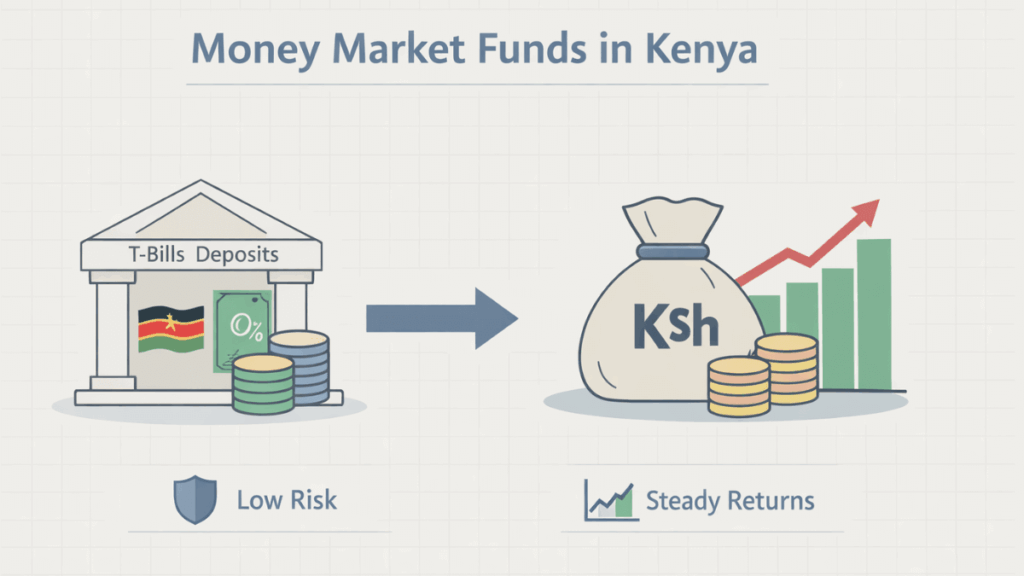

For one to choose the best money market fund in Kenya it starts with understanding what these funds are designed to do and how they fit into everyday financial needs. A money market fund (MMF) is a collective investment scheme that places investors’ money in low-risk, short-term instruments such as Treasury bills, fixed deposits, and high-quality commercial paper.

In Kenya, money market funds are widely used by individuals, small businesses, and institutions because they offer a balance between safety, liquidity, and modest but steady returns. They are often seen as a smarter alternative to keeping large amounts of cash idle in a savings account.

What a Money Market Fund Is and How It Works

A money market fund works by pooling money from many investors and investing it in short-term debt instruments with relatively low default risk. These investments typically mature within a short period, which helps preserve capital and maintain liquidity.

Returns from a money market fund come mainly from interest earned on these instruments, and the fund manager distributes this income to investors after deducting management fees. While returns are not guaranteed, they tend to be more stable than those of equity or balanced funds.

Why Money Market Funds Are Popular in Kenya

Money market funds have gained popularity in Kenya because they align well with local financial habits and needs. Many investors want access to their money without locking it away for long periods, while still earning better returns than traditional savings accounts.

Another reason for their popularity is accessibility. Most Kenyan money market funds allow relatively low minimum investments and offer mobile-friendly platforms, making them practical for both first-time investors and experienced savers.

Key Features That Define the Best Money Market Fund in Kenya

The best money market fund in Kenya is not defined by a single factor but by a combination of features that work together. Understanding these features helps investors make informed comparisons rather than relying on advertised returns alone.

Strong funds tend to focus on capital preservation, consistent performance, and transparent operations. They are also managed by firms with a solid reputation and a clear investment strategy.

Interest Rates and Historical Returns

Returns are often the first thing investors look at when comparing money market funds, and for good reason. A consistently competitive yield shows that the fund manager is effectively allocating assets while managing risk.

That said, the best money market fund in Kenya is not always the one with the highest short-term return. Sustainable performance over time is usually more important than brief spikes caused by temporary market conditions.

Fund Management and Experience

The quality of fund management plays a major role in long-term performance and stability. Experienced fund managers understand how to balance yield and safety, especially in changing interest rate environments.

In Kenya, well-established asset management companies often have dedicated research teams and strict risk controls. This experience helps protect investors’ capital during periods of economic uncertainty.

Fees and Other Costs

Fees directly affect the returns you take home, which is why they deserve careful attention. Management fees, trustee fees, and other charges are usually deducted before returns are credited to investors.

The best money market fund in Kenya keeps fees reasonable and clearly disclosed. Transparency in costs builds trust and allows investors to accurately compare funds on a like-for-like basis.

Liquidity and Ease of Access

Liquidity refers to how quickly you can access your money without penalties. One of the main advantages of money market funds is the ability to withdraw funds within a short time frame, often a few working days.

Funds that offer easy access through mobile apps, online dashboards, or simple withdrawal procedures tend to stand out. For many Kenyan investors, convenience is just as important as returns.

Regulation and Investor Protection in Kenya

Money market funds in Kenya are regulated by the Capital Markets Authority (CMA). This oversight ensures that fund managers follow strict guidelines on disclosure, asset allocation, and investor protection.

While regulation does not eliminate risk entirely, it provides a framework that promotes transparency and accountability. The best money market fund in Kenya operates fully within this regulatory environment and provides regular, clear reporting.

Who Should Invest in a Money Market Fund

Money market funds are suitable for a wide range of investors with different financial goals. They are especially useful for people who want to protect capital while earning modest returns.

These funds are commonly used by individuals saving for short-term goals, businesses managing cash flow, and investors seeking a low-risk parking place for funds before making longer-term investments.

Money Market Funds vs Savings Accounts in Kenya

Many Kenyans compare money market funds with traditional savings accounts because both serve similar purposes. While savings accounts offer simplicity and instant access, they often provide lower interest rates.

Money market funds, on the other hand, usually offer higher returns while still maintaining good liquidity. The trade-off is that they are investments, not bank deposits, and returns can vary slightly from period to period.

Risks to Be Aware Of

Although money market funds are considered low-risk, they are not completely risk-free. Interest rate changes can affect returns, and poor management decisions can impact performance.

Understanding these risks helps set realistic expectations. The best money market fund in Kenya manages these risks carefully through diversification and conservative investment choices.

How to Choose the Best Money Market Fund in Kenya for You

Choosing the right fund depends on your personal goals, time horizon, and comfort with risk. Comparing returns, fees, management quality, and ease of access gives a more complete picture than focusing on one factor alone.

It is also wise to review fund fact sheets and past performance reports. These documents provide insights into how the fund operates and how it has handled different market conditions.

Final Thoughts

The best money market fund in Kenya is one that aligns with your financial objectives while offering stability, transparency, and fair returns. Rather than chasing the highest advertised yield, informed investors look for consistency, strong management, and clear communication.

When used correctly, a money market fund can play a valuable role in building financial discipline, managing short-term savings, and providing peace of mind in an uncertain economic environment.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.