The Dark Cloud Cover pattern is a popular bearish candlestick signal used by traders to spot potential market reversals. It often appears after a strong uptrend and serves as an early warning that buying pressure may be fading.

Understanding how Dark Cloud Cover works can help traders protect profits, avoid bad entries, and identify high-probability sell opportunities. While it is simple in appearance, it becomes far more powerful when used with proper confirmation and context.

What Is the Dark Cloud Cover Pattern?

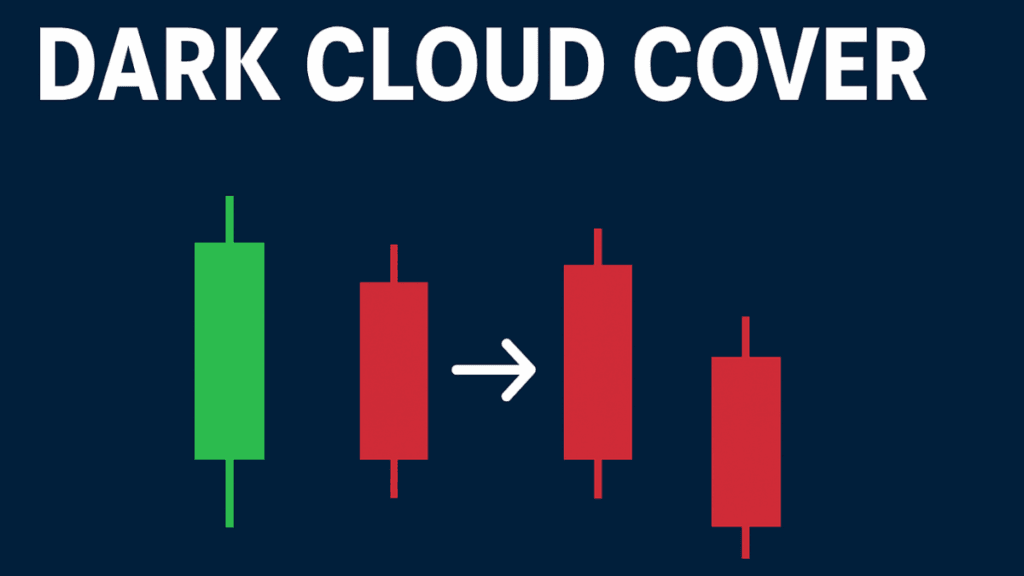

Before diving into trading strategies, it is important to clearly understand what this pattern represents. Dark Cloud Cover is a two-candlestick bearish reversal pattern found on candlestick charts.

It signals a possible shift from bullish momentum to bearish pressure. However, it does not guarantee a reversal on its own, which is why professional traders use it alongside other tools.

Structure of the Dark Cloud Cover Pattern

To correctly identify Dark Cloud Cover, the market must meet specific conditions. These conditions explain why the pattern reflects a loss of bullish strength.

First Candlestick: Strong Bullish Candle

The first candle is a long bullish candlestick that closes near its high. This candle confirms that buyers are in control and that the uptrend remains strong at this stage.

Second Candlestick: Bearish Reversal Candle

The second candle opens above the previous candle’s high, creating a bullish gap. However, the price then reverses sharply and closes below the midpoint of the first candle’s body.

This sudden shift shows that sellers have stepped in aggressively, overpowering buyers.

Why the Dark Cloud Cover Pattern Matters

Dark Cloud Cover is valuable because it reveals a psychological shift in the market. Bulls initially push prices higher, but their failure to hold gains exposes weakness.

This change in sentiment often leads to short-term pullbacks or full trend reversals, especially when the pattern forms at key resistance levels.

Key Conditions for a Valid Dark Cloud Cover

Not every similar-looking pattern is a true Dark Cloud Cover. Certain conditions must be present for reliability.

- The market must be in a clear uptrend

- The second candle must open above the first candle’s high

- The second candle must close below 50% of the first candle’s body

- The stronger the close, the more reliable the signal

These rules help traders filter out weak or misleading signals.

Dark Cloud Cover vs Similar Candlestick Patterns

To avoid confusion, it helps to understand how Dark Cloud Cover differs from other bearish formations.

Dark Cloud Cover vs Bearish Engulfing

While both patterns are bearish, a bearish engulfing candle fully covers the previous candle’s body. Dark Cloud Cover only requires a close below the midpoint, not a full engulfment.

Dark Cloud Cover vs Evening Star

Evening Star is a three-candle pattern and often signals a stronger reversal. Dark Cloud Cover is faster but slightly less reliable without confirmation.

How to Trade the Dark Cloud Cover Pattern

Knowing the pattern is not enough. Successful trading depends on execution, confirmation, and risk management.

Entry Strategy

Traders usually enter a sell position after the second candle closes. Conservative traders may wait for the next candle to confirm bearish continuation.

Stop-Loss Placement

A common stop-loss is placed above the high of the second candle. This protects the trade if the market resumes its uptrend.

Take-Profit Targets

Profit targets can be set using:

- Previous support levels

- Fibonacci retracement levels

- Risk-to-reward ratios such as 1:2 or higher

This structured approach helps maintain consistency.

Best Indicators to Confirm Dark Cloud Cover

Dark Cloud Cover works best when combined with technical indicators. Confirmation increases accuracy and reduces false signals.

Relative Strength Index (RSI)

If RSI is above 70 and starts turning down, the bearish signal becomes stronger.

Moving Averages

A Dark Cloud Cover forming near the 50-period or 200-period moving average often signals stronger resistance.

Volume

Higher volume on the second bearish candle confirms strong selling pressure.

Timeframes Where Dark Cloud Cover Works Best

This pattern can appear on any timeframe, but reliability improves on higher timeframes.

Daily and 4-hour charts tend to produce more reliable signals than very short timeframes. Lower timeframes may generate more noise and false reversals.

Common Mistakes Traders Make

Many traders misuse Dark Cloud Cover due to a lack of context. Avoiding these mistakes can significantly improve results.

- Tradint in a sideways market

- Ignoring trend direction

- Entering without confirmation

- Using poor risk management

Professional traders always focus on probability, not certainty.

Is Dark Cloud Cover Reliable?

Dark Cloud Cover is reliable when used correctly, but it is not a standalone strategy. Its effectiveness increases when combined with trend analysis, support and resistance, and momentum indicators.

Experienced traders treat it as a warning signal, not an automatic sell command.

Real-World Markets Where Dark Cloud Cover Is Used

This pattern is widely used across different markets due to its simplicity and clarity.

- Forex pairs like EUR/USD and GBP/USD

- Stock indices such as NASDAQ and S&P 500

- Cryptocurrencies, including BTC and ETH

- Commodities like gold and oil

Its flexibility makes it popular among both swing traders and day traders.

Final Thoughts

The Dark Cloud Cover candlestick pattern is a powerful bearish signal when identified correctly and traded with discipline. It highlights a shift in market sentiment that often precedes price reversals or corrections.

By combining Dark Cloud Cover with proper confirmation tools and strong risk management, traders can significantly improve their decision-making and long-term consistency.