The Bearish Engulfing Pattern is one of the most reliable candlestick patterns used in technical analysis to identify potential trend reversals. Traders across forex, stocks, crypto, and commodities rely on this pattern to spot early signs that buying pressure is weakening and sellers may soon take control.

In this guide, you will learn exactly how the Bearish Engulfing Pattern works, why it forms, and how to trade it safely. The explanations are clear, practical, and based on real trading experience rather than theory alone.

What Is the Bearish Engulfing Pattern?

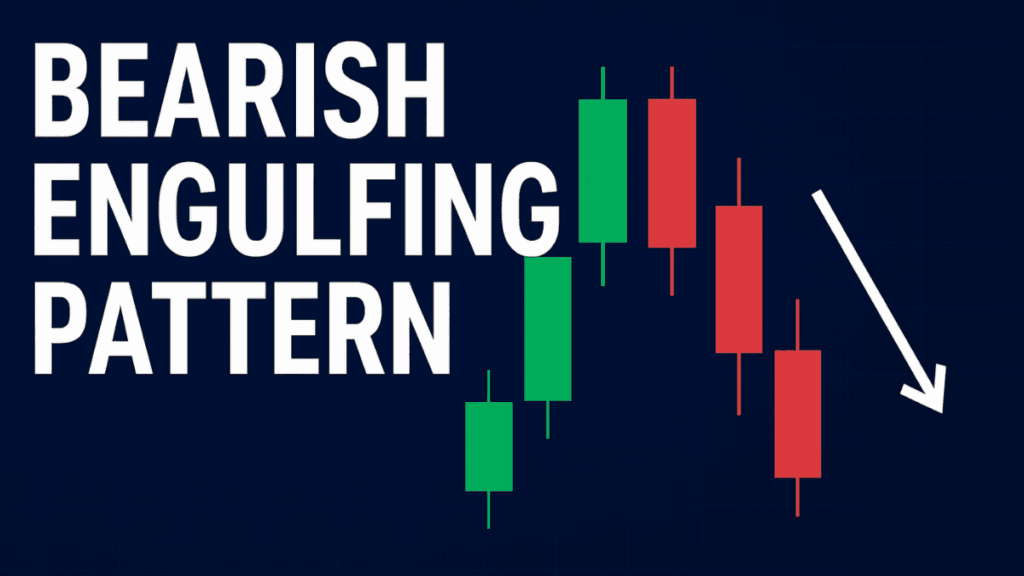

The Bearish Engulfing Pattern is a two-candle reversal pattern that appears after an uptrend or a price rally. It signals a possible shift from bullish momentum to bearish momentum.

This pattern forms when a small bullish candle is immediately followed by a larger bearish candle. The second candle fully “engulfs” the body of the first one, showing that sellers have overpowered buyers.

Before traders act on it, they must understand that the pattern does not guarantee a reversal. Instead, it provides a warning that market sentiment may be changing.

How the Bearish Engulfing Pattern Forms

To correctly identify this pattern, the market must meet specific conditions. These conditions help traders avoid false signals and low-quality setups.

First, the price should be in an uptrend or at least moving higher. This context is important because the pattern represents a potential reversal, not a continuation.

Second, the first candle must be bullish, showing buyers are still in control. The second candle must then open above or near the first candle’s close and close below its open, fully engulfing the body.

This sudden shift shows aggressive selling pressure entering the market.

Psychology Behind the Bearish Engulfing Pattern

Understanding trader psychology makes this pattern far more powerful. Without psychology, candlestick patterns lose much of their meaning.

During the first candle, buyers feel confident and continue pushing prices higher. Many traders enter late, expecting the uptrend to continue.

On the next candle, sellers step in strongly. Price falls fast, trapping late buyers and forcing them to exit their positions. This creates more selling pressure, which can lead to a trend reversal or at least a pullback.

Why the Bearish Engulfing Pattern Matters

The Bearish Engulfing Pattern matters because it reflects a clear shift in market control. It shows that sellers are no longer passive and are willing to dominate price action.

Professional traders value this pattern because it often appears near market tops, resistance zones, or key technical levels. When combined with other tools, it becomes a high-probability signal rather than a guess.

Bearish Engulfing Pattern vs Bearish Harami

Although both are bearish reversal patterns, they communicate different levels of strength.

The Bearish Engulfing Pattern is stronger because the second candle completely overwhelms the first one. This shows decisive selling pressure.

The Bearish Harami, on the other hand, reflects hesitation rather than aggression. It warns of a possible reversal but does not show strong seller control.

Traders generally prefer the Bearish Engulfing Pattern when looking for clearer reversal signals.

Best Places to Use the Bearish Engulfing Pattern

Location is more important than the pattern itself. A Bearish Engulfing Pattern in the wrong place often fails.

This pattern works best when it appears at key resistance levels, such as previous highs or supply zones. It is also effective near psychological price levels where traders tend to react strongly.

When the pattern forms after an extended uptrend, its reliability increases because the market may already be overbought.

How to Trade the Bearish Engulfing Pattern

Trading the Bearish Engulfing Pattern requires patience and confirmation. Entering too early or without context can lead to losses.

Most traders wait for the bearish candle to close before entering a short position. This confirms that sellers maintained control until the end of the session.

Stop-loss placement is usually above the high of the engulfing candle. This protects traders if the market continues upward instead of reversing.

Profit targets are often placed near support levels, previous lows, or based on risk-to-reward ratios.

Confirmation Signals to Increase Accuracy

Relying on the Bearish Engulfing Pattern alone is risky. Smart traders combine it with confirmation tools.

Indicators such as RSI can help identify overbought conditions. When RSI is high and a Bearish Engulfing Pattern appears, the reversal signal becomes stronger.

Volume is another useful confirmation. A higher volume on the engulfing candle suggests strong seller participation, increasing confidence in the setup.

Common Mistakes Traders Make

Many traders misuse the Bearish Engulfing Pattern because they focus only on the candle shape. This often leads to false signals.

One common mistake is trading the pattern during sideways markets. Without a prior uptrend, the pattern loses its reversal meaning.

Another mistake is ignoring higher timeframes. A Bearish Engulfing Pattern on a small timeframe may fail if the larger trend remains strongly bullish.

Is the Bearish Engulfing Pattern Reliable?

The Bearish Engulfing Pattern is reliable when used correctly and in the right context. It is not a standalone strategy but a powerful confirmation tool.

Professional traders treat it as a warning sign rather than a guaranteed signal. When combined with trend analysis, support and resistance, and proper risk management, it can significantly improve trading decisions.

Consistency and discipline matter more than the pattern itself.

Final Thoughts

The Bearish Engulfing Pattern is a valuable tool for traders who want to identify potential market reversals with clarity. It reflects a clear shift in market psychology and often appears at critical price levels.

When used with patience, confirmation, and proper risk control, this pattern can become a reliable part of any trading strategy. Focus on quality setups rather than frequency, and always trade with a clear plan.