An ascending channel is a technical chart pattern that shows a market moving higher in a controlled, upward trend. It appears when price makes a series of higher highs and higher lows that stay within two parallel, upward-sloping lines.

In the first moments of any chart analysis, spotting an ascending channel helps traders understand market direction and structure. The pattern reflects steady buying pressure rather than sudden price spikes, which makes it useful for both short-term and long-term decision-making.

What Is an Ascending Channel?

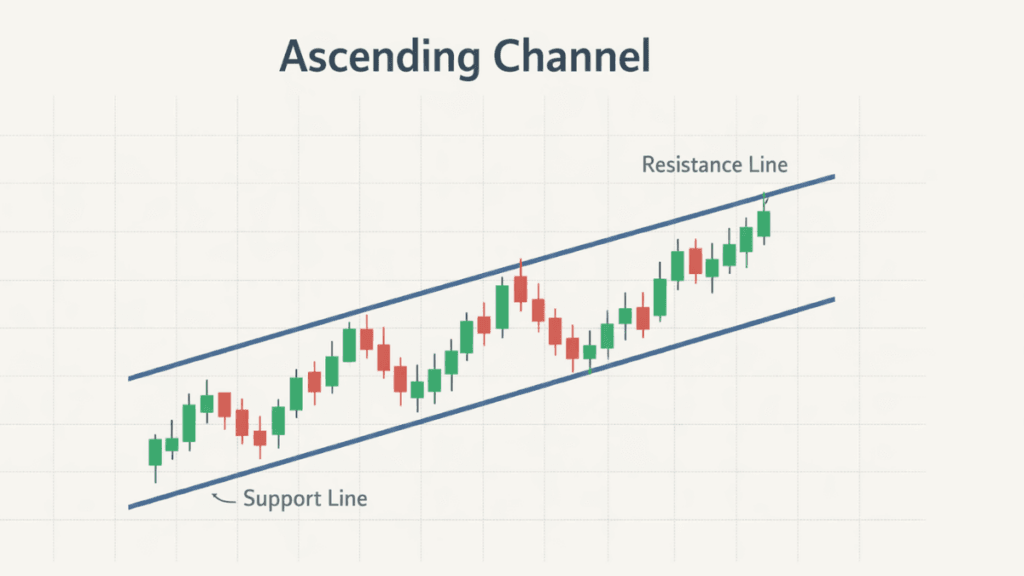

An ascending channel forms when price action is contained between a rising support line and a rising resistance line. These two trendlines move upward at roughly the same angle, creating a visible channel that guides price movement.

The lower boundary acts as support, where buyers tend to step in, while the upper boundary acts as resistance, where selling pressure often appears. As long as the price respects these boundaries, the trend is considered healthy and intact.

Key Characteristics of an Ascending Channel

An ascending channel has several defining features that distinguish it from other chart patterns. Understanding these traits helps traders avoid misidentifying similar-looking structures.

Common characteristics include:

- A clearly rising support line connecting higher lows

- A parallel rising resistance line connecting higher highs

- Repeated price reactions at both boundaries

- A trend that develops over time rather than instantly

These features together signal an orderly uptrend rather than a random or volatile move.

How an Ascending Channel Forms

An ascending channel forms when demand steadily outweighs supply, but not aggressively enough to cause a breakout. Buyers push prices higher, while sellers temporarily cap advances at rising resistance.

This behavior often appears during healthy trends where institutions accumulate positions gradually. Instead of sharp spikes, the market advances in controlled waves, creating a visually clean channel structure.

How to Identify an Ascending Channel on a Chart

Identifying an ascending channel starts with observing price behavior rather than forcing lines onto a chart. The pattern should be obvious and respected by the price multiple times.

Begin by drawing a trendline under at least two higher lows to form the support line. Then draw a parallel line across the highs to form resistance, adjusting slightly so most price action fits cleanly within the channel.

Ascending Channel vs Other Channel Patterns

Ascending channels are part of a broader family of channel patterns, each reflecting a different market bias. Comparing them helps clarify what the market is signaling.

An ascending channel signals a bullish trend, while a descending channel shows a bearish trend with lower highs and lower lows. A horizontal channel, by contrast, reflects a range-bound market with no clear directional bias.

What an Ascending Channel Tells You About Market Psychology

An ascending channel reflects steady optimism among buyers without excessive excitement. Buyers are confident enough to keep pushing prices higher, but sellers remain active at predictable levels.

This balance creates a rhythm in price movement, making the pattern appealing to traders who prefer structured and disciplined setups. It often appears in trending markets driven by consistent fundamentals or strong sentiment.

Common Trading Strategies Using an Ascending Channel

Trading an ascending channel means aligning with the prevailing trend instead of fighting it.

Traders often look for buying opportunities near the lower boundary when the price shows signs of holding support, then manage exits as the price approaches the upper boundary.

Partial profit-taking near resistance is common, while leaving a portion of the position open allows participation in further upside.

Rather than acting as a standalone signal, the ascending channel serves as a structural guide for planning entries, exits, and risk management within an established trend.

Buying Near Channel Support

Buying near the lower trendline aligns trades with the dominant trend. This approach seeks value within strength rather than chasing price at highs.

Traders often look for confirmation, such as bullish candlesticks or momentum stabilization, before entering. Stops are commonly placed just below channel support.

Selling or Taking Profits Near Channel Resistance

The upper trendline often acts as a logical profit-taking zone. Even in strong uptrends, the price frequently pauses or pulls back from this level.

Short-term traders may also look for countertrend setups here, though this carries higher risk. Most trend-followers simply reduce exposure near resistance.

Trading the Breakout

A decisive break above the upper channel line can signal trend acceleration. This suggests buyers are overwhelming sellers who previously defended resistance.

Breakouts are more reliable when supported by increased volume or strong momentum. False breakouts are common, so confirmation matters.

Breakouts and Breakdowns from an Ascending Channel

An ascending channel does not last forever, and the price will eventually leave the pattern. The direction of the breakout can offer important information.

A breakout above resistance often signals trend acceleration, especially when volume increases. A breakdown below support may indicate weakening momentum or a trend reversal, particularly if it follows repeated failed attempts to make higher highs.

Using Indicators to Confirm an Ascending Channel

Indicators can add confidence when trading an ascending channel, especially in uncertain market conditions. They should support the price structure rather than replace it.

Moving averages often slope upward within a healthy channel, reinforcing the trend direction. Momentum indicators such as RSI can help spot overbought conditions near resistance or oversold conditions near support.

Risk Management When Trading Ascending Channels

Risk management is essential when trading any chart pattern, including ascending channels. Even well-formed channels can fail unexpectedly.

Stop-loss orders are commonly placed just below the support line to limit downside risk. Position sizing should reflect the distance between entry and stop level rather than emotional confidence in the pattern.

Common Mistakes Traders Make with Ascending Channels

Misusing ascending channels can lead to poor decisions, even when the pattern looks clear. Many mistakes come from forcing structure onto random price movement.

Common errors include:

- Drawing channels without enough price touches

- Ignoring the overall market context

- Assuming every channel will result in a breakout

A channel is a guide, not a guarantee, and should always be part of a broader analysis.

Ascending Channels in Different Timeframes

Ascending channels appear across all timeframes, from minute charts to monthly charts. The timeframe determines how the pattern should be traded and interpreted.

Shorter timeframes tend to produce quicker signals with higher noise, while longer timeframes offer stronger trend reliability. Matching the channel’s timeframe to your trading style improves consistency.

Final Thoughts

An ascending channel is a reliable and widely used pattern for understanding upward-trending markets. Its strength lies in its simplicity, clarity, and ability to reflect real market behavior.

When used with proper risk management and confirmation, ascending channels can help traders stay aligned with the trend rather than reacting emotionally to price movement. Over time, recognizing these patterns builds confidence and discipline in technical analysis.