Elliott Wave Theory is a form of technical analysis that explains market price movements through recurring wave patterns shaped by human psychology. The idea is that markets do not move randomly, but instead follow recognizable cycles of optimism and pessimism that repeat over time.

Developed in the 1930s by Ralph Nelson Elliott, the theory is widely used in stocks, forex, commodities, and cryptocurrencies. It appeals to traders and analysts because it attempts to explain why markets move, not just how they move on a chart.

The Core Idea Behind Elliott Wave Theory

At its foundation, Elliott Wave Theory is built on the belief that collective investor behavior follows natural rhythms. These rhythms create structured price movements that unfold in waves, regardless of the timeframe or market being analyzed.

Elliott observed that these waves appear consistently across charts and timeframes. From minutes to decades, the same wave structure can be seen repeating at different scales, a concept known as market fractals.

Impulse Waves and Corrective Waves

Every Elliott Wave cycle is made up of two main phases that describe the market’s direction and reaction. Understanding this distinction is essential before diving deeper into wave counting.

Impulse Waves

Impulse waves move in the direction of the main trend and reflect strong market conviction. These waves show where buyers or sellers are in clear control of price movement.

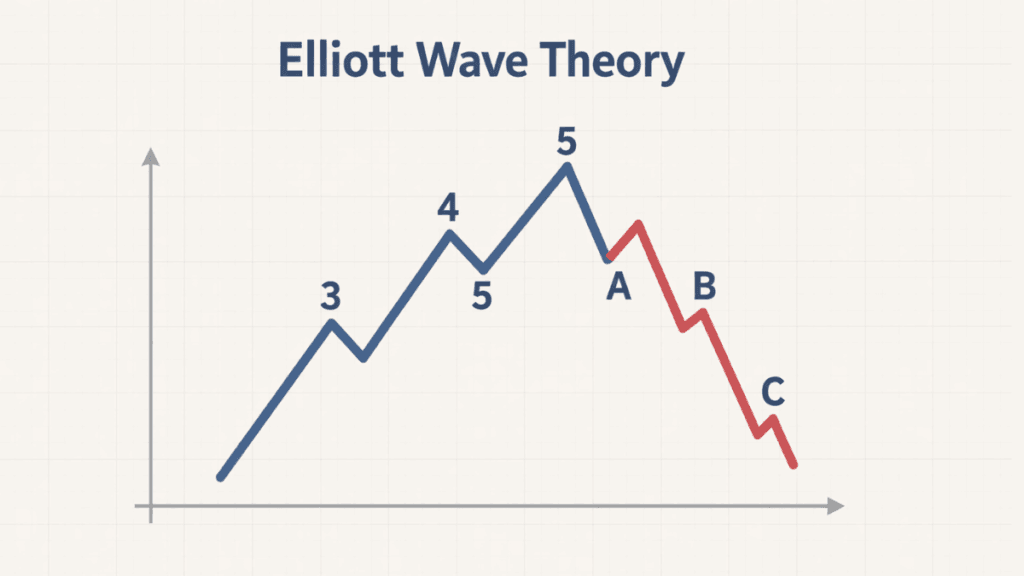

An impulse phase consists of five waves, labeled 1 through 5. Waves 1, 3, and 5 move with the trend, while Waves 2 and 4 are temporary pullbacks that do not break the overall direction.

Corrective Waves

Corrective waves move against the prevailing trend and represent periods of consolidation or profit-taking. They typically occur after a strong impulse move has already taken place.

The corrective phase usually consists of three waves, labeled A, B, and C. These corrections help reset market sentiment before the next major impulse begins.

The Basic Five-Wave Structure

The five-wave impulse pattern is the most recognizable feature of Elliott Wave Theory. It provides a framework for identifying trend strength and potential turning points.

Wave 1 often begins quietly, as only a small group of traders recognizes the new trend. Wave 2 follows as early buyers take profits, but the price does not fall below the start of Wave 1.

Wave 3 is typically the strongest and longest wave, driven by growing confidence and wider participation. Wave 4 then forms as the market pauses, before Wave 5 completes the trend with a final push fueled by enthusiasm or speculation.

The Three-Wave Correction Pattern

After a five-wave impulse, the market usually enters a corrective phase that moves against the prior trend. This correction helps relieve overbought or oversold conditions.

Wave A marks the initial move against the trend, often mistaken for a temporary pullback. Wave B retraces part of Wave A and can mislead traders into thinking the trend has resumed. Wave C completes the correction and often mirrors Wave A in strength or length.

Elliott Wave Degrees and Market Fractals

One of the defining features of Elliott Wave Theory is its fractal nature. This means that each wave can be broken down into smaller waves that follow the same structure.

Large waves contain smaller sub-waves, while small waves are part of larger patterns. Traders often refer to these different sizes as wave degrees, ranging from short-term intraday movements to multi-decade market cycles.

Key Rules That Elliott Waves Must Follow

Elliott Wave Theory is not purely subjective, as it includes strict rules that must be respected. These rules help prevent invalid wave counts and improve consistency.

- Wave 2 cannot retrace more than 100% of Wave 1

- Wave 3 can never be the shortest of the three impulse waves

- Wave 4 must not overlap the price territory of Wave 1

If any of these rules are broken, the wave count is considered invalid and must be reassessed.

Common Elliott Wave Patterns

Beyond the basic impulse and correction, Elliott identified recurring corrective formations. These patterns help traders anticipate how corrections may unfold.

Zigzags

Zigzags are sharp corrections that move strongly against the trend. They are common after powerful impulse waves and usually reflect decisive shifts in sentiment.

Flats

Flat corrections move sideways and reflect market indecision. Prices tend to remain within a range as buyers and sellers struggle for control.

Triangles

Triangles appear during periods of consolidation and often precede a strong breakout. They typically form during Wave 4 or Wave B, signaling that a major move may follow.

How Traders Use Elliott Wave Theory

Traders apply Elliott Wave Theory to identify trend direction, potential reversal zones, and price targets. When combined with other tools, it can offer a structured approach to market analysis.

Many traders use Fibonacci retracement and extension levels alongside wave counts. These ratios often align with wave boundaries, adding confirmation to trade setups and risk management decisions.

Strengths and Limitations of Elliott Wave Theory

Elliott Wave Theory offers a deep framework for understanding market behavior, but it is not without challenges. Its effectiveness depends heavily on the analyst’s experience and discipline.

The theory’s main strength lies in its ability to link price action with crowd psychology. However, wave counting can be subjective, especially in complex or choppy markets. For this reason, many traders use Elliott Waves as a guiding framework rather than a standalone system.

Elliott Wave Theory for Beginners

For new traders, Elliott Wave Theory can seem overwhelming at first. The terminology and multiple patterns require time and practice to understand fully.

Beginners are best served by focusing on the basic five-wave impulse and three-wave correction. Mastering these core structures builds a strong foundation before exploring advanced patterns and wave degrees.

Final Thoughts

Elliott Wave Theory remains one of the most influential and debated concepts in technical analysis. Its focus on human behavior and recurring market cycles continues to attract traders across all asset classes.

While it requires patience and practice, the theory can provide valuable insight into market structure when used carefully. When combined with sound risk management and supporting indicators, Elliott Wave Theory can become a powerful tool in a trader’s analytical toolkit.