A downtrend is a market condition in which the price of a financial asset, such as a stock, commodity, or market index consistently moves lower over time.

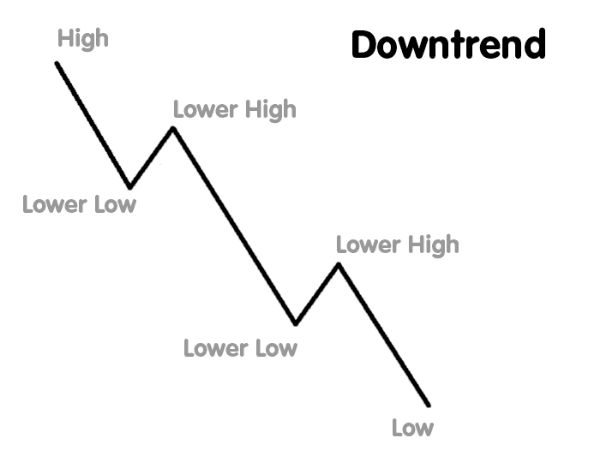

The key feature is a sequence of lower highs and lower lows, indicating that each rally fails to reach the previous high, and each pull-back drops below the prior low.

In other words, the keyword “downtrend” indicates that sellers dominate buyers over a sustained period, causing the asset’s value to drift downward.

How a Downtrend Works and Its Importance

Mechanics

- A downtrend begins when supply (selling pressure) outpaces demand (buying interest) for an asset.

- On a price chart, this manifests as peaks (highs) that keep dropping and troughs (lows) that keep dropping.

- Analysts often draw a downtrend line by connecting two or more descending highs; as long as the price stays below this line, the downtrend is said to be intact.

Why It Matters

- For investors, spotting a downtrend early can help them avoid holding assets that are likely to decline further.

- For traders, a downtrend offers opportunities: either to short-sell (betting the price will fall) or to buy at a later stage when the downtrend may be ending (value-buying).

- In broader financial markets, a prolonged downtrend in major indices or sectors signals waning investor confidence and may coincide with economic headwinds.

Recognising a downtrend is crucial in risk management, portfolio strategy, and timing of trades or investments.

Examples and Scenarios of Application

Example 1: Stock in a Downtrend

Imagine a company whose quarterly earnings progressively disappoint. The stock price rallies slightly after each earnings release but fails to exceed the previous rally high, then drops further. Charting this reveals lower highs and lower lows — a textbook downtrend.

Example 2: Market/Index Downtrend

A stock market index falls for several months. Every interim bounce is smaller than the last, and each subsequent dip reaches a new low. Sentiment shifts from optimism to caution. This is a downtrend at the market level.

Short-term vs Long-term downtrend

- A short-term downtrend might last hours or days (relevant for day traders).

- A long-term downtrend may span months or years (relevant for strategic investors).

Trading in a downtrend

- A trader notices the asset price failing to make new highs, draws a downtrend line, and places a sell or short order.

- Alternatively, an investor sees the downtrend potentially nearing exhaustion (for example, via divergence in momentum indicators) and considers buying at a heavily discounted price — though this is riskier.

Key Components or Types of Downtrend

Understanding the key components or types of a downtrend is essential for accurately identifying and analyzing bearish market movements.

These elements help traders and investors recognize when a downtrend is forming, confirm its strength, and determine potential reversal points. By examining these structural features, one can make more informed decisions on whether to enter, exit, or avoid a trade during a declining market phase.

Components

- Lower highs: Each rally is weaker than the previous one.

- Lower lows: Each dip falls further than the prior one.

- Trendline resistance: A descending line connecting the highs acts as resistance.

- Timeframe: The downtrend may occur over any timeframe — intraday, daily, weekly, or monthly.

- Volume or momentum: Can accompany the trend (e.g., rising volume on down-moves), though not always.

Types / Forms

- Gradual downtrend: Price drifts lower steadily; the slope is shallow.

- Sharp downtrend: Triggered by a negative event (earnings miss, macro shock); price falls steeply.

- Channelled downtrend: Price drifts within parallel descending lines (a downward channel).

- Multi-timeframe downtrend: A long-term downtrend may contain several minor counter-trends (interruptions) but remains downward overall.

Advantages, Limitations, or Risks

Advantages

- For traders, a downtrend offers short-selling opportunities (selling high, buying back lower) when executed carefully.

- For long-term investors, downtrends may offer buying opportunities at lower valuations if they believe in the underlying fundamentals remaining intact.

Limitations and Risks

- Downtrends can accelerate: When they do, losses may compound quickly — risk is higher.

- Timing reversals is tricky: Betting on the bottom of a downtrend is risky because it may continue longer than expected.

- Indicators and trendlines may give false signals for instance, a temporary bounce might look like a reversal, but the downtrend resumes.

- When short-selling, risk is theoretically unlimited if the asset turns and moves higher instead of lower.

Role of a Downtrend in Trading, Investing, and Financial Markets

In Trading

- Trend-following traders may enter short positions once a downtrend is clearly established (lower highs, lower lows, below a trendline).

- They place stop-loss orders above the recent high to limit risk in case the trend reverses.

- Day traders might use shorter timeframes to identify micro downtrends (e.g., one-minute or five-minute charts).

In Investing

- Long-term investors monitor downtrends as a warning sign: if a company’s share price is in a sustained downtrend, it may reflect deteriorating fundamentals or sector weakness.

- Contrarian investors might look for value opportunities during a downtrend, buying quality assets when temporarily out of favour — but they need conviction in fundamental recovery.

In Market Analysis

- A sector or market index in a downtrend signals bearish sentiment, which may prompt defensive portfolio adjustments (e.g., shifting to cash or hedging).

- Downtrends may reflect broader macro-economic issues, for instance, rising interest rates, inflation, or geopolitical risk.

- A downtrend can reverse into an uptrend; spotting the reversal may provide an early entry point for the next phase of growth.

Conclusion

In summary, a downtrend is a foundational concept in financial trading and investing, signifying a sustained sequence of falling prices marked by lower highs and lower lows.

Recognising a downtrend helps market participants manage risk, spot opportunities, and formulate a strategy (whether short-selling, buying at discounted levels, or avoiding further losses).

While a downtrend may signal danger, it can also present potential. But timing and confirmation are crucial — because attempting to trade or invest during a downtrend without discipline often leads to avoidable losses.

For traders and investors alike, the key is not just seeing that a downtrend is occurring — but understanding why it’s happening and what signs might indicate its end.