The Double Bottom is a well-known technical analysis chart pattern that signals a potential shift from a downtrend to an uptrend. It appears after a period of declining prices and reflects a situation in which selling pressure weakens, and buyers begin to regain control.

This pattern is popular because it combines visual clarity with a clear market story, making it easier for traders to interpret price behavior. When used carefully and confirmed with other signals, it can help traders identify favorable entry points with defined risk.

What Is a Double Bottom Pattern?

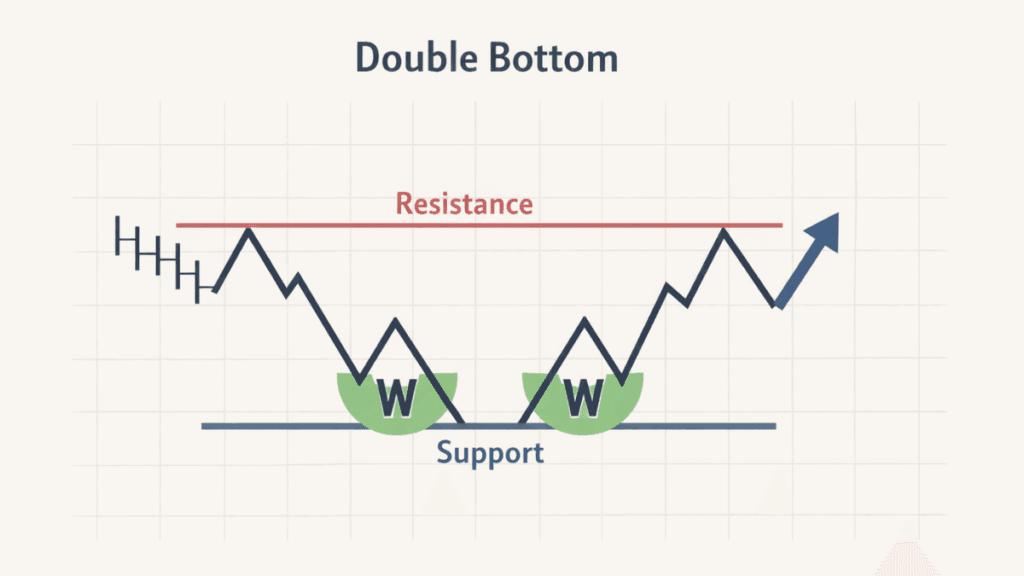

A Double Bottom pattern forms when price reaches a low, rebounds, drops again to a similar low, and then rises decisively. This structure resembles the letter “W” on a price chart and highlights repeated failure by sellers to push prices lower.

The pattern suggests that demand is starting to match or exceed supply at a key price level. As a result, market sentiment gradually shifts from bearish to bullish.

The Market Psychology Behind a Double Bottom

Understanding the psychology behind a Double Bottom helps explain why the pattern works in real markets. After a prolonged decline, sellers are confident and continue to push prices lower until buying interest emerges.

When price revisits the same low and fails to break it, sellers begin to lose conviction while buyers gain confidence. The eventual breakout confirms that buyers have taken control, often leading to sustained upward movement.

Key Components of a Double Bottom Pattern

Every Double Bottom pattern has distinct structural elements that traders look for on a chart. Recognizing these parts correctly improves accuracy and reduces false signals.

The main components include:

- First bottom: The initial low formed after a sustained downtrend.

- Second bottom: A retest of the low that fails to break meaningfully lower.

- Neckline: A resistance level created by the high between the two bottoms.

- Breakout: A decisive move above the neckline that confirms the pattern.

Each component plays a role in validating the shift in market direction.

How to Identify a Double Bottom on a Chart

Identifying a Double Bottom starts with confirming that the price was in a clear downtrend beforehand. Without a prior decline, the pattern loses much of its significance.

Next, look for two distinct lows near the same price level, separated by a moderate bounce. The pattern is considered complete only when price breaks above the neckline with conviction, not merely when the second low forms.

Volume Behavior in a Double Bottom Pattern

Volume provides important clues about the strength of a Double Bottom. During the first bottom, volume is often high due to panic selling and forced exits.

At the second bottom, volume typically decreases, signaling that selling pressure is fading. A noticeable increase in volume during the breakout above the neckline strengthens the pattern and confirms genuine buying interest.

Double Bottom vs Double Top

The Double Bottom is often compared to the Double Top because the two patterns are structural opposites. While the Double Bottom signals a bullish reversal, the Double Top suggests a bearish reversal after an uptrend.

Both patterns rely on the idea of repeated failure to break a key level. The difference lies in market context, with one marking the potential end of selling pressure and the other highlighting weakening buying momentum.

How Traders Use the Double Bottom in Practice

Traders use the Double Bottom to plan entries, exits, and risk management with greater clarity. The most common approach is to enter a trade after the price breaks above the neckline.

Stop-loss levels are often placed below the second bottom to limit downside risk. Profit targets are typically estimated by measuring the distance between the bottoms and the neckline, then projecting that distance upward from the breakout point.

Common Mistakes When Trading the Double Bottom

Many traders struggle with Double Bottom patterns because they act too early. Entering before the neckline breakout increases the risk of being caught in a continuation of the downtrend.

Another frequent mistake is ignoring the broader market context. A Double Bottom works best when aligned with overall market conditions, strong support zones, or confirming indicators rather than being traded in isolation.

Confirming a Double Bottom with Technical Indicators

Confirmation tools can improve the reliability of a Double Bottom pattern. Indicators such as RSI, MACD, or moving averages are commonly used to validate momentum and trend shifts.

For example, bullish divergence on RSI during the second bottom often strengthens the case for a reversal. These confirmations help traders filter out weaker setups and focus on higher-quality opportunities.

Reliability and Limitations of the Double Bottom Pattern

The Double Bottom is respected but not foolproof. Like all chart patterns, it reflects probabilities rather than certainties and can fail under certain market conditions.

False breakouts, low liquidity, or strong fundamental news can invalidate the pattern. This is why disciplined risk management and confirmation are essential when trading it.

Double Bottom in Different Timeframes

The Double Bottom appears across all timeframes, from intraday charts to weekly and monthly charts. Patterns on higher timeframes generally carry more weight because they reflect broader market participation.

Shorter timeframes may produce more frequent Double Bottoms, but they are also more prone to noise. Choosing the right timeframe depends on trading style and risk tolerance.

Final Thoughts

The Double Bottom remains one of the most practical and widely used reversal patterns in technical analysis. Its strength lies in its clear structure, intuitive psychology, and adaptability across markets.

When combined with sound analysis, volume confirmation, and proper risk control, the Double Bottom can be a valuable tool for traders seeking to identify early signs of trend reversal and improve market sentiment.