The Aroon Indicator is a technical analysis tool designed to help traders identify trend direction and trend strength in financial markets. It focuses on how recently the price has reached a high or a low, making it especially useful for spotting the early stages of new trends.

Unlike many momentum indicators that rely on price averages, the Aroon Indicator measures time. This time-based approach helps traders understand whether a market is trending, consolidating, or potentially preparing for a reversal.

What Is the Aroon Indicator?

The Aroon Indicator is a trend-following indicator developed by Tushar Chande in 1995. Its main purpose is to determine whether an asset is in a strong trend and how long that trend has been in place.

The indicator consists of two separate lines that move between fixed values. By comparing these lines, traders can quickly see whether buyers or sellers are currently in control of the market.

The Two Components of the Aroon Indicator

The Aroon Indicator is built from two lines that work together to describe market behavior. Each line provides specific information about recent price action.

AroonThe Up

The Aroon Indicator Up measures the number of periods since the most recent high. When this line is high, it indicates that prices are making new highs frequently.

A rising Aroon Up suggests strengthening bullish momentum. When it stays near the top of the scale, it often confirms that an uptrend is well established.

Aroon Down

Aroon Down tracks how many periods have passed since the most recent low. A high Aroon Down value shows that prices are regularly making new lows.

When Aroon Down remains elevated, it signals strong bearish pressure. This behavior is commonly seen during sustained downtrends.

How the Aroon Indicator Is Calculated

The Aroon Indicator calculated is based on time rather than price magnitude. This makes it different from oscillators that focus on speed or distance of price moves.

The formula uses a chosen lookback period, commonly 14 periods. It then measures how recently the highest high or lowest low occurred within that window and converts the result into a percentage between 0 and 100.

How to Read the Aroon Indicator

Interpreting the Aroon Indicator becomes straightforward once you understand how the two lines interact. The key lies in their relative position and movement over time.

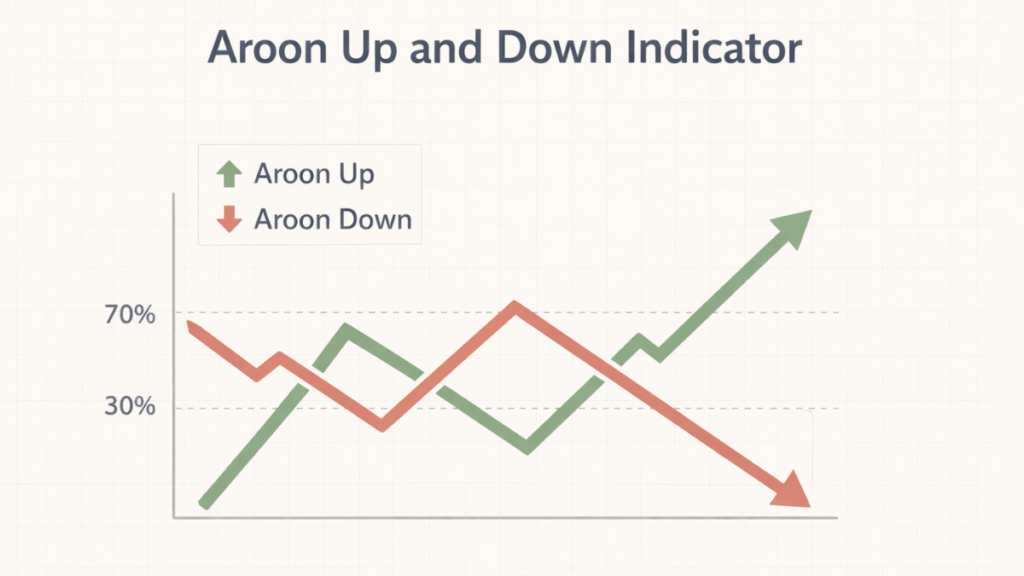

When Aroon Up is above Aroon Down, the market is generally bullish. When Aroon Down is above Aroon Up, bearish conditions are more likely dominating.

Identifying Trend Strength with Aroon

The Aroon Indicator is particularly effective at showing whether a trend is strong or weak. Strong trends tend to keep one line near the top of the scale.

Aroon values above 70 often indicate a healthy, established trend. Values below 30 suggest weak trends or range-bound market conditions where price lacks direction.

Using Aroon to Spot Trend Reversals

One of the most valuable uses of the Aroon Indicator is identifying potential trend changes. These signals often appear before price patterns become obvious on the chart.

A possible bullish reversal occurs when Aroon Up rises sharply while Aroon Down falls. A bearish reversal may be forming when Aroon Down rises above Aroon Up after a prolonged uptrend.

Aroon Indicator vs Other Trend Indicators

The Aroon Indicator differs from tools like moving averages and the MACD. Instead of smoothing price data, it focuses on the timing of highs and lows.

This makes Aroon especially useful in markets where price moves are irregular, but trends still exist. Many traders combine it with other indicators to confirm signals and reduce false readings.

Best Market Conditions for the Aroon Indicator

The Aroon Indicator performs best in markets that experience clear directional trends. Stocks, forex pairs, and commodities with sustained momentum tend to produce more reliable signals.

In sideways or choppy markets, Aroon lines may cross frequently. During these periods, traders often use additional confirmation tools to avoid overtrading.

Common Aroon Indicator Trading Strategies

Traders use the Aroon Indicator in several practical ways. These approaches focus on trend confirmation rather than precise entry timing.

- Trend confirmation when one line stays above 70 and the other below 30

- Trend change signals when Aroon Up and Down cross

- Trade filtering by avoiding positions when both lines stay below 50

Each strategy works best when combined with price action or support and resistance levels.

Limitations of the Aroon Indicator

Like all technical indicators, the Aroon Indicator has limitations. It does not predict price targets or exact entry points on its own.

Because it is time-based, it may lag during sudden price spikes. Traders should always consider broader market context and risk management alongside Aroon signals.

How to Combine the Aroon Indicator with Other Tools

The Aroon Indicator becomes more effective when paired with complementary indicators. Momentum oscillators and volume tools can help confirm trend strength.

Common combinations include using Aroon with a moving average signal to signal direction, or with RSI to confirm overbought and oversold conditions. This layered approach helps improve decision-making.

Final Thoughts

The Aroon Indicator is a powerful yet simple tool for understanding market trends. Its focus on time since highs and lows offers a unique perspective that many indicators overlook.

For beginners, it provides a clear way to recognize whether a market is trending. For experienced traders, it serves as a reliable trend filter when used alongside other technical tools.