In the fast-paced world of trading, knowing how markets move is crucial for success. One important movement traders come across is called a breakdown. It shows a change in how people feel about the market and can lead to chances for trading. In this guide, we explore breakdowns, why they matter, and how traders can use them to their advantage.

A Definitive Overview

In technical analysis, a breakdown represents a pivotal moment in the price action of an asset. It happens when the price of an asset falls below an important support level, showing that the market sentiment is turning bearish. Unlike breakouts, which show prices moving up, breakdowns show prices going down. This indicates that sellers are taking control, and the strength of buyers is decreasing.

When the price falls below a support level, it’s likely to keep dropping, making it a sell signal, especially if trading volume is high. If the price has fallen a lot after breaking the support, waiting for a reaction back might get you a better price.

However, it’s important to remember that in an uptrend, price drops below support can sometimes be false signals for selling.

Identifying the Characteristics of a Breakdown

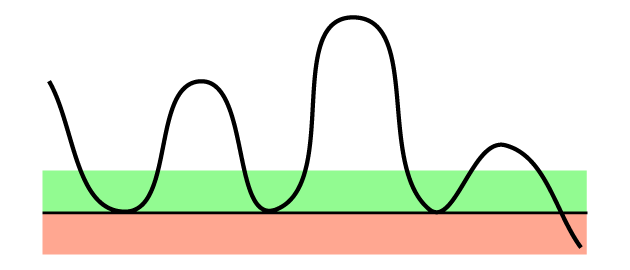

A breakdown typically manifests after a period of consolidation or sideways movement in the price action. During this phase, the market experiences a lack of bullish momentum, resulting in the inability of prices to sustain higher levels. As a consequence, sellers gain traction, pushing the price below-established support levels.

The Significance of Support Levels in Breakdowns

Support levels play a pivotal role in identifying potential breakdown scenarios. These levels represent zones where buying interest is historically strong, preventing the price from declining further. However, when support levels are breached, it signifies a notable shift in market dynamics, as buyers fail to defend their positions, allowing sellers to exert greater influence.

Understanding Market Dynamics During Breakdowns

During a breakdown, market dynamics undergo a significant transformation, marked by an imbalance between supply and demand. The absence of strong buying pressure and the emergence of selling interest contribute to the downward momentum, creating an environment conducive to short-selling and profit-taking strategies.

Analyzing Volume in Breakdown Scenarios

Volume analysis is a critical component in validating breakdown signals. A surge in trading volume during a breakdown reinforces the credibility of the signal, indicating heightened market participation and conviction among traders. Moreover, increasing volume enhances the reliability of the breakdown, substantiating the bearish outlook and potential downward trajectory.

Implementing Strategies for Trading Breakdowns

Trading breakdowns require a disciplined approach and a thorough understanding of market dynamics. Traders can capitalize on breakdowns by initiating short positions or implementing bearish strategies, aiming to profit from downward price movements. Additionally, waiting for a pullback after the initial breakdown can provide traders with improved entry opportunities and enhanced risk-reward ratios.

Cautionary Considerations and False Signals

While breakdowns often present lucrative trading opportunities, traders must exercise caution, as false signals can occur, particularly in uptrending markets. False breakdowns may lead to premature entries and potential losses, highlighting the importance of confirming signals through additional technical indicators and market analysis.

Conclusion

In conclusion, breakdowns represent critical junctures in the price action of financial assets, signaling shifts in market sentiment and trading dynamics. By understanding the characteristics, significance, and strategies associated with breakdowns, traders can navigate volatile market conditions with confidence, capitalizing on emerging opportunities and optimizing their trading outcomes. As with any trading strategy, diligence, patience, and risk management are essential elements for success in trading breakdowns.