Understanding candlestick patterns is essential for traders who want to make informed decisions, and the Bullish Belt Hold is one pattern that signals early strength in the market. The bullish belt hold often appears at the end of a downtrend, and it helps traders identify a possible reversal before momentum shifts.

What Is a Bullish Belt Hold?

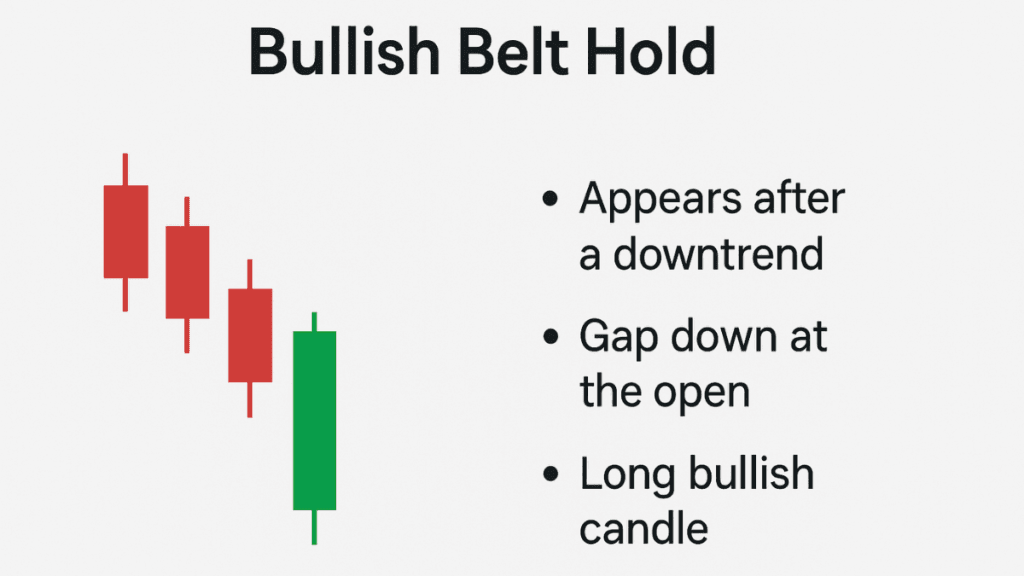

Before exploring its importance, it helps to understand what the Bullish Belt Hold actually is. A Bullish Belt Hold is a single-candle Japanese candlestick pattern that forms during a downtrend and shows strong buying interest. It starts with a gap down at the open and ends with a long bullish candle, which shows that buyers quickly stepped in and regained control.

This pattern is well-known among technical analysts because it provides a clear sign that selling pressure may be weakening.

How the Bullish Belt Hold Forms

To understand this pattern clearly, we need to look at how it develops on the chart.

The Bullish Belt Hold forms when the market opens lower than the previous close, but buyers take over immediately and push the price upward throughout the session. As a result, the candle closes near its high, showing strong bullish strength.

Key Characteristics of a Bullish Belt Hold

A few features help traders identify the pattern without confusion:

- It appears after a downtrend.

- The candle opens with a gap down.

- The body is long and bullish with little or no lower shadow.

- The close is near the high of the session.

These characteristics work together to signal a shift from selling pressure to buying interest.

Why the Bullish Belt Hold Matters in Trading

Now that you know how the pattern forms, it is important to understand why traders pay attention to it.

The Bullish Belt Hold matters because it represents a sudden change in market sentiment. Sellers are no longer in control, and buyers step in aggressively. This strong buying pressure can mark the beginning of a new upward movement.

For traders looking for early reversal signs, this pattern can be valuable because it often appears before other indicators confirm a trend change.

How Traders Use the Bullish Belt Hold

Before applying the pattern, traders should consider how it fits into a broader strategy. A single candlestick does not guarantee a trend reversal, so confirmation is essential.

Entry and Exit Considerations

Here are some common ways traders use it:

- Traders may enter when the next candle confirms the bullish strength.

- Some wait for a break above the high of the Bullish Belt Hold candle.

- For risk management, a stop-loss is often placed below the low of the candle.

These steps help minimize risk while taking advantage of early bullish momentum.

Combining With Other Technical Tools

A transitional explanation helps show how traders improve accuracy. Traders rarely rely on one pattern alone, so combining the Bullish Belt Hold with other tools can strengthen the signal.

Popular confirmations include:

- Support zones

- Oversold signals from RSI

- Bullish divergence in momentum indicators

- Increased trading volume

Using multiple factors can improve the reliability of the pattern.

Strengths and Limitations of the Pattern

Before relying on the Bullish Belt Hold, it is necessary to know both its benefits and limitations. This helps traders apply it with realistic expectations.

Strengths

The pattern provides a few key advantages:

- It gives early reversal signals, which can offer strong entry opportunities.

- It is simple to identify because it is a single candlestick.

- It shows clear buying pressure, making sentiment easy to understand.

Limitations

Like any candlestick pattern, it is not perfect:

- It may fail during strong downtrends where sellers remain dominant.

- It requires confirmation from the following candles or other indicators.

- External market events can override technical signals.

By understanding both sides, traders can use the pattern more effectively.

Common Mistakes Traders Make With the Pattern

A smooth transition helps highlight practical insights. Even though the Bullish Belt Hold is straightforward, beginners often misinterpret it. Avoiding common mistakes can greatly improve accuracy.

Typical errors include:

- Entering too early without waiting for confirmation

- Ignoring the overall trend or market context

- Using the pattern in isolation

- Failing to manage risk properly

Being aware of these mistakes helps traders approach the pattern with discipline.

Is the Bullish Belt Hold Reliable?

Before concluding, it is helpful to understand how reliable the pattern is in real trading.

The Bullish Belt Hold is considered moderately reliable, especially when supported by other indicators or when it appears near strong support levels. It works best when the market is slowing down after a sustained decline, as buyers often step in to take advantage of lower prices.

While it is not a stand-alone signal, it plays an important role in technical analysis.

Conclusion

The Bullish Belt Hold is a powerful candlestick pattern that signals a potential reversal during a downtrend. It forms when buyers take control after a gap down, creating a long bullish candle with strong upward momentum. When combined with confirmation signals and proper risk management, this pattern can help traders identify valuable entry opportunities.

By understanding how it forms, how to use it, and its strengths and limitations, traders can apply the Bullish Belt Hold with confidence and strategy.