The Bullish Engulfing pattern is one of the most trusted reversal signals in technical analysis. Traders across forex, stocks, crypto, and commodities use it to identify potential trend changes from bearish to bullish conditions. When understood and applied correctly, it can offer high-probability entry opportunities with clearly defined risk.

This guide explains the Bullish Engulfing pattern in simple terms, shows how it works in real markets, and teaches you how professionals trade it. Every section builds logically, so you can move from beginner understanding to confident application.

What Is a Bullish Engulfing Pattern?

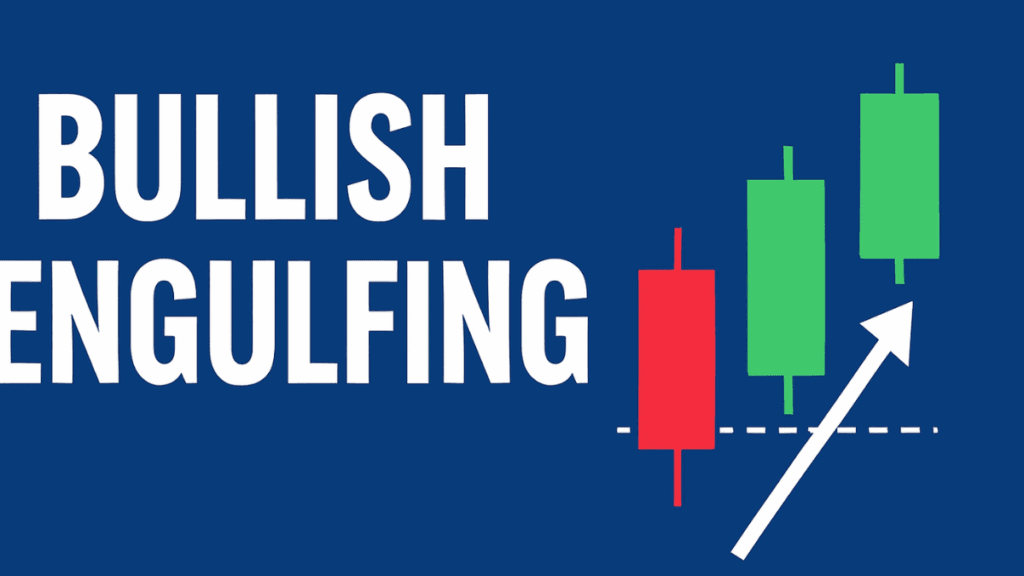

The Bullish Engulfing pattern is a two-candle reversal pattern that appears after a downtrend. It signals that buyers have taken control after sellers dominated the market.

The first candle is bearish, showing continued selling pressure. The second candle is bullish and completely engulfs the body of the first candle, indicating a strong shift in market sentiment.

This pattern matters because it reflects a sudden and meaningful change in order flow. Sellers lose control, and buyers step in aggressively.

Why the Bullish Engulfing Pattern Is Important

Before diving into structure, it is important to understand why traders respect this pattern. Candlestick patterns work because they represent real trader behavior, not just shapes on a chart.

The Bullish Engulfing pattern is important because it shows:

- Strong buying pressure entering the market

- A possible end to bearish momentum

- Early signs of a trend reversal

When this pattern appears at the right location, it often marks the start of a new upward move.

Structure of a Bullish Engulfing Candle

Understanding the structure helps you avoid false signals. The pattern must meet specific conditions to be valid.

First Candle: Bearish Control

The first candle closes lower than it opens, showing that sellers are still in control. This candle usually appears within a downtrend or a pullback.

It does not need to be large, but it must clearly reflect bearish momentum.

Second Candle: Strong Bullish Takeover

The second candle opens below or near the close of the first candle and closes above its open. Its real body must fully engulf the body of the first candle.

This shows that buyers overwhelmed sellers within one trading session.

Key Rules That Define a True Bullish Engulfing Pattern

Not every two-candle formation is a valid Bullish Engulfing. The following rules help filter out weak setups.

A valid Bullish Engulfing pattern should:

- Appear after a clear downtrend or pullback

- Have a second candle that fully engulfs the first candle’s body

- Close near the high, showing strong buying interest

- Form near support or a key technical level

When these conditions align, the pattern carries much more weight.

Market Psychology Behind the Bullish Engulfing Pattern

Candlestick patterns work because they reflect psychology. The Bullish Engulfing pattern tells a clear story about fear, control, and confidence.

At first, sellers push prices lower, reinforcing bearish sentiment. Many traders expect the downtrend to continue. Suddenly, strong buyers enter the market and absorb all selling pressure.

By the close of the second candle, buyers are in full control. This shift often triggers short covering and new long positions, pushing prices higher.

Best Market Conditions for Bullish Engulfing Setups

The Bullish Engulfing pattern performs best in specific environments. Understanding context improves accuracy.

It works best when:

- The market is in a corrective phase within a larger uptrend

- Price is near strong historical support

- Momentum indicators show oversold conditions

The pattern is less reliable in sideways or low-volume markets, where price lacks direction.

Bullish Engulfing vs Bearish Engulfing

To fully understand the Bullish Engulfing, it helps to compare it with its opposite. Both patterns use the same logic but signal different outcomes.

The Bullish Engulfing signals a potential upward reversal after a decline. The Bearish Engulfing signals a possible downward reversal after an uptrend.

Recognizing both patterns allows traders to read market sentiment from both sides of price action.

How to Trade the Bullish Engulfing Pattern

Trading the Bullish Engulfing pattern requires more than spotting it on a chart. You need a clear entry, stop loss, and profit plan.

Entry Strategies

Many traders enter a trade at the close of the bullish engulfing candle. This confirms buyer strength and avoids premature entries.

More conservative traders wait for a small pullback or a break above the pattern’s high before entering.

Stop Loss Placement

Risk management is critical. The most common stop loss placement is below the low of the engulfing candle.

This level invalidates the pattern if broken, keeping losses controlled.

Profit Targets

Profit targets depend on market structure. Common approaches include:

- Previous resistance levels

- Risk-to-reward ratios such as 1:2 or 1:3

- Trailing stops during strong trends

Clear targets remove emotion from trading decisions.

Bullish Engulfing Pattern with Support and Resistance

The Bullish Engulfing pattern becomes far more powerful when it forms at key levels. Support and resistance provide context that confirms the signal.

When price forms a Bullish Engulfing at support, it suggests that buyers are defending that level. This often leads to strong rebounds.

Patterns that appear randomly in the middle of price ranges are less reliable and should be treated with caution.

Using Indicators to Confirm Bullish Engulfing Signals

While the pattern works well on its own, confirmation improves accuracy. Indicators help validate momentum and market strength.

Common confirmations include:

- RSIs are showing oversold conditions

- Moving averages act as dynamic support

- Volume is increasing on the engulfing candle

Indicators should confirm the story, not replace price action.

Bullish Engulfing Across Different Markets

The Bullish Engulfing pattern works across all liquid markets because it is based on human behavior.

In forex, it often appears during pullbacks in trending currency pairs. In stocks, it frequently forms near earnings reactions or strong demand zones. In crypto, it can signal sharp reversals due to volatility.

The logic remains the same regardless of the market.

Timeframes and Reliability

Timeframe selection affects reliability. Higher timeframes generally produce stronger signals.

Daily and weekly Bullish Engulfing patterns carry more weight than those on very short timeframes. Lower timeframes can still work, but require stricter confirmation.

Choosing a timeframe that matches your trading style is essential.

Common Mistakes Traders Make with Bullish Engulfing Patterns

Even strong patterns fail when misused. Understanding common mistakes helps protect capital.

Traders often:

- Ignore the trend and trade against strong momentum

- Enter without confirmation

- Place stop losses too tight

- Trade every engulfing candle without context

Discipline and patience are just as important as pattern recognition.

Bullish Engulfing Pattern in Trend Continuation

Although it is a reversal pattern, the Bullish Engulfing can also act as a continuation signal. This happens when it forms during pullbacks in an uptrend.

In this context, the pattern signals trend strength rather than a full reversal. Many professional traders use it to add to winning positions.

Risk Management When Trading Bullish Engulfing

No pattern is guaranteed. Risk management ensures survival during losing trades.

Always risk a small percentage of your capital per trade. Consistent position sizing protects your account and allows long-term growth.

Successful traders focus on process, not individual outcomes.

Real-World Example of a Bullish Engulfing Pattern

Imagine a market declining for several days and approaching a known support zone. A bearish candle forms, followed by a strong bullish candle that fully engulfs it.

Volume increases, RSI is oversold, and price holds above long-term support. This combination creates a high-probability Bullish Engulfing setup.

This is how professionals stack probabilities.

Is the Bullish Engulfing Pattern Reliable?

The Bullish Engulfing pattern is reliable when used correctly. It is not a standalone strategy but a powerful component of a complete trading plan.

Its reliability improves with:

- Proper market context

- Confirmation tools

- Strong risk management

When these elements align, the pattern can become a consistent edge.

Final Thoughts

The Bullish Engulfing pattern is a timeless price action signal that reflects real market psychology. It helps traders identify shifts in control from sellers to buyers and anticipate potential upward moves.

By focusing on context, confirmation, and risk management, traders can use this pattern with confidence. Mastery comes not from spotting patterns, but from understanding what they represent.

When respected and applied with discipline, the Bullish Engulfing pattern can be a valuable tool in any trader’s strategy.