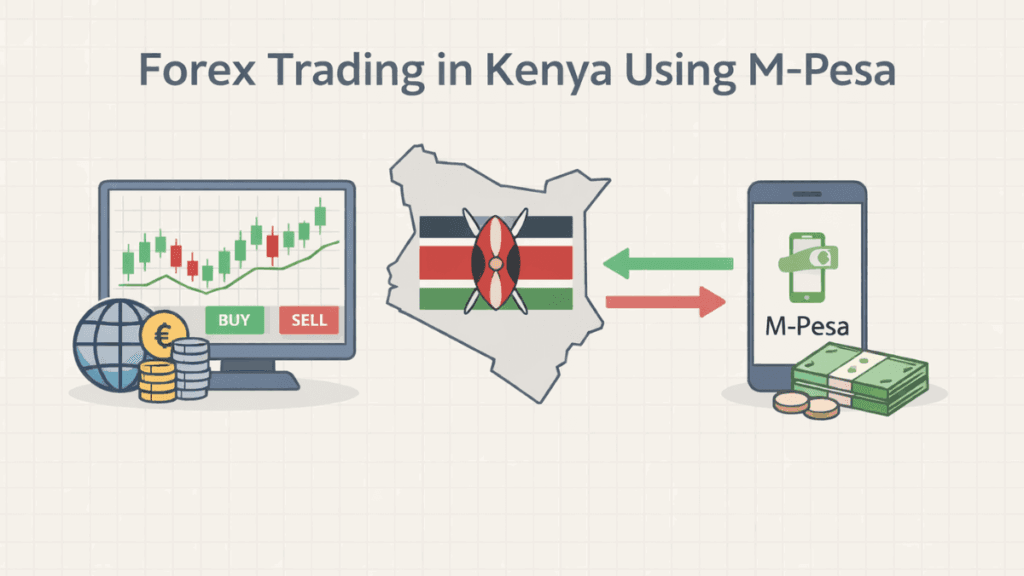

Forex Trading in Kenya using M-Pesa has become one of the most convenient ways for Kenyans to access the global currency market. By combining mobile money with online trading platforms, traders can fund accounts, withdraw profits, and manage risk without relying on traditional banking systems. This guide explains how it works, who it is best suited for, and what you should know before trading real money.

What Forex Trading Means in the Kenyan Context

Forex trading involves buying one currency while selling another with the aim of profiting from price movements. In Kenya, this activity has grown rapidly due to improved internet access, mobile payments, and increased financial awareness.

Most Kenyan traders participate through online brokers that provide access to global currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Trades are executed electronically, and profits or losses are reflected in the trading account balance.

Why M-Pesa Is Central to Forex Trading in Kenya

M-Pesa plays a major role in making forex trading accessible to ordinary Kenyans. It allows traders to deposit and withdraw funds directly from their mobile phones without visiting a bank or using international cards.

The main reason M-Pesa is widely adopted is trust and familiarity. Most Kenyans already use M-Pesa daily, so extending it to forex trading feels natural and less intimidating for beginners.

How Forex Trading in Kenya Using M-Pesa Works

Forex trading using M-Pesa follows a straightforward process once an account is set up. The system connects your mobile wallet to your trading account through a regulated broker or payment processor.

The typical flow includes:

- Opening a trading account with a broker that supports M-Pesa

- Depositing funds from M-Pesa into the trading account

- Trading currencies on the broker’s platform

- Withdrawing profits back to M-Pesa

Each step is digital, and most transactions are completed within minutes or a few hours.

Choosing a Forex Broker That Accepts M-Pesa

Selecting the right broker is one of the most important decisions you will make. A good broker ensures fast transactions, fair pricing, and the safety of your funds.

When evaluating brokers that support M-Pesa, focus on:

- Regulation by reputable authorities

- Clear M-Pesa deposit and withdrawal policies

- Transparent fees and spreads

- Reliable customer support accessible to Kenyans

Avoid brokers that promise guaranteed profits or pressure you to deposit large amounts quickly.

Regulation and Legal Status of Forex Trading in Kenya

Forex trading in Kenya is legal, but traders must understand how regulation works. The Capital Markets Authority (CMA) regulates locally licensed online forex brokers.

Many Kenyans also trade with international brokers regulated outside the country. While this is allowed, it requires extra caution since disputes are handled under foreign jurisdictions. Trading only with regulated brokers reduces the risk of fraud and unfair practices.

Steps to Start Forex Trading in Kenya Using M-Pesa

Starting forex trading does not require complex paperwork, but it does require discipline and preparation. The process is simple when approached step by step.

First, choose a reputable broker that supports M-Pesa and open an account. Second, verify your identity using your national ID or passport as required. Third, deposit a small amount via M-Pesa and practice on a demo account before trading live.

Minimum Deposit Requirements When Using M-Pesa

One advantage of forex trading in Kenya using M-Pesa is the low entry barrier. Many brokers allow deposits starting from as low as KES 1,000 or even less.

Low minimum deposits help beginners learn without risking large sums. However, small accounts require careful risk management because market fluctuations can affect them more quickly.

M-Pesa Deposits and Withdrawals Explained

M-Pesa deposits are usually instant, allowing traders to react quickly to market opportunities. Withdrawals may take longer, often ranging from a few minutes to 24 hours, depending on the broker.

Most brokers process withdrawals back to the same M-Pesa number used for deposits. This policy helps prevent fraud and ensures funds reach the rightful owner.

Costs and Fees Involved in Forex Trading Using M-Pesa

Trading forex involves several types of costs that traders should understand clearly. These costs affect overall profitability, especially for frequent traders.

Common costs include spreads, commissions, overnight swap fees, and M-Pesa transaction charges. Always review the broker’s fee structure before depositing funds to avoid surprises.

Currency Pairs Commonly Traded by Kenyan Traders

Kenyan traders often focus on major and minor currency pairs due to their high liquidity and relatively stable price movements. These pairs are easier to analyze and trade.

Popular choices include EUR/USD, GBP/USD, USD/JPY, and GBP/JPY. Some traders also trade gold and indices, which are offered by many forex brokers as additional instruments.

Risks Associated With Forex Trading in Kenya

Forex trading carries significant risk, and losses are possible even with experience. Understanding these risks helps traders make informed decisions and protect their capital.

Key risks include market volatility, leverage misuse, emotional trading, and unregulated brokers. Managing risk through proper position sizing and stop-loss orders is essential for long-term survival.

Risk Management Tips for M-Pesa Forex Traders

Risk management is the foundation of consistent trading results. It helps traders stay in the market long enough to learn and improve.

Important principles include risking only a small percentage of your account per trade, using stop-loss orders, and avoiding overtrading. Keeping a trading journal can also help identify mistakes and improve discipline.

Common Mistakes Made by Beginner Traders in Kenya

Many beginners enter forex trading with unrealistic expectations. These expectations often lead to poor decisions and quick losses.

Common mistakes include trading without a plan, following unverified signals, and increasing trade size after losses. Learning slowly and focusing on skill development reduces these errors.

Education and Learning Resources for Kenyan Forex Traders

Education plays a key role in successful forex trading. Traders who invest time in learning tend to make more informed and disciplined decisions.

Useful resources include broker-provided tutorials, online courses, webinars, and practice demo accounts. Learning basic technical and fundamental analysis builds confidence over time.

Is Forex Trading in Kenya Using M-Pesa Safe?

Safety depends largely on the broker you choose and how you manage your trading activity. Using regulated brokers and secure platforms significantly reduces risk.

M-Pesa itself is a secure payment system, but traders should protect their accounts with strong passwords and avoid sharing sensitive information. Staying informed and cautious improves overall safety.

Who Should Consider Forex Trading Using M-Pesa?

Forex trading using M-Pesa suits individuals who want flexible access to financial markets and are willing to learn. It is not a guaranteed income source and should not replace essential financial responsibilities.

Traders who approach forex with patience, education, and realistic expectations are better positioned to benefit from its opportunities.

Final Thoughts

Forex Trading in Kenya using M-Pesa has lowered barriers to entry and made global markets accessible to many Kenyans. Its convenience, speed, and familiarity make it an attractive option for both beginners and experienced traders.

Success in forex trading depends on education, discipline, and choosing the right broker rather than the payment method alone. When approached responsibly, M-Pesa can be a powerful tool in a well-planned trading journey.

Our financial editorial team covers global markets, economic policy, and investment trends. We combine real-time research with AI-powered writing assistants to deliver accurate, timely, and easy-to-read articles. Our editors review all content to ensure quality, neutrality, and clarity for our readers.