The breakeven point is a simple but powerful financial concept that helps businesses, investors, and traders understand the minimum level of income needed to avoid losses. When you reach the breakeven point, you are no longer operating at a loss—any increase beyond this level becomes profit. This makes the breakeven point one of the most important terms in finance, budgeting, and business strategy.

Before we explore formulas and examples, it’s important to understand why this concept is used across different industries.

What Is the Breakeven Point?

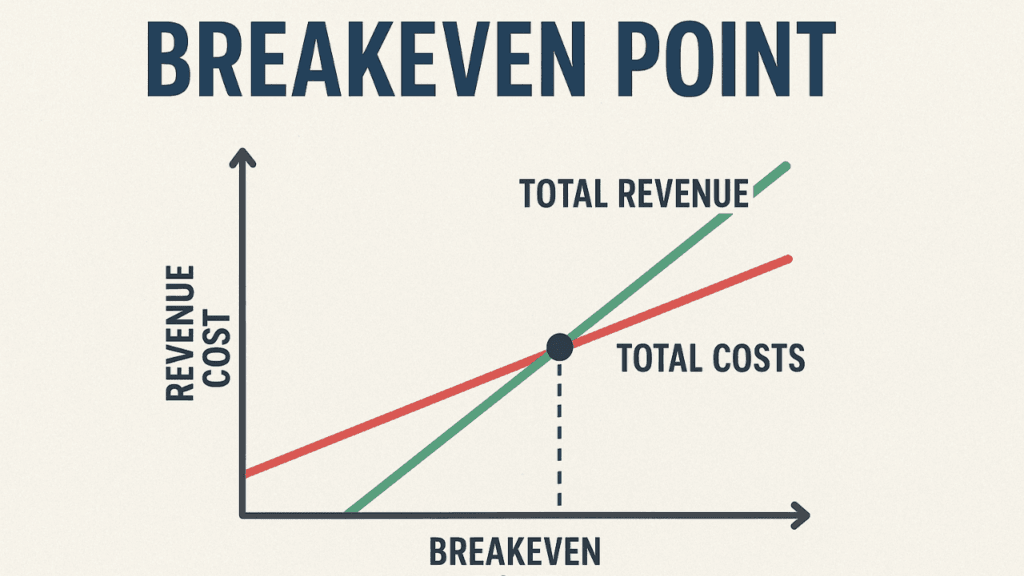

To understand the breakeven point clearly, we must look at it as the moment when total revenue equals total costs. At this stage, the business or investment is neither losing nor making money. It is simply covering all expenses.

The breakeven point is used to answer a key question:

“How much do I need to sell or earn to avoid a loss?”

This question helps business owners make pricing decisions, traders manage risk, and project managers estimate feasibility.

Why the Breakeven Point Matters

Before going deeper, it’s important to know why the breakeven point is widely used in financial planning. It acts as a foundation for making informed decisions and setting realistic goals.

1. Helps Businesses Set Prices

Companies use this concept to decide the minimum selling price needed to stay profitable. If a price is too low, a business may never reach its breakeven point.

2. Useful for Cost Control

Knowing the breakeven point makes it easier to identify unnecessary expenses. Businesses can adjust fixed and variable costs to lower their breakeven target.

3. Guides Investment Decisions

Entrepreneurs and investors analyze how long it will take for an initial investment to pay off. A shorter breakeven period often means lower risk.

4. Supports Risk Management in Trading

In trading, breakeven levels show where a trade must return to avoid losses. Traders often move their stop-loss to breakeven once a trade becomes profitable.

How the Breakeven Point Works

Before using formulas, we need to understand the two cost types that make up the breakeven calculation.

Fixed Costs

These do not change even if production or sales increase. Examples include rent, salaries, insurance, and licenses.

Variable Costs

These change depending on the level of production or sales. Examples include raw materials, packaging, and transaction fees.

Total Costs

This refers to the sum of fixed and variable costs. Once total revenue equals total costs, the breakeven point is reached.

Breakeven Point Formula

Here is the most common formula used in business:

Breakeven Point (Units) = Fixed Costs ÷ (Selling Price per Unit – Variable Cost per Unit)

This formula shows the number of units you need to sell to cover all costs.

There is also a revenue-based version:

Breakeven Point (Revenue) = Fixed Costs ÷ Contribution Margin Ratio

Contribution margin ratio is:

(Selling Price – Variable Cost) ÷ Selling Price

Understanding these formulas helps you analyze cost structure and pricing more accurately.

Example of Breakeven Point Calculation

Before looking at applications, let’s walk through a simple example to make the formula clear.

Example

A company sells T-shirts at $25 each.

Variable cost per shirt = $10

Fixed monthly costs = $3,000

Breakeven Point (Units) = 3,000 ÷ (25 – 10)

= 3,000 ÷ 15

= 200 units

This means the company must sell 200 shirts per month to avoid a loss. Any sale after the 200th unit contributes to profit.

Breakeven Point in Trading

Before moving into other applications, it’s important to see how traders use this concept. Unlike businesses that deal with units and products, traders use the breakeven point to determine the price level where a trade neither gains nor loses money.

How Traders Use Breakeven Levels

- To move the stop-loss to breakeven after a trade becomes profitable

- To calculate position size

- To determine the minimum price change needed to cover fees or spreads

- To avoid emotional decision-making in volatile markets

Many professional traders use breakeven levels as part of their risk management strategy to protect capital.

Applications of the Breakeven Point

Before we conclude, it’s helpful to understand the different practical uses of this concept beyond simple cost calculations.

1. Startup Planning

Entrepreneurs use the breakeven point to estimate how long it will take for a new business to start generating profit.

2. Product Launch Decisions

Businesses analyze whether a new product can realistically meet its breakeven target before investing heavily.

3. Budgeting and Forecasting

Financial planners use breakeven analysis to create more realistic budgets and predict future cash needs.

4. Scaling and Expansion

Companies measure current breakeven levels to determine if they can support growth or expansion.

Limitations of the Breakeven Point

Even though the breakeven point is important, it also has limitations that need to be acknowledged before relying on it fully.

1. Assumes Constant Prices

It assumes selling price and costs remain stable, which is not always true in dynamic markets.

2. Ignores Market Demand

Reaching the breakeven point is meaningless if there is no demand for the product.

3. Does Not Consider Competitor Reactions

Competitors may reduce prices or increase marketing, which can affect the breakeven point.

4. Not Fully Accurate for Multiple Products

If a business sells different items with different margins, calculating a single breakeven point becomes more complex.

Final Thoughts

Understanding the breakeven point is essential for anyone running a business, planning a startup, or trading financial markets. It helps you know the exact moment when your operations shift from loss to profit. By learning how to calculate and apply it, you can make smarter financial decisions, manage risk effectively, and set realistic goals.

This simple yet powerful concept remains one of the most reliable tools for financial planning and long-term success.