The New York Session in Kenyan Time is one of the most important periods in the forex market, especially for traders who want high liquidity and strong price movement. This session represents the opening of the US financial markets, where major institutions, banks, and funds become active.

For Kenyan traders, understanding the exact New York session hours and how they change during daylight saving time is essential. When timed correctly, this session offers clear trading opportunities, tighter spreads, and reliable market behavior.

What Is the New York Forex Session?

The New York forex session is the period when financial markets in the United States are open and actively trading currencies. It is closely linked to economic data releases from the US, making it one of the most influential sessions globally.

This session often sets the tone for daily market direction because the US dollar is involved in most forex trades. As a result, price movements during this period tend to be decisive rather than random.

New York Session Opening and Closing Time in Kenya

The New York Session in Kenyan Time depends on whether the United States is observing daylight saving time. Since Kenya does not change its clocks, the session hours shift slightly during the year.

New York Session in Kenyan Time (Standard Time)

When the US is on standard time, the New York forex session runs from 4:00 PM to 1:00 AM Kenyan Time (EAT). This period usually falls between early November and mid-March.

During these months, Kenyan traders experience slightly later market activity, which can suit traders who prefer evening sessions.

New York Session in Kenyan Time (Daylight Saving Time)

When daylight saving time is active in the US, the New York session runs from 3:00 PM to 12:00 Midnight Kenyan Time (EAT). This period typically starts in mid-March and ends in early November.

This earlier opening is often preferred by Kenyan traders, as it overlaps more comfortably with normal evening hours.

Why the New York Session Matters to Kenyan Traders

The New York session plays a major role in shaping daily forex price action. Many of the strongest trends either begin or end during this period.

For Kenyan traders, this session is especially valuable because it aligns well with after-work hours. It also offers enough volatility to support both short-term and swing trading strategies.

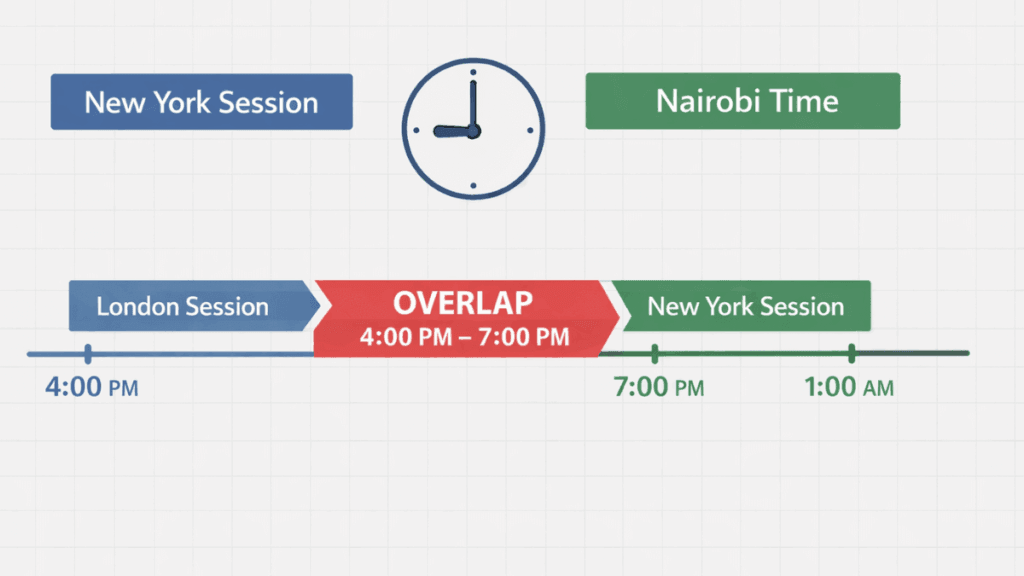

Overlap Between the London and New York Sessions

One of the most active periods in forex trading occurs when the London session and New York sessions overlap. This overlap happens for several hours each trading day.

In Kenyan Time, the London–New York overlap usually runs between 4:00 PM and 7:00 PM EAT during daylight saving time. This window is known for increased volume, faster price movements, and clearer trade setups.

Best Currency Pairs to Trade During the New York Session

The New York session favors currency pairs that include the US dollar. These pairs respond strongly to US economic news and institutional trading activity.

Popular pairs during this session include:

- EUR/USD due to heavy European and US participation

- GBP/USD is affected by strong volatility

- USD/JPY is influenced by US bond yields

- XAU/USD (Gold) for traders focused on safe-haven assets

These instruments often show better structure and follow technical levels more cleanly during this session.

Market Behavior During the New York Session

The New York session often starts with strong momentum, especially after major US news releases. Price can move quickly in one direction before settling into a clearer trend or range.

Later in the session, volatility may reduce as European markets close. This shift can lead to consolidation, which suits traders who prefer range-based strategies.

Best Trading Styles for the New York Session

Different trading styles work well during the New York Session in Kenyan Time, depending on the trader’s schedule and experience level.

Scalpers often focus on the session open and overlap period, where spreads are tight and price moves quickly. Day traders usually target trend continuation or reversals following major news releases.

Risk Management During the New York Session

High volatility can be profitable, but it also increases risk. Proper position sizing and stop-loss placement are essential when trading during the New York session.

Kenyan traders should avoid overtrading late into the night, especially when liquidity drops. Trading only the most active hours helps maintain discipline and consistency.

Economic News and the New York Session

Many high-impact economic reports are released during the New York session. These include US employment data, inflation reports, and Federal Reserve announcements.

Such events can cause sharp price movements within seconds. Traders should always be aware of the economic calendar and avoid entering trades blindly before major releases.

Common Mistakes Kenyan Traders Make During the New York Session

Some traders assume that volatility guarantees profit, which is not always true. Without a clear plan, fast markets can lead to emotional decisions.

Another common mistake is ignoring daylight saving changes. Trading at the wrong hours can mean missing the most active part of the session or entering trades during low liquidity.

How to Plan Your Trading Schedule Around the New York Session

A well-structured routine helps traders stay focused and avoid fatigue. Kenyan traders can prepare by analyzing charts earlier in the day and waiting for confirmation during the New York session.

Limiting trading to one or two high-quality setups per day often produces better results than trading every price movement.

Is the New York Session Suitable for Beginners?

The New York session can be suitable for beginners if approached carefully. Its clear price action and strong liquidity make it easier to apply technical analysis.

However, beginners should start with small position sizes and avoid trading during major news until they gain experience. Practicing on a demo account during this session can also help build confidence.

Final Thoughts

Understanding the New York Session in Kenyan Time gives Kenyan traders a clear advantage in the forex market. Knowing the correct hours, market behavior, and best trading approaches helps reduce guesswork and improve consistency.

When traded with discipline and proper risk management, the New York session offers some of the best opportunities in forex trading for Kenyan-based traders.

Our financial editorial team covers global markets, economic policy, and investment trends. We combine real-time research with AI-powered writing assistants to deliver accurate, timely, and easy-to-read articles. Our editors review all content to ensure quality, neutrality, and clarity for our readers.