The Cup and Handle pattern is one of the most respected chart patterns in technical analysis. Traders across forex, stocks, crypto, and commodities use it to identify potential bullish breakouts with strong continuation potential. When applied correctly, this pattern helps traders spot periods of consolidation that often lead to powerful price moves.

In this guide, you will learn what the Cup and Handle pattern is, how to identify it correctly, how to trade it step by step, and the common mistakes traders make. The explanations are simple, practical, and based on real market behavior.

What Is the Cup and Handle Pattern?

The Cup and Handle is a bullish continuation pattern that forms after an uptrend. It represents a temporary pause in price before buyers regain control and push the market higher.

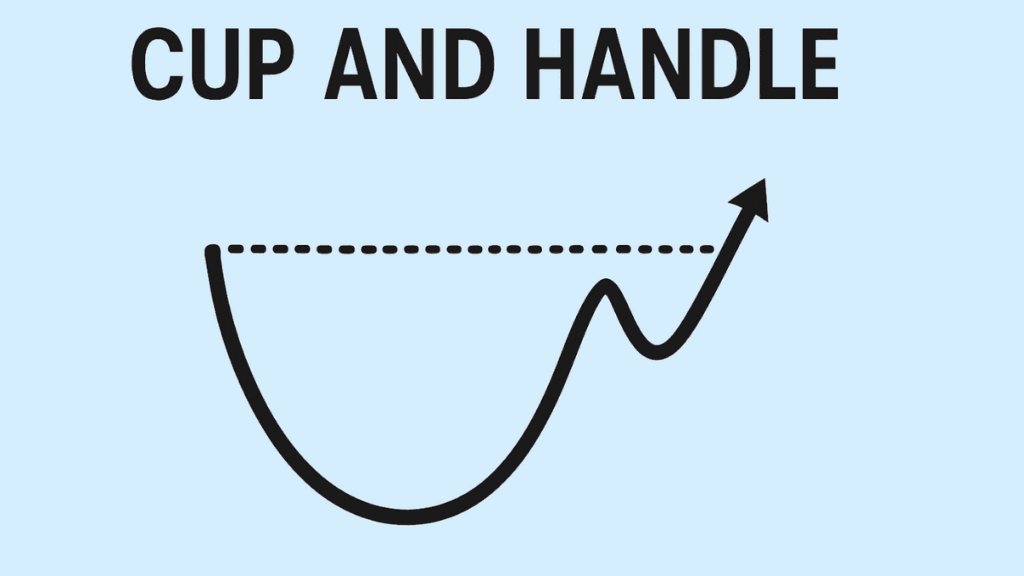

The pattern gets its name from its shape. The first part looks like a rounded cup, while the second part forms a smaller pullback known as the handle. Together, they show a healthy correction rather than a trend reversal.

This pattern works because it reflects market psychology. Sellers gradually lose strength during the cup formation, while buyers quietly accumulate positions before the breakout.

Why the Cup and Handle Pattern Matters

Before learning how to trade it, it is important to understand why traders trust this pattern. The Cup and Handle is not just a chart shape. It represents a clear shift in supply and demand.

Here is why it is widely used:

- It appears in many markets and timeframes

- It offers clear entry, stop loss, and target levels

- It aligns well with trend-following strategies

Because of these qualities, the Cup and Handle is often used by swing traders and position traders who prefer high-probability setups.

Structure of the Cup and Handle Pattern

To trade this pattern correctly, you must understand its two main components. Each part tells a different story about market behavior.

The Cup Formation

The cup forms after a prior uptrend when the price begins to pull back gradually. Instead of dropping sharply, the price creates a smooth, rounded bottom. This shows that selling pressure is weakening over time.

A healthy cup has the following characteristics:

- A rounded bottom, not a sharp V-shape

- Relatively equal highs on both sides of the cup

- A reasonable depth, usually less than 50% of the prior move

The slower and smoother the cup, the more reliable the pattern tends to be.

The Handle Formation

After the price returns to the previous high, it often pulls back again slightly. This small consolidation forms the handle. The handle shakes out weak buyers before the breakout.

A proper handle usually:

- Slopes slightly downward or moves sideways

- Stays above the midpoint of the cup

- Has a lower volume than the cup

The handle is a critical part of the pattern. Without it, the breakout is often weaker or more prone to failure.

How to Identify a Valid Cup and Handle Pattern

Not every rounded shape on a chart is a Cup and Handle. Many traders lose money by forcing the pattern where it does not belong. A valid pattern follows specific rules.

First, the market must already be in an uptrend. The Cup and Handle is a continuation pattern, not a reversal pattern.

Second, the cup should take time to form. Patterns that form too quickly often fail because they do not allow proper accumulation.

Third, the handle should be smaller than the cup. A deep handle signals strong selling pressure, which reduces the chance of a successful breakout.

How to Trade the Cup and Handle Pattern

Once you confirm a valid pattern, the next step is execution. Trading the Cup and Handle becomes much easier when you follow a clear plan.

Entry Strategy

The most common entry point is the breakout above the handle resistance. This level is usually the same price as the highs formed on both sides of the cup.

Many traders wait for a strong candle close above resistance to avoid false breakouts. Conservative traders may also wait for a retest of the breakout level.

Stop Loss Placement

Risk management is essential when trading any pattern. For the Cup and Handle, the stop loss is typically placed:

- Below the lowest point of the handle

- Or below a nearby support level

This placement protects you if the breakout fails while keeping risk controlled.

Take Profit Target

The standard profit target is calculated by measuring the depth of the cup and projecting that distance upward from the breakout point. This method provides a logical and consistent target.

Some traders also scale out of positions, taking partial profits at key resistance levels while letting the rest run.

Best Timeframes for the Cup and Handle Pattern

The Cup and Handle pattern works on multiple timeframes, but reliability improves on higher timeframes. Daily and weekly charts tend to produce stronger and more sustainable breakouts.

On lower timeframes, such as the 15-minute or 1-hour chart, the pattern can still work. However, false breakouts are more common due to market noise.

Choosing the right timeframe depends on your trading style and risk tolerance.

Common Mistakes Traders Make

Even though the Cup and Handle pattern is powerful, many traders misuse it. Avoiding common mistakes can significantly improve your results.

One frequent error is trading the pattern without a prior uptrend. Another mistake is entering too early, before the handle forms. Some traders also ignore volume, which often confirms the strength of the breakout.

Patience and discipline are key when trading this pattern successfully.

Cup and Handle vs Other Chart Patterns

Compared to patterns like flags or triangles, the Cup and Handle often takes longer to form. However, it usually offers larger and more reliable moves.

Unlike reversal patterns, it aligns with the existing trend. This makes it attractive for traders who prefer trading with momentum rather than against it.

Understanding the context of the pattern is more important than memorizing its shape.

Final Thoughts

The Cup and Handle pattern is a powerful tool for traders who value structure, patience, and clear risk management. When identified correctly, it provides high-quality breakout opportunities across different markets.

Like any trading strategy, it should not be used in isolation. Combining it with trend analysis, volume, and proper risk control improves consistency over time.

Mastering the Cup and Handle pattern does not happen overnight. With practice and discipline, it can become a reliable part of your trading approach.