The Evening Star is one of the most reliable bearish reversal candlestick patterns in trading. It helps traders identify when an uptrend may be losing strength and when sellers may be taking control. Understanding this pattern can improve your chart analysis and help you make better trading decisions.

What Is the Evening Star Pattern?

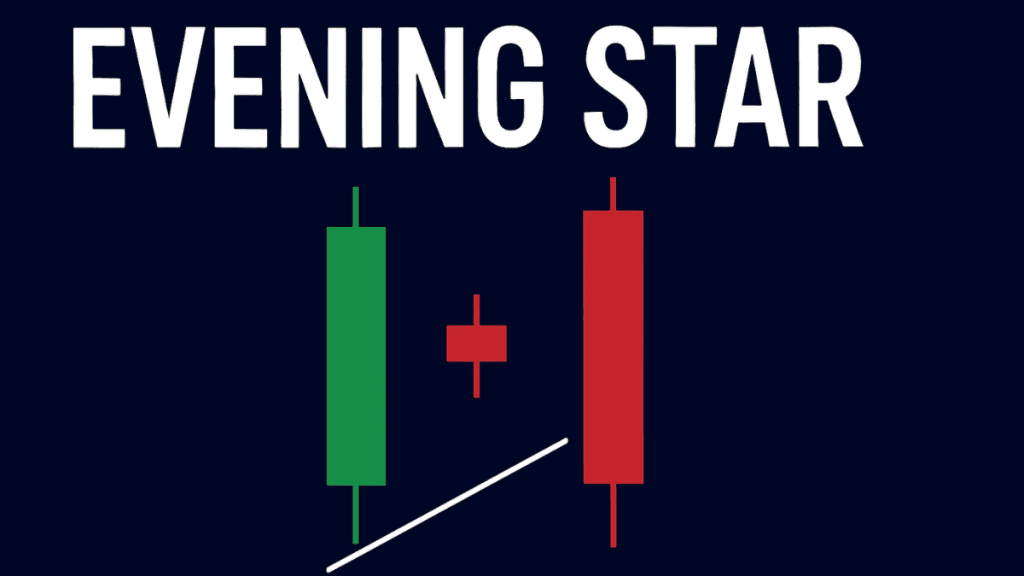

The Evening Star is a three-candle bearish reversal pattern that appears after an uptrend. It signals that buying pressure is weakening and a potential downtrend may begin. Traders use it to spot early signs of market exhaustion.

Even though it’s simple to recognize, it carries strong meaning because it shows a clear change in momentum.

How the Evening Star Pattern Forms

For an Evening Star to form, three candles must appear in a specific sequence:

1. Candle 1: Strong Bullish Candle

This large green (bullish) candle represents strong buying momentum and confirms that the market has been in an uptrend.

2. Candle 2: Small Candle Showing Indecision

The second candle can be bullish or bearish.

The key feature is its small size—showing indecision, reduced buying strength, and early signs of a slowdown.

It may appear as:

- A Doji

- A small-bodied candle

3. Candle 3: Strong Bearish Candle

The final candle is a large red (bearish) candle that closes well into the body of the first candle.

This confirms that sellers have taken control.

Why the Evening Star Matters to Traders

The Evening Star is popular because:

- It appears across all markets (forex, stocks, crypto, indices).

- It works on multiple timeframes.

- It helps traders spot reversals early.

It reflects a clear shift in market psychology:

- Buyers push the price up

- Market stalls

- Sellers step in strongly

This makes it a strong warning that the uptrend may be ending.

How Traders Use the Evening Star

1. Trend Reversal Identification

Traders use it to spot when an uptrend is weakening and when selling pressure might begin.

2. Entry and Exit Signals

Typical trading approach:

- Enter short after the third candle closes

- Place a stop-loss above the pattern

- Set take-profit at the next support level

3. Confirmation Improves Accuracy

Strong confirmations include:

- Higher-than-normal volume on the bearish candle

- Appearance near resistance

- Other indicators showing bearish momentum (e.g., RSI divergence)

Strengths of the Evening Star Pattern

- Easy to identify

- Works well with trend analysis

- Offers early warning of trend changes

- Reliable when supported by volume or resistance zones

Limitations You Should Know

While powerful, no candlestick pattern is perfect.

The Evening Star can produce false signals when:

- The market is choppy

- News events create sudden volatility

- It forms in the middle of a range instead of at the top

This is why traders combine it with trendlines, support/resistance, volume, or indicators.

Real Market Example

Imagine a stock rising consistently. A big green candle appears, showing strong buying.

Next, a small candle forms, showing hesitation.

On the third day, a large red candle forms and closes below the midpoint of the first candle.

This sequence warns that buyers may be losing control and a downward movement might follow.

Evening Star vs. Morning Star

| Feature | Evening Star | Morning Star |

| Trend | Appears after uptrend | Appears after downtrend |

| Signal | Bearish reversal | Bullish reversal |

| Candle Count | 3 | 3 |

Understanding both helps traders see momentum changes in any direction.

Tips for Using the Evening Star Safely and Wisely

- Focus on higher timeframes for stronger signals

- Confirm with indicators or resistance levels

- Always manage risk with a stop-loss

- Never rely on one pattern alone

These principles help traders maintain discipline and avoid emotional decisions.

FAQs About the Evening Star Candlestick Pattern

1. What is an Evening Star in trading?

An Evening Star is a three-candle bearish reversal pattern that appears after an uptrend. It signals that buying pressure is weakening and the price may start moving down.

2. How can I identify an Evening Star pattern?

Look for three candles: a strong bullish candle, a small candle showing indecision, and a large bearish candle that closes deep into the first candle’s body.

3. Is the Evening Star pattern reliable?

Yes, it is considered one of the more reliable reversal patterns, especially when it forms near resistance or when indicators also show bearish momentum.

4. Which markets does the Evening Star work best in?

It works well in forex, stocks, crypto, indices, and commodities. The pattern behaves the same way across all liquid markets.

5. What timeframe is best for spotting an Evening Star?

Higher timeframes like the 1H, 4H, or Daily usually give stronger and more accurate signals. Lower timeframes may produce more false signals.

6. Should I use other indicators with the Evening Star?

Yes. Confirming the pattern with indicators like RSI, MACD, or volume can greatly improve accuracy and reduce false signals.

Final Thoughts

The Evening Star is a powerful candlestick pattern that helps traders spot potential bearish reversals. When used with trend analysis and proper confirmation, it becomes a reliable tool for understanding market behavior. Whether you are new to trading or already experienced, mastering this pattern can strengthen your decision-making and improve your chart-reading skills.