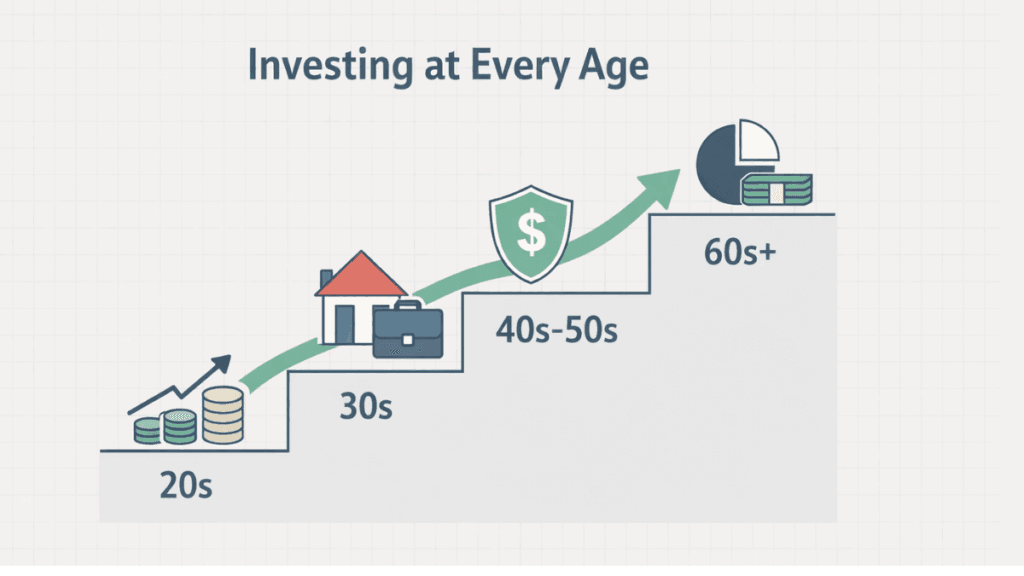

The best ways to invest your money at every age depend on your income level, goals, responsibilities, and tolerance for risk. While the core principles of investing remain the same, the strategies that work well in your twenties often need adjustment as you move through different life stages. Understanding how your priorities change over time allows you to invest with confidence rather than reacting emotionally to market movements.

This guide breaks down age-based investing in a practical, realistic way. It focuses on building good habits early, protecting progress in midlife, and preserving wealth later on, without assuming advanced financial knowledge.

Investing in your 20s: building habits and taking calculated risks

Your twenties are a foundational stage where time is your biggest advantage. Even small amounts invested consistently can grow significantly due to compounding, making this decade more about discipline than large sums of money.

Focus on financial foundations first.

Before pursuing aggressive investments, it is important to create a stable base. This reduces the chances of being forced to sell investments during emergencies.

Key priorities at this stage include:

- Building an emergency fund that covers at least three to six months of expenses

- Paying down high-interest debt, especially credit cards

- Learning basic money management and budgeting skills

These steps may not feel exciting, but they protect your future investments and help you stay invested during difficult periods.

Invest heavily in a growth-oriented asset.s

Once basic stability is in place, growth should be your main objective. With decades ahead of you, short-term market fluctuations matter far less than long-term returns.

Common growth-focused options include:

- Broad stock market index funds

- Individual stocks of established companies

- Low-cost exchange-traded funds (ETFs)

At this age, market downturns are opportunities rather than threats. The ability to recover over time allows you to accept higher volatility in exchange for higher potential returns.

Invest in yourself as an asset

Education and skills often deliver the highest return in your twenties. Improving earning potential increases how much you can invest later.

This may involve professional certifications, technical skills, or starting a side business. While not traditional investments, these choices directly affect your long-term financial growth.

Investing in your 30s: balancing growth with responsibility

Your thirties often bring higher income along with greater financial responsibilities. Investing during this phase requires balancing ambition with stability.

Increase consistency and contribution levels

With more stable earnings, regular investing becomes easier and more impactful. Automating contributions helps remove emotional decision-making.

Consistency matters more than timing the market. Even during uncertain periods, steady investing builds discipline and captures long-term growth.

Diversify beyond pure stocks

While growth remains important, diversification starts playing a larger role. Spreading investments reduces the risk of relying too heavily on one asset class.

A balanced portfolio may include:

- Stocks and equity funds

- Bonds or bond funds for stability

- Real estate exposure, either direct or through real estate funds

Diversification does not eliminate risk, but it smooths performance over time.

Start planning for long-term milestones

Major life goals often emerge in this decade, including home ownership, children’s education, or business ventures. Investments should align with these timelines.

Money needed within five years is better placed in lower-risk options, while long-term funds can remain growth-oriented. Clear separation of goals helps avoid poor decisions during market stress.

Investing in your 40s: protecting progress while growing steadily

Your forties are often peak earning years, making this a crucial period for wealth accumulation. At the same time, the margin for error begins to shrink.

Shift toward risk awareness, not risk avoidance

This stage is not about abandoning growth, but about being more intentional with risk. Large losses become harder to recover from as retirement approaches.

A more measured approach includes:

- Gradually increasing exposure to lower-volatility assets

- Reviewing asset allocation annually

- Avoiding speculative investments that lack a clear strategy

The goal is steady growth with fewer sharp declines.

Strengthen retirement-focused investing

Retirement planning becomes more concrete during this decade. Contributions should increase as income rises, especially if earlier investing was limited.

Employer-sponsored plans, personal retirement accounts, and diversified long-term funds become central tools. The focus shifts from experimentation to reliability.

Reduce financial leaks

High income does not automatically translate into wealth. Lifestyle inflation and unnecessary debt can quietly erode progress.

Regular reviews of spending, insurance coverage, and debt levels ensure that investments are supported rather than undermined by daily financial decisions.

Investing in your 50s: preparing for income and stability

Your fifties represent a transition from accumulation to preparation. Investing decisions now focus on ensuring income security and protecting what you have built.

Reassess timelines and goals realistically

Retirement planning becomes tangible rather than abstract. Knowing when you plan to stop working helps determine how much risk is appropriate.

Shorter timelines require greater stability. Funds needed within ten years should face less market exposure than long-term holdings.

Increase emphasis on income-generating assets

At this stage, investments that produce regular income become more attractive. These can supplement future retirement income and reduce reliance on selling assets.

Examples include:

- Dividend-paying stocks

- Bonds and fixed-income funds

- Real estate investments that generate rental income

Income-focused investing adds predictability to your financial plan.

Eliminate high-risk and unnecessary positions

Speculative investments that once felt manageable may now pose outsized risks. Simplifying your portfolio improves clarity and reduces stress.

This is also a good time to ensure estate plans and beneficiary designations align with your intentions.

Investing in your 60s: shifting from growth to preservation

In your sixties, the primary purpose of investing changes. The focus moves from growing wealth aggressively to sustaining it throughout retirement.

Prioritize capital preservation

Preserving capital ensures that market downturns do not threaten your ability to meet basic living expenses. While some growth is still necessary, safety takes precedence.

Lower-volatility investments help protect against sequence-of-returns risk, which occurs when losses happen early in retirement.

Maintain a balanced approach to inflation

Completely avoiding growth can be just as risky as excessive exposure to stocks. Inflation steadily erodes purchasing power over long retirements.

Maintaining a modest allocation to growth assets helps protect long-term income without exposing the entire portfolio to market swings.

Plan withdrawals carefully

How you withdraw money matters as much as how you invested it. Poor withdrawal strategies can shorten the lifespan of your savings.

Structured withdrawal plans provide predictable income while preserving long-term stability.

Investing in your 70s and beyond: sustaining wealth and legacy planning

Later years emphasize simplicity, predictability, and peace of mind. Investing becomes part of a broader financial legacy rather than a growth challenge.

Simplify investments for ease of management

Complex portfolios can become difficult to manage over time. Simplification reduces stress and the risk of mistakes.

Clear structures help both you and any family members involved in managing finances.

Focus on income and liquidity

Ready access to cash ensures flexibility for healthcare and lifestyle needs. Investments should support living expenses without forcing asset sales during downturns.

Liquidity also provides reassurance, which is an often-overlooked benefit in later years.

Incorporate legacy and estate considerations

Investing decisions now extend beyond personal needs. Estate planning ensures that assets are distributed according to your wishes.

Tax-efficient strategies and clear documentation help protect wealth for the next generation.

Timeless investment principles that apply at every age

Regardless of age, certain principles remain constant. These habits support smart investing across all life stages.

Consistency beats timing

Trying to predict market movements often leads to missed opportunities. Regular investing builds wealth steadily over time.

Costs matter more than many people realize

High fees quietly reduce long-term returns. Choosing low-cost investment options leaves more money working for you.

Emotions are the biggest risk

Fear and greed cause more damage than market volatility. A clear plan helps prevent emotional decisions during uncertainty.

Final thoughts on investing wisely at every stage of life

The best ways to invest your money at every age involve adapting strategies as your life evolves, not chasing trends or copying others. Each decade presents different opportunities and risks, and successful investors adjust without abandoning core principles.

Investing is not about perfection or constant action. It is about patience, clarity, and making decisions that support both your present needs and your future security. When approached thoughtfully, investing becomes a lifelong tool for stability, independence, and peace of mind.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.