The National Bank Paybill number makes it easy for customers to move money from M-Pesa to their National Bank of Kenya (NBK) accounts instantly. With the rise of mobile banking in Kenya, using the NBK Paybill has become the fastest, safest, and most reliable way to deposit money into your bank—whether you are topping up savings, paying a loan, or funding your business account.

In this guide, you will learn everything about the National Bank Paybill, how it works, step-by-step deposit and payment instructions, limits, charges, common mistakes to avoid, and answers to frequently asked questions.

What Is the National Bank Paybill Number?

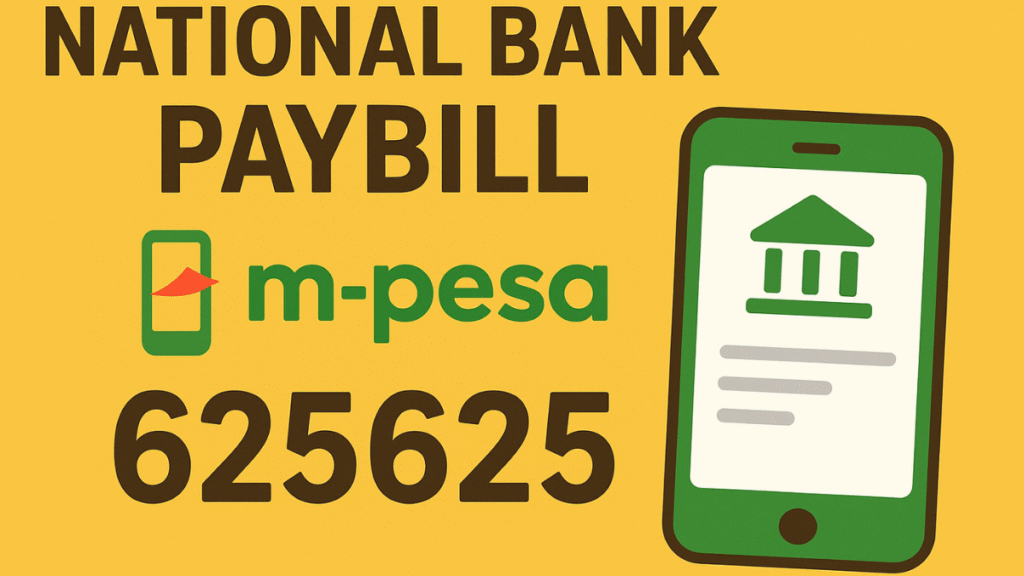

The official National Bank Paybill number is 625625.

This Paybill allows you to send money from your M-Pesa account directly into any National Bank account in seconds. The service is available 24/7 and supports personal, business, and loan accounts.

Why Use the National Bank Paybill?

The NBK Paybill makes banking fast and convenient. It eliminates the need to visit a physical branch or ATM, especially during emergencies or when handling business transactions.

Key Benefits

- Instant deposits into any NBK account

- Easy loan repayment

- Available 24/7 nationwide

- Secure and traceable transactions

- Works for both personal and business accounts

- No need for paperwork or queues

How to Deposit Money to National Bank Using M-Pesa Paybill (625625)

Follow this simple procedure:

- Go to M-Pesa menu.

- Select Lipa na M-Pesa.

- Choose Paybill.

- Enter Business Number: 625625.

- Enter your NBK Account Number as the Account Number.

- Enter the amount you want to deposit.

- Enter your M-Pesa PIN.

- Confirm the details and press OK.

You will receive two SMS messages:

- Confirmation from M-Pesa

- Confirmation from National Bank

How to Pay a National Bank Loan Using Paybill

If you have an NBK loan, you can repay it using the same Paybill number.

Steps

- Go to Lipa na M-Pesa

- Select Paybill

- Enter 625625

- Enter your Loan Account Number

- Enter the amount

- Enter your PIN and confirm

Your loan balance will update automatically once the deposit is processed.

National Bank Paybill for National Online Banking Transfers

National Bank customers who use NatConnect or NBK mobile app can fund their accounts via M-Pesa using the same Paybill number. Funds reflect almost immediately, allowing you to continue transacting on online banking without interruptions.

National Bank Paybill Charges

M-Pesa charges apply when sending money to NBK Paybill. National Bank does not charge customers for deposits made through M-Pesa.

Charges depend on how much money you send through M-Pesa. Safaricom regularly updates the fees, but the general rule is:

- Low amounts have small charges

- Larger amounts attract higher fees

- No fee for deposits under the free tier (as per Safaricom updates)

For the most accurate charges, always check the M-Pesa app or Safaricom website.

Daily and Transaction Limits

Safaricom has limits for Paybill transactions:

- Maximum per transaction: Ksh 250,000

- Daily maximum: Ksh 500,000

- Minimum amount: Ksh 1

NBK does not limit deposits beyond what M-Pesa allows.

Common Mistakes When Using NBK Paybill

Using Paybill is easy, but small errors can delay your transaction.

Mistakes to Avoid

- Entering the wrong account number

- Sending money to the wrong Paybill

- Exceeding daily M-Pesa limits

- Poor network connection during the transaction

- Using an inactive NBK account

If you mistakenly send money to the wrong account, contact NBK customer care or Safaricom immediately for reversal assistance.

How to Check Your National Bank Account Balance After a Paybill Deposit

Here are the fastest ways to confirm your balance:

1. NBK Mobile App

- Log in

- Tap Account Balance

*2. NBK USSD Code – 625# (if available)

- Dial *625#

- Follow the balance inquiry prompt

3. ATM

Insert your card and check balance from the main menu.

4. Visit a Branch

Use this only when necessary—mobile and USSD are faster.

Can You Use National Bank Paybill for Business Accounts?

Yes. NBK Paybill 625625 supports:

- Business accounts

- Merchant accounts

- Personal accounts

- Joint accounts

- Loan accounts

Simply use the business account number as the Account Number in M-Pesa.

National Bank Customer Care Contacts

If you experience any issues with Paybill deposits, NBK customer care is always available.

Contacts

- Phone: 020-2828000

- Toll-Free: 0800 720 444

- Twitter/X: @nbk_kenya

- Facebook: National Bank of Kenya

- Email: customercare@nationalbank.co.ke

For reversal issues, contact NBK and Safaricom immediately.

Frequently Asked Questions (FAQs)

1. What is the National Bank Paybill number?

The official NBK Paybill number is 625625.

2. How long does it take for money to reflect?

Usually instantly, but may take a few minutes during high traffic.

3. Can I deposit money to someone else’s NBK account?

Yes, as long as you enter their correct account number.

4. Does National Bank charge for M-Pesa Paybill deposits?

No. NBK deposits via Paybill are free. Only M-Pesa charges apply.

5. What if I enter the wrong account number?

Contact NBK customer care or Safaricom immediately for help.

6. Can I use the Paybill for loan repayment?

Yes, you can repay all NBK loans using the same Paybill.

Final Thoughts

The National Bank Paybill number 625625 gives customers a fast, secure, and convenient way to manage their banking from anywhere in Kenya. Whether you are depositing money, repaying a loan, funding your savings, or supporting a business account, this Paybill offers reliability and flexibility at all times.

With simple steps, fast processing, and 24/7 availability, the NBK Paybill remains one of the best ways to move money between M-Pesa and National Bank accounts.

I hope this National Bank Paybill guide made your payment process easier. You may also want to read our step-by-step Consolidated Bank Paybill guide or explore the Co-operative Bank Paybill process.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.