The London Session forex time in Kenya is one of the most important trading windows for traders who want strong price movement and reliable liquidity. Because London is a global financial hub, a large share of daily forex volume flows through this session, making it especially relevant for Kenyan traders seeking active markets.

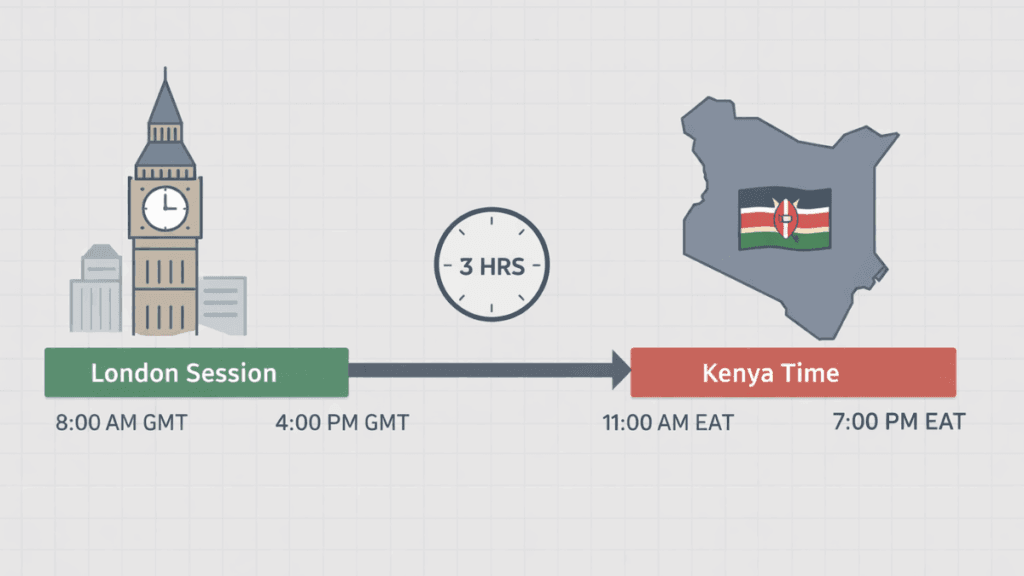

Kenya operates on East Africa Time (EAT), which is three hours ahead of Coordinated Universal Time (UTC+3). Understanding how London trading hours align with Kenyan time helps traders plan entries, manage risk, and avoid low-activity periods.

What the London Forex Session Is

The London forex session refers to the period when major financial institutions in London are actively trading currencies. It is widely regarded as the most influential forex session because of the volume of transactions and the number of major banks involved.

This session often sets the tone for the rest of the trading day. Price trends that begin in London frequently continue into the New York session, giving traders clearer market direction.

London Session Forex Time in Kenya (EAT)

The exact London session forex time in Kenya depends on whether the UK is observing daylight saving time. The United Kingdom switches between Greenwich Mean Time (GMT) and British Summer Time (BST) during the year.

London Session Time in Kenya (When the UK Is on GMT)

When the UK is on Greenwich Mean Time, the London forex session runs from 11:00 AM to 8:00 PM Kenyan time. This period usually falls between late October and late March.

During these months, Kenyan traders experience the London open closer to midday, which fits well with normal daytime schedules.

London Session Time in Kenya (When the UK Is on BST)

When the UK observes British Summer Time, the London session shifts one hour earlier. In this case, the London forex session runs from 10:00 AM to 7:00 PM Kenyan time.

This timing typically applies from late March to late October. Traders in Kenya should adjust their schedules during this period to avoid missing early London volatility.

Why the London Session Matters to Kenyan Traders

The London session matters because it combines high liquidity with meaningful price movement. For Kenyan traders, this means tighter spreads and better trade execution during most of the session.

Another reason the session is important is the overlap. The London market overlaps with both the Asian session and the New York session, creating short windows of especially strong activity that many traders prefer.

Best Trading Hours Within the London Session

Not every hour of the London session behaves the same way. Some periods are calmer, while others see sharp moves driven by news and institutional orders.

London Session Open

The first two hours after the London market opens are often the most active. During this time, traders react to overnight developments and position themselves for the day.

Price breakouts are common during the London open, especially on major currency pairs. Kenyan traders who prefer momentum trading often focus on this window.

London–New York Overlap (Most Volatile Period)

The overlap between London and New York sessions is the most volatile part of the trading day. In Kenyan time, this overlap usually occurs between 4:00 PM and 7:00 PM, depending on daylight saving.

During this period, both European and U.S. institutions are active. This leads to high volume, strong trends, and frequent trading opportunities.

Best Currency Pairs to Trade During the London Session

Certain currency pairs perform better during the London session because of regional economic activity. These pairs tend to have higher liquidity and clearer price movements.

Commonly traded pairs during the London session include:

- EUR/USD, which benefits from both European and U.S. participation

- GBP/USD, which is highly active during London hours

- EUR/GBP, which reacts strongly to UK and Eurozone news

- USD/CHF, which often shows clean trends during European trading

These pairs are popular among Kenyan traders because spreads are usually lower during London hours.

Trading Strategies That Work Well in the London Session

The London session supports several trading styles, depending on a trader’s experience and risk tolerance. What matters most is matching the strategy to the session’s volatility.

Breakout strategies are common during the London open, when price moves out of the Asian session range. Trend-following strategies also work well, especially when strong moves continue into the New York session.

Key Economic News During the London Session

Many important economic reports are released during London trading hours. These announcements can cause sharp price movements within minutes.

Common news events during this session include UK employment data, inflation figures, interest rate decisions, and major Eurozone reports. Kenyan traders should always check an economic calendar before trading high-impact news.

Common Mistakes Kenyan Traders Make During the London Session

One common mistake is ignoring daylight saving time changes in the UK. This can cause traders to enter the market too early or too late, missing key setups.

Another frequent error is overtrading during high volatility. While the London session offers many opportunities, disciplined risk management is still essential to avoid unnecessary losses.

How to Prepare for the London Session in Kenya

Preparation starts with knowing the correct London session forex time in Kenya for the current season. Traders should also mark key support and resistance levels before the session begins.

Using alerts and setting a clear trading plan helps reduce emotional decisions. A well-prepared trader is more likely to take high-quality setups rather than react impulsively to market noise.

Is the London Session Suitable for Beginners?

The London session can be suitable for beginners, but only if approached carefully. The higher volatility can be both an advantage and a risk for new traders.

Beginners in Kenya may benefit from starting with a demo account during London hours. This allows them to observe price behavior and practice strategies without risking real money.

Final Thoughts

Understanding the London session forex time in Kenya gives traders a strong advantage in planning and execution. By knowing when liquidity is highest and volatility is strongest, traders can focus on the most productive hours of the day.

For Kenyan traders who prefer active markets and clear price movement, the London session remains one of the best times to trade forex. Consistent timing, discipline, and proper risk management are what turn these hours into long-term trading opportunities.

Our financial editorial team covers global markets, economic policy, and investment trends. We combine real-time research with AI-powered writing assistants to deliver accurate, timely, and easy-to-read articles. Our editors review all content to ensure quality, neutrality, and clarity for our readers.