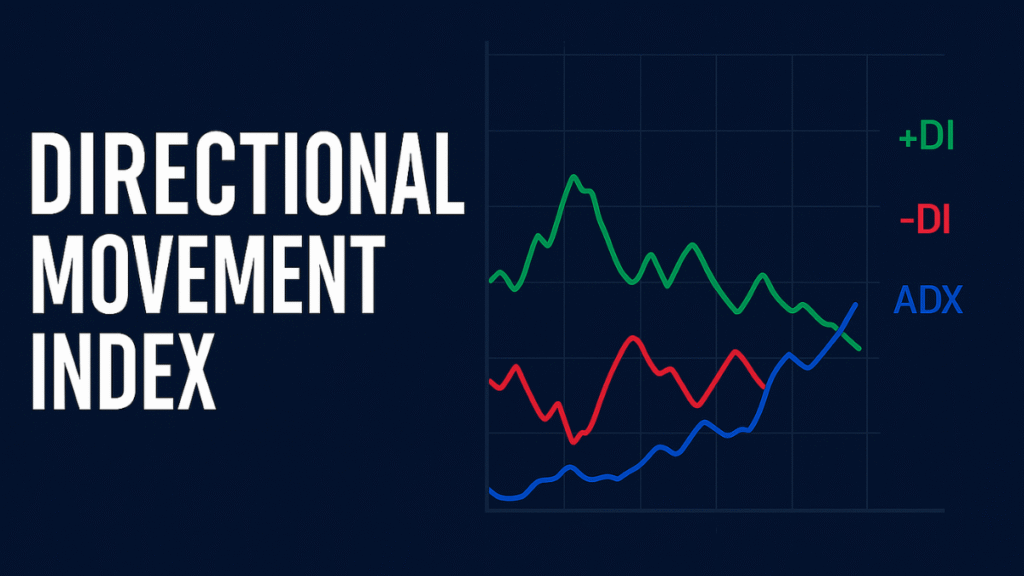

The Directional Movement Index (DMI) is a technical indicator developed by J. Welles Wilder Jr. to measure the strength and direction of a price trend in the financial markets. It helps traders determine whether an asset is trending and, if so, whether the trend is bullish or bearish.

DMI is a crucial part of the Average Directional Index (ADX) system, which is widely used in technical analysis to evaluate market momentum and identify high-probability trading opportunities.

What Is the Directional Movement Index (DMI)?

The Directional Movement Index (DMI) is a momentum indicator that compares the highs and lows of price movements to determine which side—buyers or sellers—is stronger.

It consists of two main lines:

- +DI (Positive Directional Indicator) — measures upward price movement.

- –DI (Negative Directional Indicator) — measures downward price movement.

When used with the Average Directional Index (ADX), traders can assess both the trend’s direction and strength.

In simple terms, DMI tells traders whether to buy, sell, or stay out of the market by showing who’s currently in control—bulls or bears.

How the Directional Movement Index Works

The DMI uses price highs and lows over a specific period—usually 14 days—to calculate directional movement. The system is based on the logic that:

- If today’s high is higher than yesterday’s high, there’s positive directional movement.

- If today’s low is lower than yesterday’s low, there’s negative directional movement.

These movements are smoothed over time to create two separate indicators: +DI and –DI.

The interaction between these two lines reveals the trend direction:

- When +DI > –DI, the trend is bullish.

- When –DI > +DI, the trend is bearish.

However, to avoid false signals, traders combine these with the ADX line, which measures trend strength—whether strong or weak.

Formula and Components of DMI

The DMI is calculated through several steps:

- Calculate Positive and Negative Directional Movement

- +DM = Current High – Previous High (if positive, else 0)

- –DM = Previous Low – Current Low (if positive, else 0)

- Calculate True Range (TR)

- TR = Max[(High – Low), |High – Previous Close|, |Low – Previous Close|]

- Smooth the Values (usually over 14 periods)

- Compute Directional Indicators

- +DI = (Smoothed +DM ÷ TR) × 100

- –DI = (Smoothed –DM ÷ TR) × 100

- Calculate ADX (Average Directional Index) to measure trend strength.

While the calculations seem complex, most charting platforms like TradingView, MetaTrader, and ThinkorSwim automatically generate DMI readings.

Understanding the DMI Lines

1. +DI (Positive Directional Indicator)

- Indicates bullish momentum.

- A rising +DI shows strong upward price movement.

2. –DI (Negative Directional Indicator)

- Indicates bearish momentum.

- A rising –DI shows strong downward price pressure.

3. ADX (Average Directional Index)

- Derived from +DI and –DI.

- Measures trend strength, not direction.

- ADX values:

- 0–25: Weak or no trend.

- 25–50: Moderate to strong trend.

- 50+: Very strong trend.

When ADX is rising, it signals a strengthening trend—whether bullish or bearish.

How to Use the Directional Movement Index in Trading

The DMI is used by traders to identify entry and exit points, confirm trends, and avoid choppy markets.

Here’s how traders commonly use it:

1. Identify Trend Direction

- If +DI > –DI, the market is trending upward.

- If –DI > +DI, the market is trending downward.

2. Confirm Trend Strength

- Check if the ADX is above 25—it means a strong trend.

- If ADX is below 20–25, it indicates a sideways or weak trend.

3. Generate Buy and Sell Signals

- Buy Signal: +DI crosses above –DI, and ADX is rising above 25.

- Sell Signal: –DI crosses above +DI and ADX is rising above 25.

4. Avoid False Breakouts

When ADX is low and flat, it’s best to avoid trading, since DMI signals are unreliable in sideways markets.

Example of DMI in Action

Imagine a stock trading at KSh 100. Over the next few days, its highs keep rising while its lows remain stable.

- The +DI line climbs above the –DI line, showing strong upward movement.

- The ADX rises from 20 to 35, confirming trend strength.

This combination tells a trader the stock is entering a strong bullish phase, making it a good time to consider a long position.

Conversely, if –DI crosses above +DI and ADX increases, the trend is turning bearish, signaling potential short opportunities.

Advantages of Using the Directional Movement Index

- Identifies Trend Strength and Direction:

Helps traders avoid sideways markets and focus on strong trends. - Versatile Across Markets:

Works well in stocks, forex, commodities, and cryptocurrency trading. - Reduces False Signals:

Combining +DI, –DI, and ADX filters out noise. - Supports Risk Management:

Knowing trend strength helps position sizing and stop-loss placement. - Useful for Both Short and Long-Term Analysis:

Works on any timeframe—from 5-minute to weekly charts.

Limitations of the Directional Movement Index

- Lagging Indicator:

DMI uses historical data, so it can react slowly to sudden price reversals. - Complex Calculations:

Manual computation is cumbersome, though modern platforms simplify this. - Whipsaws in Ranging Markets:

In low-volatility conditions, crossovers can produce false signals. - Needs Confirmation Tools:

Best used alongside price action, moving averages, or support/resistance levels.

Combining DMI with Other Indicators

To improve accuracy, traders often use DMI with complementary tools:

- Moving Averages: Confirm overall market direction.

- RSI (Relative Strength Index): Identify overbought or oversold zones.

- MACD: Confirm trend momentum.

- Price Action: Validate DMI signals with chart patterns or candlestick setups.

For example, a buy signal from DMI (+DI > –DI, ADX > 25) is stronger when the RSI is rising and price breaks resistance.

Applications of DMI in Financial Markets

- Forex Trading:

DMI helps identify currency pairs with strong directional trends, ideal for swing or position trades. - Stock Market:

Traders use DMI to detect breakouts and ride sustained trends. - Commodity Markets:

DMI filters out choppy commodity price movements to capture momentum. - Crypto Trading:

With high volatility, DMI helps traders confirm real momentum versus short-lived spikes.

Frequently Asked Questions (FAQs) About Directional Movement Index

1. What does a high ADX value mean in the DMI system?

A high ADX value (above 25) indicates a strong trend—whether bullish or bearish. It doesn’t show direction but rather how powerful the trend is.

2. Can the Directional Movement Index predict reversals?

Not directly. DMI identifies trend strength and direction, but doesn’t forecast turning points. Traders often combine it with oscillators like RSI to spot reversals.

3. What’s the best ADX value for trading signals?

Most traders look for ADX values above 25 to confirm a valid trend. Below 20 usually signals a range-bound market.

4. Is the DMI suitable for day trading?

Yes. DMI can be applied to intraday charts (5-, 15-, or 30-minute timeframes) to spot short-term trends, though it performs best in trending conditions.

5. How is DMI different from ADX?

DMI consists of +DI and –DI, showing direction, while ADX measures the strength of that trend. Together, they form a complete trend analysis system.

Conclusion

The Directional Movement Index (DMI) is a powerful trend-following indicator that helps traders identify both trend direction and strength. By combining +DI, –DI, and ADX, it provides a clear framework for trading decisions—helping traders stay aligned with strong market moves and avoid flat conditions.

Although DMI is not perfect—it lags and may give false signals in sideways markets—it remains a reliable tool when used with other indicators and sound risk management.

For traders and investors, mastering the DMI can enhance decision-making, improve timing, and lead to more disciplined trading strategies.