A Breakout occurs when the price moves decisively beyond a well-defined level of support or resistance, signaling a potential shift in market direction. Traders pay close attention to breakout setups because they often mark the start of a new trend or a strong continuation of an existing one. When understood correctly, breakouts can offer timely entries with clear risk levels, making them popular among both short-term and long-term traders.

This guide explains what a breakout is, why it matters, how to identify high-quality signals, and how to manage risk effectively. The goal is to help you understand the concept clearly and apply it with discipline rather than hype.

What Is a Breakout?

A breakout happens when the price pushes beyond a price level that has previously acted as a barrier. That barrier may be resistance above price or support below it, and the breakout suggests that supply and demand have shifted.

What makes a breakout meaningful is not just the level itself, but the market behavior around it. Strong breakouts tend to occur after a period of consolidation, where price moves in a narrow range, and market participants wait for direction.

Why Breakouts Matter to Traders

Breakouts matter because they often represent moments of decision in the market. When price escapes a range, it can attract new buyers or sellers who were waiting for confirmation.

From a practical perspective, breakouts offer structure. Traders can define where they are wrong, where risk is limited, and where potential reward may expand if momentum builds.

Key Levels Involved in Breakouts

Every breakout is built around clearly defined price levels. Understanding these levels helps traders separate valid setups from random price movement.

Support and Resistance Levels

Support is a price area where buying pressure has previously stopped declines, while resistance is where selling pressure has capped advances. Breakouts occur when the price closes beyond these areas with conviction.

These levels are best identified using repeated price reactions rather than single touches. The more times a level is tested, the more significant a breakout above or below it becomes.

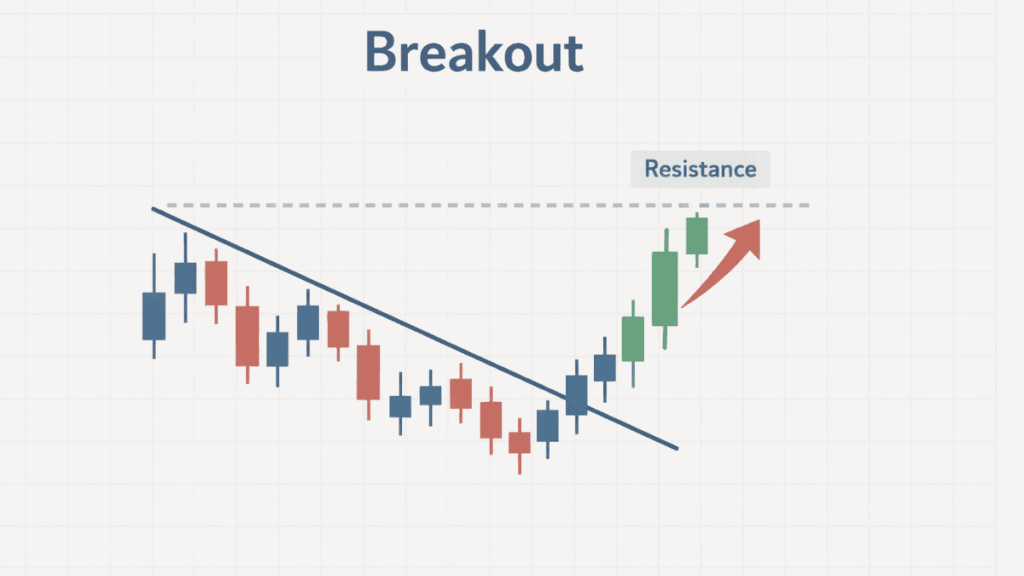

Trendlines and Channels

Breakouts can also occur from trendlines or price channels. When price breaks above a descending trendline or below an ascending one, it may signal a trend change.

Channels provide visual structure, and a breakout from a channel often leads to accelerated price movement as the prior balance breaks down.

Common Types of Breakouts

Not all breakouts look the same, and understanding their context improves decision-making.

Range Breakouts

Range breakouts happen when the price escapes a sideways market. These are common in consolidating markets and often lead to strong directional moves if supported by volume.

They are easier to spot and are widely used by traders because the boundaries of the range provide clear reference points.

Continuation Breakouts

Continuation breakouts occur in trending markets. Price pauses, forms a flag, pennant, or small consolidation, and then breaks in the direction of the existing trend.

These breakouts tend to be more reliable because they align with the broader market direction rather than fighting it.

Reversal Breakouts

Reversal breakouts happen when the price breaks a long-standing trendline or key support or resistance level in the opposite direction of the prior trend. These signals suggest a possible change in market sentiment.

They require more confirmation because false signals are more common during trend transitions.

How to Identify a High-Quality Breakout

Not every move beyond a level is tradable. Quality matters more than speed.

Price Structure and Consolidation

Strong breakouts usually follow periods of tight price action. When volatility contracts and price form a clear structure, the eventual breakout often carries more force.

Loose, choppy markets tend to produce unreliable breakouts that quickly reverse.

Volume Confirmation

Volume provides important context for a breakout. When a price breaks a key level with above-average volume, it suggests broader participation and stronger conviction.

Low-volume breakouts may still work, but they are more vulnerable to failure, especially in uncertain market conditions.

Closing Price Matters

A true breakout is better confirmed by a candle close beyond the level, not just a brief intraday move. Closed shows commitment and reduces the risk of reacting to noise.

Waiting for confirmation may reduce early entry opportunities, but it often improves overall consistency.

False Breakouts and How to Avoid Them

False breakouts occur when the price briefly moves beyond a level and then reverses. These situations are common and can be costly if not managed carefully.

One way to reduce false signals is to wait for confirmation, such as a retest of the broken level that holds. Another approach is to trade in the direction of the higher timeframe trend, which filters out many low-quality setups.

Risk Management When Trading Breakouts

Risk management is essential when trading breakouts because volatility often increases after the price escapes a range.

Stops are commonly placed just inside the broken level, where the breakout would be invalidated. Position size should be adjusted so that a single failed breakout does not significantly impact overall capital.

Reward targets can be set using prior ranges, measured moves, or trailing stops that allow profits to run if momentum continues.

Breakout Trading Strategies Explained Simply

Breakout strategies work best when they are simple and repeatable. Complexity often leads to hesitation and inconsistency.

A basic approach involves identifying a clear level, waiting for a confirmed break, entering with defined risk, and managing the trade according to a pre-planned exit strategy. Over time, reviewing results helps refine timing and execution.

Breakouts Across Different Markets

Breakouts appear in all liquid markets, including stocks, forex, commodities, and cryptocurrencies. While the concept is universal, behavior may differ depending on market structure and trading hours.

For example, breakouts in forex often occur around major economic releases, while stock breakouts may be influenced by earnings or sector momentum. Understanding these differences improves context and timing.

Common Mistakes Traders Make With Breakouts

Many breakout losses come from impatience rather than poor analysis. Entering before confirmation or chasing extended moves often leads to unfavorable risk-reward outcomes.

Another common mistake is ignoring the broader market environment. Breakouts tend to work better in trending or volatile conditions than in quiet, indecisive markets.

Breakouts

A breakout is not a guarantee of profit, but it is a powerful way to understand shifts in market behavior. When combined with clear levels, confirmation, and disciplined risk management, breakout trading can become a reliable part of a broader trading approach.

The key is consistency and patience. By focusing on quality setups rather than frequent trades, traders can use breakouts as structured opportunities rather than emotional reactions to price movement.