Understanding how financial markets match buyers and sellers is essential for anyone interested in trading. One of the most important systems behind market structure is the Central Limit Order Book (CLOB), a mechanism that organizes buy and sell orders in real time. The CLOB plays a major role in keeping markets transparent and efficient, which is why traders, brokers, and institutions rely on it every day.

Before looking its deeper functions, it’s important to understand what a CLOB is and why it influences almost every modern electronic market.

What Is a Central Limit Order Book (CLOB)?

To fully grasp market behavior, you first need to know how trading orders are collected. A Central Limit Order Book (CLOB) is a system that displays all open buy and sell orders for a specific asset in a centralized, organized list. It acts as the core of modern electronic trading, allowing buyers and sellers to interact directly without needing a traditional middleman.

The CLOB arranges orders by price and time, ensuring fair execution. It is used in stock markets, crypto exchanges, futures markets, and other electronic trading platforms.

How a CLOB Works in Modern Trading

Before looking at the step-by-step flow, it helps to understand why the CLOB is central to price discovery. The book collects every active order and updates instantly whenever a new order enters or an old one is executed or cancelled. This continuous update process ensures that market prices always reflect real demand and supply.

Price-Time Priority Explained

A CLOB follows a simple but fair rule called price-time priority. This means:

- Orders with the best price get matched first.

- If prices are the same, the earliest order gets priority.

This rule prevents manipulation and gives traders equal opportunity based on their actions, not their influence.

Matching Orders Efficiently

After being placed, orders go through the matching engine. The engine checks if a new order can be matched with an existing one based on price. If a match occurs, the trade executes immediately. If not, the new order remains in the book until a suitable match appears.

This process happens in milliseconds in most markets, offering speed and efficiency.

Components of a Central Limit Order Book

To understand how the CLOB organizes data, you must know the main sections of the book. These sections help traders read market conditions quickly and accurately.

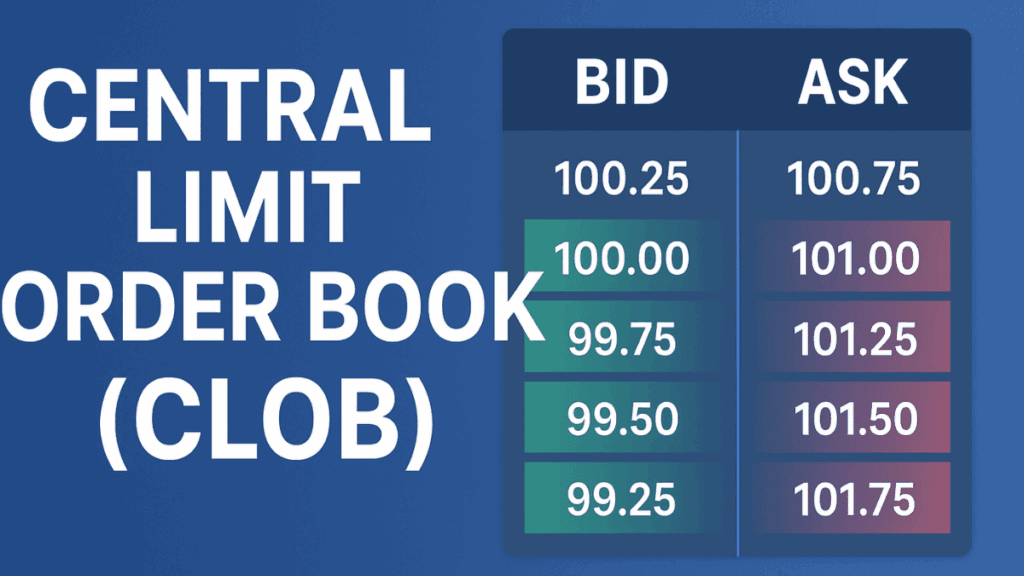

Bid Side

The bid side contains all buy orders. They are sorted from the highest price to the lowest. A high bid indicates strong buying interest.

Ask Side

The ask side lists all sell orders. They are sorted from the lowest price to the highest. A low ask shows sellers are willing to accept less.

Order Depth

Order depth shows how many orders exist at each price level. This helps traders measure liquidity and anticipate price movement.

Spread

The spread is the difference between the highest bid and the lowest ask. A small spread usually means the market is highly liquid.

Why the CLOB Is Important in Market Structure

Before moving into specific advantages, it’s good to understand the broader impact of the CLOB. The system supports transparency, competition, and fair pricing, which makes markets healthier and more predictable.

Promotes Market Transparency

All participants can see the same real-time order data. This equal access supports fairer trading conditions.

Improves Liquidity

A centralized book gathers orders from many participants. This concentration increases liquidity and makes it easier to execute trades quickly.

Supports Efficient Price Discovery

Because the CLOB reflects live buy and sell interest, prices adjust naturally without interference. This leads to more accurate market valuations.

Reduces Information Asymmetry

Everyone sees the same order book data, which reduces the advantage that large players sometimes enjoy.

How Trades Execute Inside a CLOB System

Before diving into the types of orders involved, it’s helpful to outline the basic execution flow. The CLOB handles different order types to ensure flexibility for traders with different strategies.

Limit Orders

A limit order sets a specific price. It only executes when the market reaches that price. These orders help traders control risk and execution quality.

Market Orders

A market order executes instantly at the best available price. It is ideal when speed is more important than price.

Partial Fills

Sometimes an order matches only part of its size. The remaining portion stays in the book until it is fully executed or cancelled.

Order Cancellations

Traders can cancel unexecuted orders at any time. When they do, the book updates immediately to reflect the new state.

CLOB vs Other Market Models

Understanding what makes the CLOB unique becomes easier when you compare it to alternative models that some exchanges use.

CLOB vs Request-for-Quote (RFQ)

An RFQ system requires traders to ask for prices privately. This hides information and limits competition. A CLOB, by contrast, shows all orders publicly, increasing transparency.

CLOB vs Automated Market Makers (AMMs)

AMMs are popular in decentralized finance (DeFi). They rely on liquidity pools and formulas instead of order books. While AMMs are easier for beginners, CLOBs offer tighter spreads, deeper liquidity, and more precise order control.

CLOB vs Dealer Markets

In dealer markets, a dealer sets the price. In a CLOB market, prices form naturally through supply and demand. This difference creates a more open and competitive environment.

Benefits of Using a Central Limit Order Book

To appreciate why most exchanges adopt a CLOB, it’s useful to look at the practical advantages it provides.

Fair and Open Access

All traders see the same data. This fairness increases trust and encourages broad market participation.

Better Execution Quality

With deep liquidity and clear pricing, traders often get better execution. The CLOB reduces slippage and improves trade outcomes.

Supports Advanced Trading Strategies

Since the book provides granular data, professional traders can use strategies like:

- Scalping

- Algorithmic trading

- Market making

- High-frequency trading

These strategies rely on accurate order book information.

Scalable and Reliable

CLOB technology handles large order volumes, making it ideal for high-traffic markets.

Challenges and Limitations of CLOB Systems

Before assuming the CLOB is perfect, it is important to highlight its limitations. These challenges influence how exchanges design their trading platforms.

High Infrastructure Costs

Operating a CLOB requires powerful hardware and sophisticated technology. Small exchanges sometimes struggle with these costs.

May Favor High-Frequency Traders

Speed becomes an advantage in a CLOB. High-frequency firms can sometimes react faster than retail traders.

Lower Privacy

Because all orders are visible, large traders may expose their intentions, which can affect strategy.

CLOB in Traditional and Crypto Markets

To understand the impact of CLOBs today, it’s helpful to examine where they are used. Traditional markets such as stock exchanges rely heavily on CLOBs. Crypto exchanges are also increasingly adopting CLOB models to improve transparency and attract institutional investors.

Traditional Markets

Stock exchanges like NASDAQ and major futures markets use CLOBs to provide uniform access and consistent pricing.

Crypto Exchanges

Some centralized and decentralized crypto platforms are moving from AMM models to CLOB systems. This shift helps them offer professional-grade trading environments with improved liquidity.

Future of the Central Limit Order Book (CLOB)

As markets become more digital, the CLOB will continue to evolve. Exchanges are now exploring upgrades such as:

- Faster matching engines

- Hybrid models that blend CLOB and AMM features

- Better tools for retail traders

- Cross-chain order books in crypto

These innovations suggest that the CLOB will remain a central part of global market infrastructure for years to come.

Final Thoughts

The Central Limit Order Book (CLOB) is the backbone of most modern electronic markets. It organizes buy and sell orders in a transparent, fair, and efficient way, supporting fast execution and accurate price discovery. Whether you trade stocks, futures, or crypto, understanding how the CLOB works will help you make better trading decisions and interpret market conditions with confidence.