneer to M-PESA via Kenyan Bank Account

The easiest and safest method to withdraw from Payoneer to M-PESA is by first transferring the funds to your local Kenyan bank account that supports M-PESA.

Step-by-Step Process

- Log in to your Payoneer account.

Go to payoneer.com and sign in. - Add your Kenyan bank account.

- Navigate to Settings > Bank Accounts.

- Add your local KES (Kenyan Shilling) bank account.

- Payoneer will verify the account within 1–3 business days.

- Withdraw to your bank account.

- Once verified, go to Withdraw > To Bank Account.

- Choose your bank and enter the amount.

- Confirm the transaction.

- Receive funds in your bank.

- The funds usually arrive in 1–3 business days, depending on your bank.

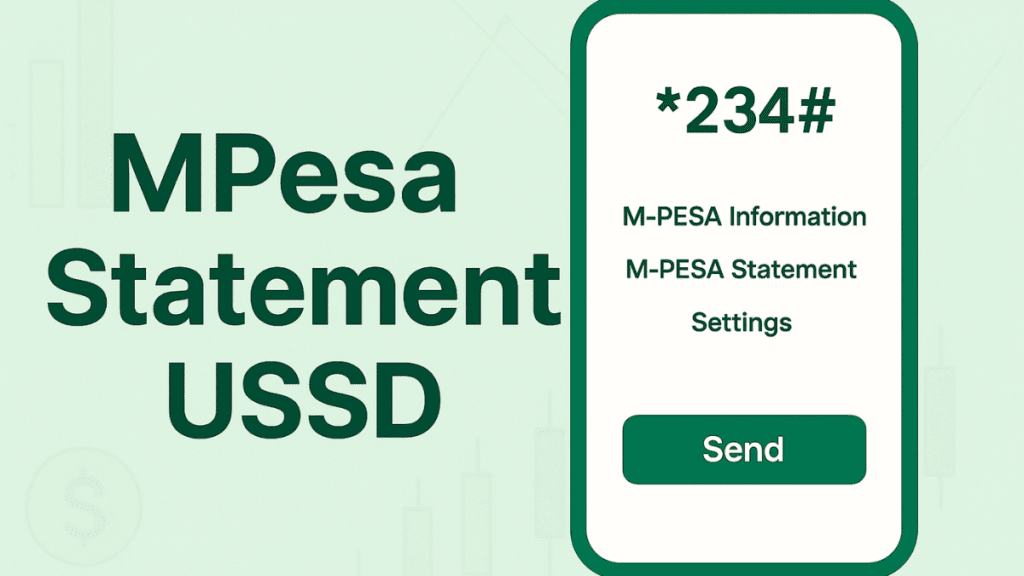

- Transfer to M-PESA.

- Once the funds reflect in your account, use your bank’s mobile app or USSD code to send money to your M-PESA wallet.

Banks That Work Best

- Equity Bank

- Cooperative Bank

- KCB (Kenya Commercial Bank)

- ABSA Kenya

- Stanbic Bank Kenya

These banks integrate seamlessly with both Payoneer and M-PESA, ensuring fast and secure transfers.

Option 2: Use a Payoneer-to-M-PESA Exchange Service

If you want instant withdrawals, you can use trusted Payoneer-to-M-PESA exchange services. These are third-party platforms or verified agents that help convert your Payoneer funds to Kenyan Shillings and send them directly to your M-PESA account.

How It Works

- Contact a verified Payoneer exchanger (for example, those recommended in Kenyan freelancer communities).

- They’ll provide you with a Payoneer receiving email to send your funds.

- Once they receive the payment, they’ll send the equivalent amount in KES to your M-PESA number, usually within 5–30 minutes.

⚠️ Important: Only use verified exchangers with a good reputation. Avoid social media “brokers” or anyone who can’t provide proof of credibility — you risk being scammed.

Advantages

- Instant M-PESA transfer.

- No need for a bank account.

- Convenient for freelancers without access to local bank cards.

Disadvantages

- Slightly higher exchange rates.

- Risk of fraud if using unverified agents.

Option 3: Use Payoneer Mastercard and Withdraw via M-PESA Agents

If you own a Payoneer Prepaid Mastercard, you can withdraw money from any ATM in Kenya that supports MasterCard, then deposit it to your M-PESA wallet through an M-PESA agent or your banking app.

How to Do It

- Request a Payoneer Mastercard (if eligible).

- Withdraw funds from an ATM using your card.

- Deposit the cash into your M-PESA wallet at an agent or through your bank app.

While not the fastest, this method gives you full control of your funds and is ideal for large withdrawals.

Payoneer to M-PESA Transfer Fees and Exchange Rates

Understanding Payoneer fees and currency conversion rates is key to maximizing your earnings.

Transaction Type | Fee/Rate | Duration |

Payoneer → Kenyan Bank | 2% above market rate | 1–3 business days |

Payoneer → M-PESA via exchanger | 2–4% depending on the agent | 5–30 minutes |

ATM Withdrawal (Payoneer Card) | $3.15 per withdrawal + local ATM fees | Instant |

💡 Tip: Always compare rates before choosing a method. Exchangers may offer faster service, but banks offer more security and predictable rates.

Tips to Withdraw from Payoneer to M-PESA Safely

- Use verified exchangers only. Ask for proof or references from other users.

- Enable 2-step verification on your Payoneer account for extra security.

- Check exchange rates before confirming any withdrawal.

- Avoid random Telegram or Facebook agents promising “best rates.”

- Keep records of all transactions for tracking and accountability.

Common Problems and Fixes

Problem | Cause | Solution |

Bank account not verifying | Wrong account details | Double-check your IBAN/SWIFT info |

Withdrawal delay | Bank processing or verification | Wait 1–3 business days |

The exchange rate is too low | Agent fees or Payoneer markup | Compare with other options |

Scam agents | Fraudulent exchangers | Use only trusted sources or Payoneer-approved partners |

Final Thoughts

While there’s no direct Payoneer to M-PESA integration, you can easily withdraw from Payoneer to M-PESA indirectly through a local bank or trusted exchange service.

For most Kenyans, the Payoneer → Bank → M-PESA route offers the best mix of safety, reliability, and fair rates. However, if you need quick access to cash, using a verified exchanger can save you time — just make sure to vet them carefully.

In 2025, Payoneer continues to be one of the most reliable payment solutions for Kenyan freelancers and online entrepreneurs. With the right withdrawal method, you can enjoy fast, safe, and affordable access to your earnings straight into your M-PESA wallet.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.