A Descending Channel is a popular technical analysis pattern that traders use to understand price direction and market behavior. It appears when the price moves lower over time while staying between two parallel downward-sloping trendlines. This pattern helps traders identify trends, manage risk, and plan better entries and exits.

In this guide, you will learn what a Descending Channel is, how to identify it correctly, how traders use it in real markets, and common mistakes to avoid. Everything is explained in simple English to make it easy for beginners and useful for experienced traders.

What Is a Descending Channel?

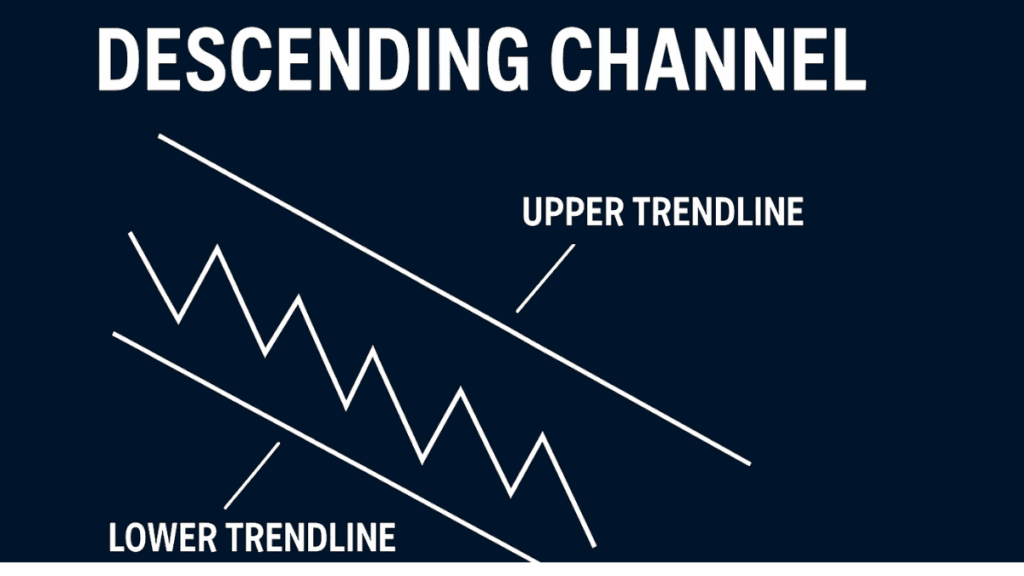

A Descending Channel is a bearish chart pattern formed by two parallel trendlines that slope downward. The upper line connects lower highs, while the lower line connects lower lows. Price moves between these two lines in a controlled downward trend.

This structure shows that sellers are in control, but the price is not falling randomly. Instead, it is moving in an orderly way, creating opportunities for traders who understand how the channel works.

Why the Descending Channel Matters in Trading

Understanding a Descending Channel is important because it provides clarity in trending markets. Rather than guessing where the price might go, traders can use the channel as a guide for decision-making.

The pattern helps traders:

- Identify a clear downtrend

- Find potential selling zones

- Spot possible trend reversals or breakouts

- Improve risk management using defined boundaries

Because of this, Descending Channels are widely used in forex, stocks, crypto, and commodities.

How a Descending Channel Forms

A Descending Channel forms when the market consistently makes lower highs and lower lows. Sellers push the price down, but buyers still step in at certain levels, creating temporary support.

Over time, these reactions form two parallel lines:

- Upper trendline: Acts as resistance

- Lower trendline: Acts as support

The space between these lines is the channel where price action unfolds.

Key Characteristics of a Descending Channel

Before trading a Descending Channel, it is important to recognize its main features. This helps avoid confusion with other chart patterns.

A valid Descending Channel usually has:

- At least two lower highs and two lower lows

- Parallel trendlines sloping downward

- Price respecting both support and resistance levels

- Clear and consistent price movement within the channel

When these conditions are present, the pattern becomes more reliable.

Descending Channel vs Other Channel Patterns

To fully understand the Descending Channel, it helps to compare it with other channel types. Each channel reflects a different market condition.

Descending Channel vs Ascending Channel

An Ascending Channel slopes upward and shows bullish market behavior. A Descending Channel slopes downward and reflects bearish pressure. While both patterns use parallel trendlines, the direction changes how traders approach entries and exits.

Descending Channel vs Horizontal Channel

A Horizontal Channel moves sideways and shows market indecision. A Descending Channel shows a clear trend direction, making it more useful for trend-following strategies.

How Traders Use the Descending Channel

Traders apply Descending Channels in different ways depending on their strategy and risk tolerance. The pattern offers multiple trading opportunities when used correctly.

Trading Within the Channel

Many traders sell near the upper trendline and take profits near the lower trendline. This approach works best when the channel is well-defined and the trend is strong.

Traders often wait for confirmation, such as bearish candlestick patterns or momentum indicators, before entering a trade.

Trading the Breakout

A Descending Channel does not last forever. When price breaks above the upper trendline, it can signal a trend reversal or a strong bullish move.

Breakout traders wait for:

- A clear close above the channel

- Increased volume

- Retest of the broken trendline for confirmation

This approach helps reduce false breakout risks.

Best Indicators to Use with a Descending Channel

While a Descending Channel can be traded on its own, combining it with indicators improves accuracy and confidence.

Commonly used indicators include:

- Relative Strength Index (RSI): Helps identify oversold conditions

- Moving Averages: Confirm overall trend direction

- Volume: Validates breakouts and breakdowns

Indicators should support the channel analysis, not replace it.

Risk Management When Trading Descending Channels

Risk management is essential when trading any chart pattern. A Descending Channel provides clear levels that make risk control easier.

Smart risk practices include:

- Placing stop-loss orders above the upper trendline for sell trades

- Using proper position sizing

- Avoiding trades when the channel structure is unclear

Consistent risk management protects your account over the long term.

Common Mistakes Traders Make

Even experienced traders can misuse the Descending Channel. Understanding common mistakes helps you avoid unnecessary losses.

Some frequent errors include:

- Forcing trendlines where none exist

- Ignoring higher time frame trends

- Trading every touch of the channel without confirmation

- Entering trades late after the move is already extended

Patience and discipline are key to using this pattern effectively.

Is the Descending Channel Bearish or Bullish?

The Descending Channel is generally considered a bearish pattern because it reflects downward price movement. However, it can also offer bullish opportunities during breakouts above resistance.

This flexibility makes it a valuable tool for both trend traders and reversal traders when used correctly.

Final Thoughts

The Descending Channel is a powerful and reliable chart pattern when properly identified and combined with sound risk management. It helps traders understand market structure, follow trends, and plan trades with more confidence.

By focusing on clear trendlines, confirmation signals, and disciplined execution, traders can use the Descending Channel to make smarter and more informed trading decisions across all financial markets.

Mastering this pattern takes practice, but once understood, it becomes a valuable part of any technical trader’s toolkit.