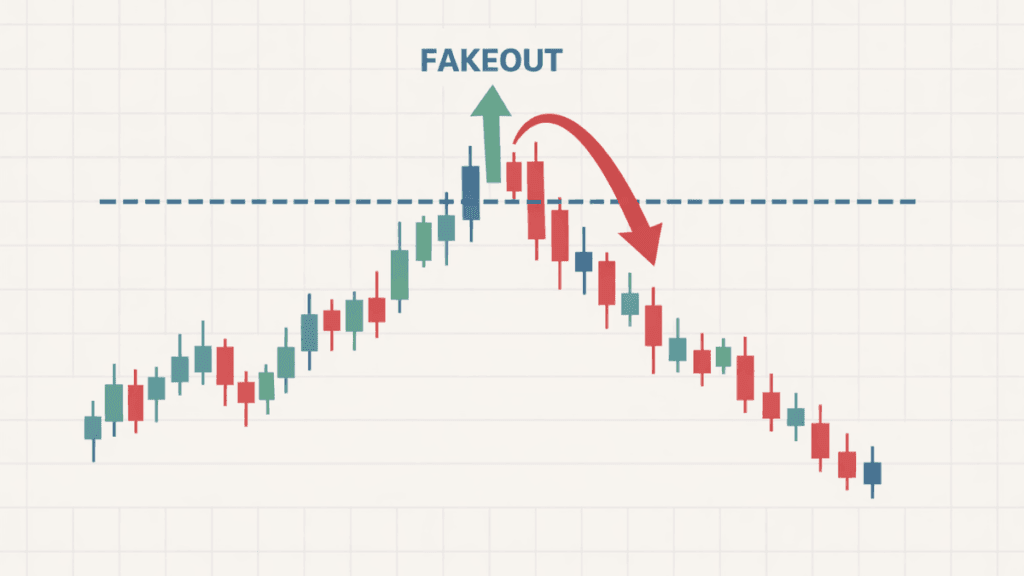

A fakeout is a market move that appears to be a real breakout or breakdown but quickly fails and reverses direction. In trading, a fakeout often traps traders who act too quickly, believing the price has confirmed a new trend when it has not.

Understanding fakeouts is important because they appear in all markets, including forex, stocks, crypto, and commodities. They are not rare mistakes or anomalies but a normal part of how markets behave, especially around key price levels.

What Is a Fakeout in Trading?

A fakeout occurs when the price briefly moves beyond an important level, such as support, resistance, or a chart pattern boundary, and then quickly returns to the inside. The move convinces many traders that a breakout has occurred, only for the market to reverse soon after.

This behavior reflects the constant struggle between buyers and sellers. When one side briefly gains control but cannot sustain it, the rice snaps back, leaving late entrants on the wrong side of the move.

How Fakeouts Differ From Genuine Breakouts

A genuine breakout is supported by follow-through, meaning the price continues moving in the breakout direction with strength. A fakeout, by contrast, lacks commitment and quickly loses momentum.

The key difference is not speed alone but confirmation. Real breakouts usually show supporting signs such as sustained closes beyond a level, increased participation, or alignment with the broader market context.

Common Types of Fakeouts

Fakeouts appear in several recognizable forms, each linked to how traders react to price levels. Knowing these types helps traders stay cautious rather than reactive.

Support and Resistance Fakeouts

These fakeouts happen when the price briefly breaks above resistance or below support, triggering buy or sell orders. After traders are trapped, the price reverses back into the previous range.

They are especially common in sideways markets where price repeatedly tests the same levels without establishing a clear trend.

Chart Pattern Fakeouts

Patterns such as triangles, flags, and ranges often attract traders waiting for a breakout. A fakeout occurs when the rice breaks the pattern boundary but fails to continue in that direction.

This usually happens when the pattern forms in a weak market environment or when traders anticipate the breakout too early.

Trendline Fakeouts

Trendlines represent the direction of price over time, and breaks are often seen as major signals. A fakeout occurs when the price briefly pierces the trendline and then resumes the original trend.

These fakeouts often shake out traders who enter too early against the prevailing market direction.

Why Fakeouts Happen So Often

Fakeouts are not random events; they are driven by market structure and trader behavior. Markets move based on orders, not opinions, and fakeouts often reflect where orders are clustered.

Some common reasons include:

- High concentration of stop-loss orders near obvious levels

- Low liquidity periods, where small orders can move the price

- Large participants test the price to find real buying or selling interest

These conditions make it easy for the rice to move briefly beyond a level without enough support to continue.

The Psychology Behind Fakeouts

Trader psychology plays a central role in fakeouts. Many traders fear missing out and rush into trades as soon as the price touches a key level.

This emotional response creates short-term imbalances that are quickly corrected. Once trapped, traders exit in panic, the reversal gains speed, reinforcing the fakeout.

How to Identify a Potential Fakeout

While no method is perfect, certain clues can help traders recognize when a move may lack strength. The goal is not prediction but better decision-making.

Key warning signs include:

- Weak or short-lived closes beyond a key level

- Lack of follow-through in the next few candles

- Breakouts that occur against the higher-timeframe trend

These signals suggest caution rather than immediate action.

Fakeouts Across Different Markets

Fakeouts behave similarly across asset classes, but the frequency and intensity can vary. Understanding the market environment helps set realistic expectations.

In forex, fakeouts are common during news releases and low-volume sessions. In stocks, they often appear around earnings or major technical levels, whereas in crypto markets, they are common due to high volatility and speculative trading.

How Traders Manage Fakeout Risk

Experienced traders accept that fakeouts cannot be eliminated; they can only be managed. Risk control and patience matter more than avoiding every false signal.

Common risk management approaches include waiting for a candle to close, using smaller position sizes near key levels, and combining technical signals with market context. These habits reduce the damage when a fakeout occurs.

Fakeouts and Trading Experience

Fakeouts are often frustrating for beginners but valuable for long-term growth. Over time, traders learn that losing trades caused by fakeouts are part of the learning process, not a sign of failure.

With experience, traders become less reactive and more selective. This shift in mindset is often what separates consistent traders from those who struggle.

Key Takeaways About Fakeouts

A fakeout is a false signal that tests both technical skills and emotional discipline. It reminds traders that markets do not move in straight lines and that confirmation matters more than speed.

By understanding why fakeouts happen and how they appear, traders can make calmer decisions and focus on long-term consistency rather than short-term excitement.