The hammer candlestick is one of the most popular reversal signals in trading. Traders use it to spot potential market bottoms and time better entry points. Understanding this pattern gives you more confidence, especially when the market is volatile or moving quickly.

What Is a Hammer Candlestick?

A hammer candlestick is a bullish reversal pattern that appears after a price decline. It suggests that although sellers pushed the price down during the session, buyers regained control and drove the price back up before closing.

This shift shows that selling pressure may be weakening, and the market could be preparing to move upward.

How a Hammer Candlestick Forms

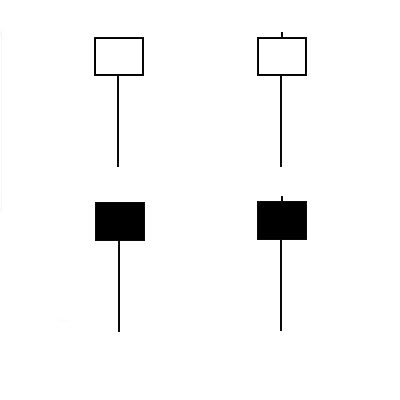

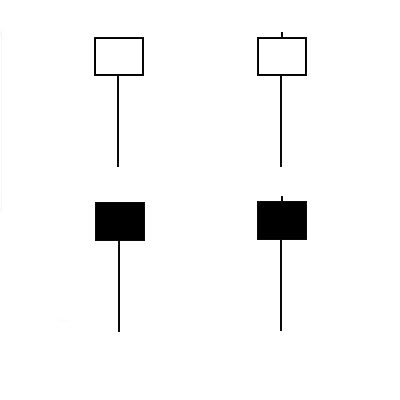

A hammer forms when the candlestick shows:

- A small real body near the top

- A long lower shadow at least 2–3 times the size of the body

- Little or no upper shadow

This shape looks like a hammer, which is where it gets its name.

What the Formation Tells You

- Sellers initially push the price lower.

- Buyers step in strongly and absorb the selling.

- Buyers gain enough strength to push prices near or above the opening level.

- Momentum shifts from bearish to bullish.

Key Characteristics of a Hammer

A hammer candlestick is a bullish signal when it appears after a downtrend. For a candlestick to qualify as a true hammer, it should meet these conditions:

- It has a very small upper shadow or none at all.

- The lower shadow is long, usually at least twice the size of the body.

- It must form after a clear downtrend, not in the middle of a sideways market.

- The body sits near the top of the candle’s overall range.

- The color of the body doesn’t matter, although a bullish (white/green) body strengthens the signal.

- The pattern works best when the next candle closes above the hammer’s high, showing confirmation from buyers.

- Do not confuse the hammer with a hanging man. They look the same, but the hanging man appears at the end of an uptrend, while the hammer forms at the bottom of a downtrend.

Where the Hammer Candlestick Appears Matters

A hammer has the strongest meaning when it appears:

1. After a Downtrend

It signals a possible reversal because buyers are showing interest at lower prices.

2. At a Key Support Level

Support zones make the pattern more reliable because buyers often defend these areas.

3. During Oversold Market Conditions

When indicators like RSI or Stochastic show oversold levels, the hammer’s reversal message becomes more convincing.

Hammer vs. Inverted Hammer

Although they sound similar, the two patterns are different:

Hammer

- Long lower shadow

- Appears after a downtrend

- Bullish reversal

Inverted Hammer

- Long upper shadow

- Appears after a downtrend

- Also bullish but weaker than a classic hammer

The normal hammer is generally considered more dependable.

Why Traders Trust the Hammer Candlestick

The hammer pattern shows a strong rejection of lower prices, which often marks a turning point.

Here’s why traders value it:

- It’s easy to identify.

- It works well with support and resistance.

- It provides early entry signals in trend reversals.

- It reflects real market psychology—buyers overpowering sellers.

How to Trade the Hammer Candlestick

While the hammer is powerful, traders rarely use it alone. Here is a simple, practical approach:

1. Confirm the Trend

Make sure a downtrend exists. A hammer is not useful in sideways or unclear markets.

2. Wait for Confirmation Candle

A bullish candle closing above the hammer’s high strengthens the reversal signal.

3. Use Reliable Support Levels

If the hammer appears at a strong support zone, the probability of reversal increases.

4. Set Logical Stop-Loss

Traders commonly place stop-losses below the hammer’s lower shadow to protect against false signals.

5. Combine with Indicators

Confirmation tools include:

- RSI (oversold zone)

- Moving averages

- MACD crossovers

- Volume increase on the reversal candle

Using several signals together improves accuracy.

Common Mistakes Traders Make With the Hammer Pattern

Even though the hammer seems simple, beginners often misuse it. Here are common mistakes to avoid:

Mistake 1: Ignoring the Trend Context

A hammer in an uptrend is not meaningful.

Mistake 2: Trading Without Confirmation

Jumping in immediately can lead to false signals.

Mistake 3: Treating Every Long Wick as a Hammer

The structure must match the definition—small body, long lower shadow, and almost no upper shadow.

Mistake 4: Not Using Risk Management

Every candlestick pattern, even strong ones, can fail in fast markets.

How Reliable Is the Hammer Candlestick?

The hammer is reliable when:

- The market has been falling

- It forms at major support

- Volume rises on the bounce

- A confirmation candle appears

It becomes less reliable when:

- It forms in a sideways market

- There is no confirmation

- It appears at random price levels

Like all technical patterns, it provides a probability—not a guarantee.

Hammer in Forex, Stocks, Crypto, and Commodities

The hammer works across different markets because it reflects universal trading psychology—fear, pressure, and buyer strength.

Forex

Often used on major pairs like EUR/USD or GBP/USD where price swings are common.

Stocks

Helps identify potential bottoming areas after sell-offs.

Crypto

Useful but should be combined with volume due to high volatility.

Commodities

Works well on gold, oil, and metals, especially around major support zones.

Example of a Strong Hammer Candlestick

Imagine a market falling for several days. Today’s price opens at $50, drops sharply to $44, then buyers rush in. By the end of the session, price closes at $49.50.

This creates:

- A tiny body near the top

- A long lower wick

- A signal that buyers pushed back strongly

This shows that selling pressure is losing strength, and the market may reverse upward.

Should You Rely on the Hammer Alone?

No. The hammer is powerful, but confirmation and context matter. You improve results by combining it with:

- Trend analysis

- Support and resistance

- Indicators

- Volume action

Smart traders use the hammer as a signal, not a full trading strategy.

Final Thoughts

The hammer candlestick is one of the simplest but most meaningful reversal patterns in trading. It tells a clear story: sellers tried to push prices lower, but buyers fought back and won. When it forms after a downtrend—especially around support—it becomes a valuable tool for identifying potential bullish reversals.

Use it with confirmation and risk management, and it becomes a dependable addition to your trading strategy.