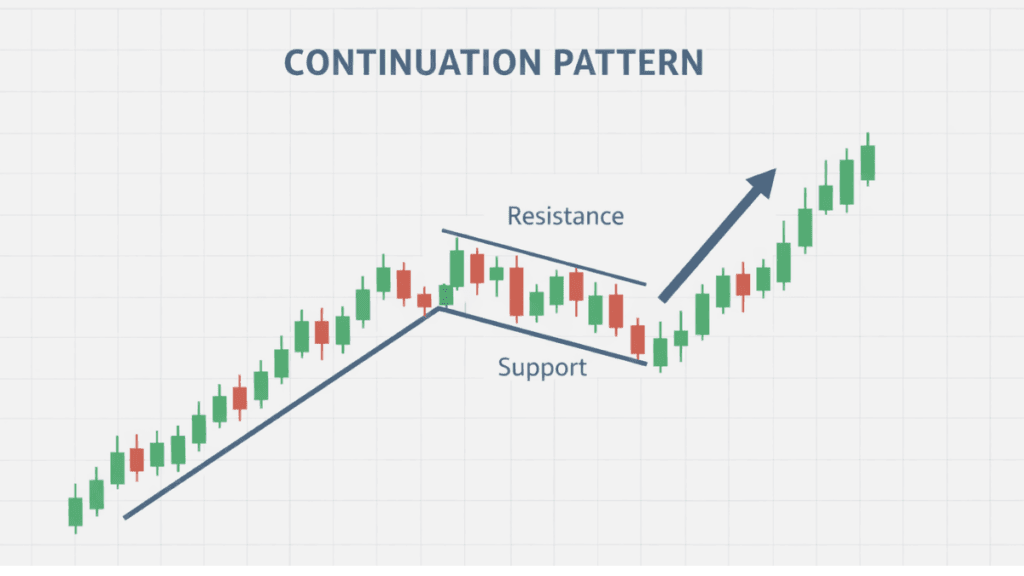

A continuation pattern is a chart formation that signals a temporary pause in price movement before the existing trend resumes. In technical analysis, continuation patterns help traders and investors understand when a market is consolidating rather than reversing, making them valuable tools for trend-following strategies.

These patterns appear after a strong price move and reflect a period of balance between buyers and sellers. Instead of indicating exhaustion, a continuation pattern usually suggests that the market is catching its breath before continuing in the same direction.

What Is a Continuation Pattern?

A continuation pattern is best understood as a structured pause within a broader trend. It forms when price moves sideways or slightly against the trend, allowing market participants to reassess value without fully changing sentiment.

This behavior reflects normal market psychology. After a sharp advance or decline, traders often take profits, while new participants wait for confirmation, creating a short-term consolidation rather than a full trend reversal.

Why Continuation Patterns Matter in Technical Analysis

Continuation patterns matter because they help distinguish healthy trends from weakening ones. By recognizing these formations, traders can avoid exiting positions too early or misinterpreting consolidation as a reversal.

They also provide practical decision points. When a continuation pattern resolves, it often offers clearer entries, defined risk levels, and measurable price targets based on the prior trend.

Key Characteristics of Continuation Patterns

Continuation patterns share common features that make them recognizable across markets and timeframes. Understanding these traits helps traders evaluate their reliability.

Typical characteristics include:

- Formation after a clear upward or downward trend

- Temporary consolidation or corrective price action

- Reduced volatility compared to the prior trend move

- A breakout that aligns with the original trend direction

These features together reinforce the idea that the dominant market force remains intact.

Common Types of Continuation Patterns

Several well-known chart patterns fall under the continuation pattern category. Each has unique visual traits, but they share the same underlying purpose.

Flags

A flag pattern forms when price moves sharply, then drifts in a small, sloping channel. This pause resembles a flag attached to a pole, with the pole representing the strong prior move.

Flags typically resolve quickly and are considered short-term continuation patterns. A breakout in the direction of the original trend often signals momentum returning to the market.

Pennants

Pennants look similar to flags but form a small symmetrical triangle instead of a channel. They reflect tightening price action as buyers and sellers reach short-term equilibrium.

This compression often leads to a strong breakout. When the breakout aligns with the previous trend, the pennant acts as a classic continuation pattern.

Rectangles

A rectangle pattern forms when price moves sideways between well-defined support and resistance levels. This structure shows a clear range where supply and demand are temporarily balanced.

Rectangles can last longer than flags or pennants. A decisive breakout from the range usually confirms trend continuation.

Triangles (Ascending, Descending, Symmetrical)

Triangles are continuation patterns when they form within an established trend. They reflect gradually narrowing price swings as the market prepares for its next move.

While triangles can sometimes signal reversals, their context within a strong trend often favors continuation once price breaks out.

Continuation Pattern vs Reversal Pattern

Understanding the difference between continuation and reversal patterns is essential for accurate analysis. While both involve consolidation, their implications differ significantly.

Continuation patterns suggest the trend is intact and likely to resume. Reversal patterns, by contrast, indicate that momentum is shifting and the existing trend may be ending. Context, trend strength, and volume behavior help distinguish between the two.

Volume Behavior in Continuation Patterns

Volume plays a supporting role in validating continuation patterns. During the consolidation phase, volume often declines as trading activity slows.

When the pattern resolves, volume typically expands in the direction of the breakout. This increase confirms renewed participation and strengthens the continuation signal.

How Traders Use Continuation Patterns

Traders use continuation patterns to time entries, manage risk, and plan exits. These patterns provide structure in otherwise uncertain market conditions.

Many traders wait for a confirmed breakout before acting. Stop-loss orders are often placed just outside the pattern, while profit targets are estimated by measuring the size of the prior trend move.

Limitations of Continuation Patterns

Continuation patterns are not guaranteed predictors of price movement. False breakouts and unexpected news can invalidate even well-formed patterns.

They also require context. Without a clear preceding trend, a pattern may lose its continuation meaning and behave unpredictably. Risk management remains essential when trading any chart pattern.

Continuation Patterns Across Different Markets

Continuation patterns appear in stocks, forex, commodities, and cryptocurrencies. Their structure is based on market behavior rather than asset type.

However, volatility and liquidity can affect how cleanly these patterns form. Highly liquid markets tend to produce more reliable continuation signals.

Continuation Pattern in Long-Term vs Short-Term Analysis

Continuation patterns can be applied across multiple timeframes. On short-term charts, they may last minutes or hours, while on longer-term charts, they can span weeks or months.

The underlying concept remains the same. A pause within a trend serves as a potential opportunity rather than a warning of trend failure.

Key Takeaways on Continuation Patterns

A continuation pattern reflects market consolidation, not indecision about direction. It represents a pause that often strengthens the underlying trend rather than weakening it.

By combining pattern recognition with trend analysis and volume confirmation, traders can use continuation patterns as reliable tools for informed decision-making rather than isolated signals.