Sending money to a bank account through MPesa is now a normal part of daily life in Kenya. If you use NCBA Bank, the NCBA Bank Paybill makes it quick and easy to deposit money from your MPesa account anytime. This guide explains how the paybill works, the correct paybill number, how to use it, the charges, and common mistakes to avoid.

This article is written in simple English and designed to help both beginners and experienced customers understand the full process clearly.

What Is NCBA Bank Paybill?

NCBA Bank Paybill is a special MPesa business number that allows customers to deposit money directly into their NCBA Bank accounts. Instead of visiting a branch or ATM, you can fund your account instantly from your phone.

It is secure, fast, and available 24/7 — even during weekends and holidays.

NCBA Bank Paybill Number

The official NCBA Bank Paybill number is 880100.

You will use this number whenever you want to transfer money from MPesa into your NCBA account.

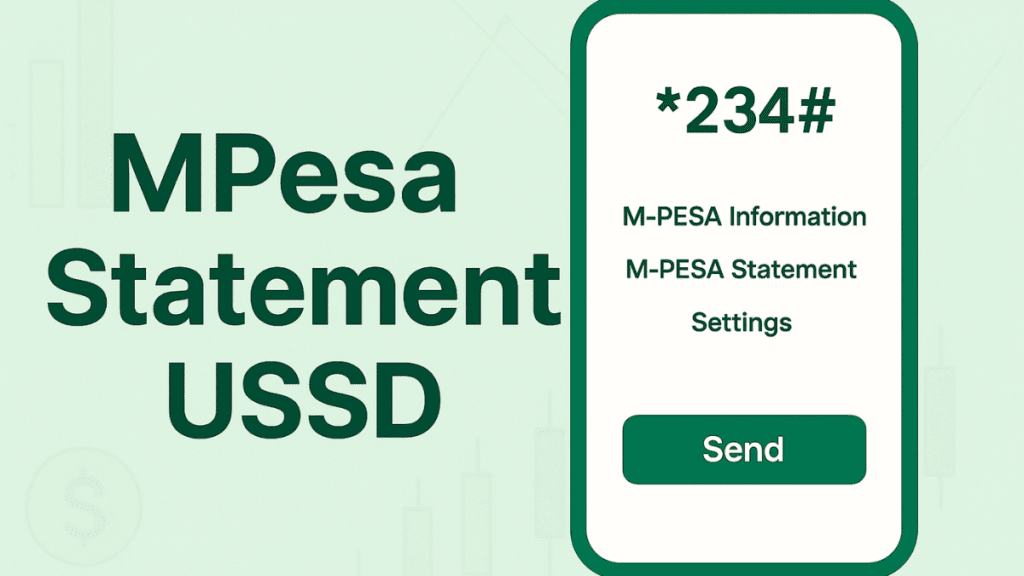

How to Deposit Money to NCBA Bank Using Paybill

Depositing money is very easy if you follow the correct steps. Here is the simple process:

Step-by-Step Process

- Go to the MPesa menu on your phone.

- Select Lipa na MPesa.

- Choose Paybill.

- Enter 880100 as the Business Number.

- Enter your NCBA Bank account number as the Account Number.

- Type the amount you want to deposit.

- Enter your MPesa PIN.

- Confirm the details and press OK.

You will receive an MPesa confirmation SMS, followed by a message from NCBA Bank showing the money has been deposited.

How Long Does It Take for the Money to Reflect?

In most cases, the money reflects instantly.

Sometimes it may take a few minutes during peak hours, but delays longer than 30 minutes are rare.

If you experience a delay, you can contact NCBA customer support with the MPesa transaction code.

NCBA Paybill Charges

NCBA Bank itself does not charge you for deposits. However, MPesa charges apply depending on the amount you send.

These charges follow the standard MPesa Paybill charges, which are usually lower than “Send Money” charges.

How to Withdraw Money From NCBA Bank to MPesa

You can also move money from your NCBA Bank account back to MPesa using mobile banking.

Using NCBA Mobile Banking App

- Log in to the NCBA app.

- Select Mobile Money or Send to MPesa.

- Enter the amount you want to transfer.

- Confirm and submit.

The money will reflect in your MPesa account within seconds.

NCBA Loop Paybill Number

If you are using NCBA Loop, note that it uses a different Paybill number from the main bank.

The NCBA Loop Paybill number is 714777.

The process of depositing follows the same steps—only the Paybill number changes.

Common NCBA Paybill Problems and Solutions

1. Money Sent to Wrong Account

If you enter the wrong account number, contact NCBA support immediately. Provide the MPesa transaction code to help trace the funds.

2. Delay in Receiving Money

Network issues sometimes cause delays. Wait 10–30 minutes.

If it still hasn’t reflected, call NCBA customer care or visit the nearest branch.

3. Incorrect Paybill Number

Always double-check that you are using 880100 (for NCBA Bank) to avoid sending money to the wrong place.

Why Use NCBA Bank Paybill?

1. Convenience

You can transfer money anytime without visiting a branch or ATM.

2. Security

The system is encrypted, and you receive SMS confirmation from both MPesa and NCBA.

3. Speed

The money reflects almost instantly, making it perfect for quick deposits.

4. Easy to Remember

The Paybill number (880100) is short and simple, and it works across all MPesa-enabled phones.

Tips to Avoid Mistakes When Using NCBA Paybill

- Always check that the Paybill number is 880100.

- Confirm your account number before sending money.

- Save the Paybill number in your phone for easier use next time.

- Keep your MPesa transaction messages for reference.

NCBA Customer Care Contacts

If you need help with Paybill transactions, NCBA offers several support options:

- Phone: 0800 720 444

- Email: contact@ncbagroup.com

- Website: ncbagroup.com

- Social Media: NCBA Group on X (Twitter), Facebook, and Instagram.

You can also visit any NCBA Bank branch for assistance.

Final Thoughts

The NCBA Bank Paybill service is one of the easiest and fastest ways to deposit money into your bank account in Kenya. It saves time, reduces queues at branches, and works at any hour of the day. Whether you are running a business, managing personal finances, or topping up savings, the MPesa Paybill option is a reliable solution.

Understanding the correct Paybill number and how to use it ensures smooth, safe, and instant transactions every time.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.