Dow Theory is one of the most important concepts in technical analysis. It forms the foundation for many tools used in modern trading—especially in Forex, stocks, indices, and cryptocurrencies. Traders and analysts rely on Dow Theory to understand market trends, predict possible reversals, and analyze price movements with more clarity.

In this article we will learn what Dow Theory is, how it works, its core principles, and why it still matters today.

What Is Dow Theory?

Dow Theory is a financial market framework developed from the writings of Charles H. Dow, the co-founder of Dow Jones & Company and the Wall Street Journal. The theory explains how markets behave, how trends form, and how investors can identify market direction using price action.

Even though Dow Theory was created over 100 years ago, it remains highly relevant in Forex trading and modern financial markets because it focuses on universal principles of supply, demand, and market psychology.

Why Dow Theory Matters

Dow Theory is widely used because it helps traders:

- Identify the primary direction of the market

- Understand trend continuation or reversal signals

- Improve decision-making based on price action

- Filter market noise

- Strengthen market timing for entry and exit points

Whether you trade currencies, stocks, or commodities, Dow Theory offers a simple but powerful lens for reading the market.

Core Principles of Dow Theory

Dow Theory is built on six major principles, which describe how trends behave and how markets process information. Understanding these principles is essential for any trader or analyst.

1. The Market Discounts Everything

This principle states that all available information—economic data, interest rates, political events, company performance, expectations, and emotions—is already reflected in the market price.

In Forex, this means currency prices instantly adjust to new information. Traders, therefore, focus more on price behavior than news itself.

2. The Market Has Three Types of Trends

Dow Theory identifies three distinct trends, each representing a different level of market movement.

Primary Trend (Major Trend)

The long-term direction of the market. It can be bullish (uptrend) or bearish (downtrend), often lasting months to years.

Secondary Trend (Intermediate Trend)

A correction within the primary trend.

For example, a pullback in a long-term uptrend.

Minor Trend (Short-Term Trend)

Short-term price fluctuations.

Day traders and scalpers often focus on this trend.

Understanding these categories helps traders avoid confusing small volatility with real shifts in market direction.

3. Every Primary Trend Has Three Phases

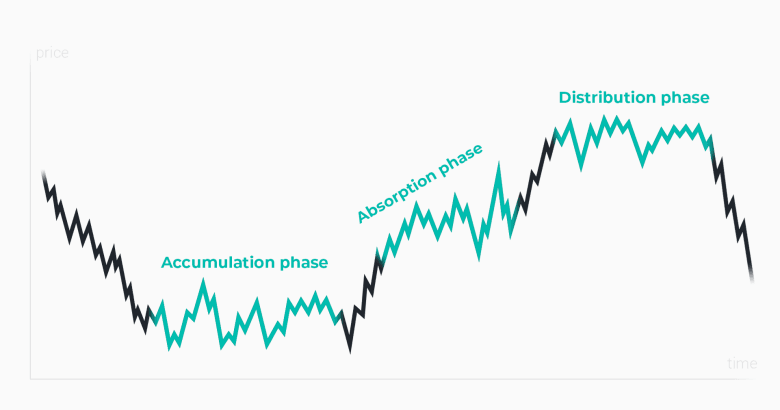

Each major trend develops in three predictable stages.

For an Uptrend

- Accumulation Phase – Smart money or institutional investors enter the market quietly.

- Public Participation Phase – More investors join as the trend becomes obvious.

- Excess Phase – Market becomes overly optimistic and eventually overbought.

For a Downtrend

- Distribution Phase – Smart money begins selling.

- Public Participation Phase – More traders recognize the downward movement.

- Panic Phase – Strong selling pressure leads to sharp declines.

In Forex or stock trading, identifying which phase the market is in helps traders judge risk and avoid emotional decisions.

4. Market Trends Must Be Confirmed

According to Dow Theory, no major trend is valid unless confirmed by another related market or indicator.

Originally, this referred to two major U.S. indexes—the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA).

In Forex or crypto, confirmation may come from:

- price action across correlated currency pairs

- volume trends

- macroeconomic indicators

- technical signals like moving averages

Confirmation reduces false signals and improves accuracy.

5. Volume Must Confirm the Trend

Volume plays a supporting role.

If a trend is strong, volume should increase in the direction of the trend.

- In an uptrend, volume rises when prices rise.

- In a downtrend, volume rises when prices fall.

Weak volume during trend movement often signals a possible reversal or lack of momentum.

6. A Trend Remains in Effect Until Clear Reversal Signals Appear

Dow Theory emphasizes that trends continue until undeniable reversal clues show up.

This means traders should avoid premature calls or emotional decisions.

A clear reversal usually requires:

- breaking the previous high or low

- failure to continue the trend

- shift in market structure

- confirming signals from correlated markets

This principle encourages discipline and reduces the risk of acting on small, misleading movements.

Dow Theory in Forex Trading

While Dow Theory was originally built for the stock market, it works extremely well in Forex due to market behavior similarity.

How Forex traders use Dow Theory

- Identifying long-term currency trends

- Filtering noise in highly volatile currency markets

- Confirming major market shifts using major pairs (e.g., EUR/USD vs. USD/JPY)

- Combining price action and volume (tick volume in Forex)

- Improving timing for entries in swing and position trading

Dow Theory becomes especially useful during macroeconomic cycles, where currencies reflect global trends.

Advantages of Using Dow Theory

Dow Theory remains a favorite among technical analysts due to its simplicity and power.

Key benefits

- Clear explanation of market psychology

- Strong foundation for trend trading

- Helps avoid false signals

- Works well with modern indicators

- Suitable for both beginners and experienced traders

- Applicable to Forex, stocks, crypto, commodities, and indices

Its principles are timeless because they focus on human behavior—something that never changes.

Limitations of Dow Theory

While Dow Theory is reliable, it has some limitations that traders should understand.

Common limitations

- It can be slow to identify early trend reversals

- Relies heavily on confirmation, causing late entries

- Volume analysis is harder in Forex

- Not ideal for scalping or high-frequency trading

Still, most analysts consider Dow Theory a trustworthy framework when combined with modern tools.

Is Dow Theory Still Relevant Today?

Yes.

Dow Theory remains one of the pillars of technical analysis. Even advanced tools like Elliott Wave Theory, market structure concepts, and trend indicators borrow ideas from it.

Because it focuses on psychology, price action, and market cycles, Dow Theory continues to influence modern trading strategies across all financial markets.

FAQs About Dow Theory

Dow Theory is a framework used in technical analysis to understand how markets move. It explains how trends form, how they change, and how traders can identify market direction using price action.

Dow Theory helps Forex traders identify the overall market trend, avoid false signals, and make more informed decisions. It provides a clear structure for reading long-term, intermediate, and short-term price movements.

Yes. Even though it was developed over 100 years ago, Dow Theory remains highly relevant. Many modern trading tools—like market structure, trend indicators, and price action strategies—are built on its principles.

The theory identifies:

i) Primary trend (long-term direction)

ii) Secondary trend (corrections within the primary trend)

iii) Minor trend (short-term fluctuations)

Understanding these helps traders avoid confusing noise with real market movement.

A trend is considered strong when volume increases in the direction of the trend. For example, rising prices with rising volume support a bullish trend.

Absolutely. Traders often combine Dow Theory with moving averages, RSI, MACD, Fibonacci levels, and support/resistance tools to improve accuracy and confirm signals.

Conclusion

Dow Theory is a timeless approach to understanding how financial markets behave. Its principles help traders identify trends, confirm market direction, and make more informed decisions. Whether you trade Forex, stocks, or crypto, mastering Dow Theory provides a solid foundation for long-term trading success.