Andrews’ Pitchfork is a technical analysis tool used to identify price trends, potential support and resistance levels, and market direction. Developed by Dr. Alan Andrews, it is based on the idea that prices tend to move around a median line over time.

Traders across forex, stocks, crypto, and commodities use Andrews’ Pitchfork because it combines structure with flexibility. When drawn correctly, it helps traders understand where price is likely to gravitate, pause, or reverse.

What Is Andrews’ Pitchfork?

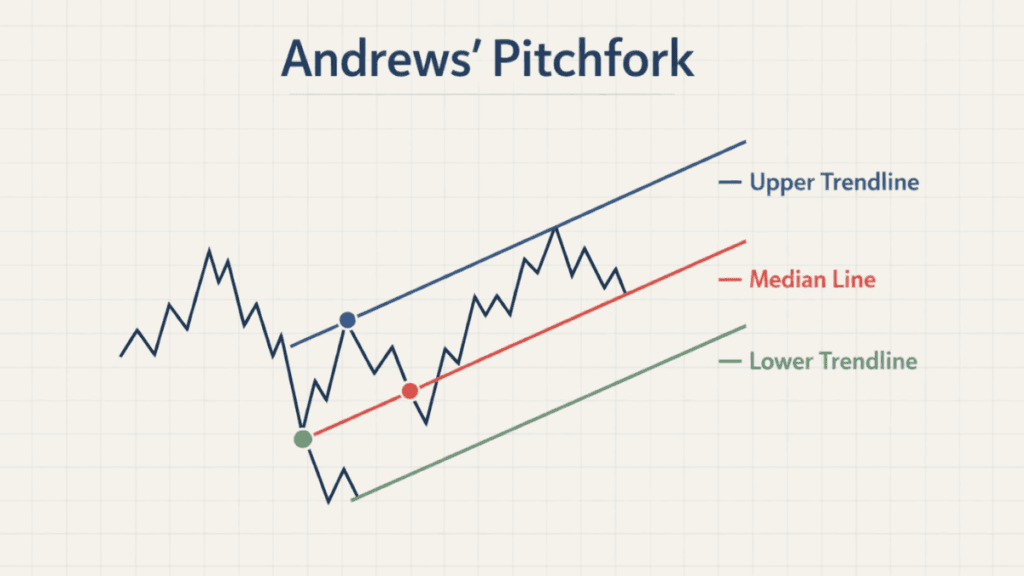

At its core, Andrews’ Pitchfork is a trend-based indicator drawn using three key price points on a chart. These points create a central median line and two parallel outer lines that resemble a pitchfork shape.

The tool assumes that once a trend begins, price will often return to the median line before continuing in the direction of the trend. This makes it useful for both trend-following and identifying potential turning points.

The Theory Behind Andrews’ Pitchfork

The logic behind Andrews’ Pitchfork comes from Newtonian physics, particularly the concept of action and reaction. Dr. Andrews believed that price movements behave in a similar way, responding to previous swings in a structured manner.

According to this theory, price tends to:

- Move toward a median line

- React predictably around parallel boundaries

- Respect past swing highs and lows as reference points

This theoretical foundation is why the tool remains relevant decades after its introduction.

Components of Andrews’ Pitchfork

Before using the indicator effectively, it is important to understand its main elements. Each line plays a specific role in guiding price analysis.

The Median Line

The median line is the central axis of the pitchfork and acts like a gravitational center for price. In a healthy trend, price frequently returns to this line before moving away again.

When price consistently fails to reach the median line, it may signal weakening momentum or a potential trend change.

Upper and Lower Parallel Lines

The two outer lines run parallel to the median line and form dynamic resistance and support levels. In an uptrend, price often bounces from the lower line, while in a downtrend it reacts from the upper line.

These lines help traders visualize price boundaries without relying on horizontal levels.

How to Draw Andrews’ Pitchfork Correctly

Drawing Andrews’ Pitchfork properly is essential for accurate analysis. The tool relies on three specific swing points that define market structure.

Choosing the Three Anchor Points

The pitchfork starts with three points:

- A major swing low or high

- A reaction swing in the opposite direction

- Another swing that confirms the emerging trend

These points should be clear and visible on the chart, not minor price fluctuations.

Applying the Tool on a Chart

Once the three points are selected, the platform automatically plots the median line and the two parallel lines. The pitchfork should align naturally with price action rather than being forced to fit.

If price consistently ignores the lines, the chosen anchor points may need adjustment.

How Traders Use Andrews’ Pitchfork in Practice

Andrews’ Pitchfork is not just a visual aid; it provides practical trading insights. Traders often combine it with price action to improve decision-making.

Identifying Trend Direction

The slope of the median line reveals the dominant trend. An upward-sloping pitchfork suggests bullish conditions, while a downward slope indicates bearish pressure.

This makes the tool useful for filtering trades in the direction of the broader market.

Finding Support and Resistance Zones

Instead of relying on static horizontal levels, traders use the pitchfork’s outer lines as dynamic zones. These areas adapt as price evolves, offering more context than fixed support and resistance.

Price reactions near these lines often provide early clues about continuation or reversal.

Timing Entries and Exits

Traders may look for buying opportunities near the lower parallel line in an uptrend or selling opportunities near the upper line in a downtrend. Exit decisions are often guided by the median line or the opposite parallel line.

This structured approach helps reduce emotional trading.

Common Variations of Andrews’ Pitchfork

Over time, traders have developed variations to adapt the tool to different market conditions. These variations keep the core concept but add flexibility.

Schiff Pitchfork

The Schiff Pitchfork adjusts the starting point to account for strong price momentum. It is often used when traditional pitchforks appear too steep.

This variation can better align with fast-moving or volatile markets.

Modified Schiff Pitchfork

The Modified Schiff version further refines the starting points to smooth out price action. Traders use it when markets show irregular swings or shallow pullbacks.

While helpful, it should still be confirmed with price behavior.

Advantages of Using Andrews’ Pitchfork

Andrews’ Pitchfork offers several benefits that make it appealing to technical traders. Its strength lies in structure rather than prediction.

Key advantages include:

- Clear visual framework for trends

- Dynamic support and resistance

- Works across multiple timeframes and markets

When used patiently, it encourages disciplined analysis rather than guesswork.

Limitations and Common Mistakes

Despite its usefulness, Andrews’ Pitchfork is not flawless. Misapplication can lead to misleading signals.

One common mistake is forcing the tool onto charts where no clear trend exists. Another issue is relying on it alone without considering market context, volume, or broader price action.

Best Practices for Using Andrews’ Pitchfork

To get consistent results, traders should treat Andrews’ Pitchfork as a guide, not a guarantee. It works best when combined with other analytical methods.

Using higher timeframes for structure and lower timeframes for entries often improves accuracy. Regular practice and chart review also help develop confidence in selecting correct anchor points.

Andrews’ Pitchfork vs Other Trend Tools

Compared to trendlines or channels, Andrews’ Pitchfork provides more structure. It automatically creates a central reference point rather than relying on subjective placement.

However, simpler tools may work better for beginners. The pitchfork becomes more effective as a trader gains experience reading price behavior.

Final Thoughts

Andrews’ Pitchfork remains a valuable tool for traders who want a structured way to analyze trends and price movement. Its strength lies in its ability to adapt to changing market conditions while maintaining clear rules.

When applied with patience, proper anchor points, and sound risk management, Andrews’ Pitchfork can become a reliable part of a well-rounded trading strategy.