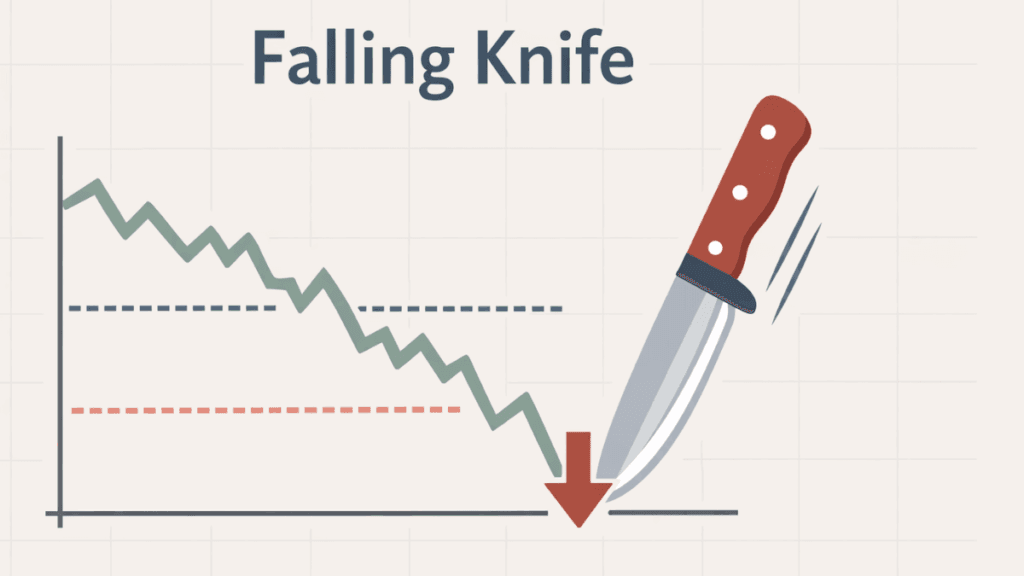

A falling knife refers to a financial asset whose price is dropping sharply and continuously, often tempting traders to buy too early. The phrase warns that trying to catch such a move can lead to painful losses if the decline has not truly ended. Understanding what a falling knife looks like and why it happens is essential for protecting capital and making disciplined trading decisions.

Rather than being a formal indicator, the falling knife is a behavioral and risk concept used widely in trading and investing. It highlights the danger of assuming a price must rebound simply because it has already fallen a long way.

What Does “Falling Knife” Mean in Trading?

A falling knife describes a situation where an asset’s price declines rapidly with little or no sign of stabilization. This type of move is often driven by strong selling pressure, negative news, or a sudden shift in market sentiment. Traders who buy during the drop are said to be “catching a falling knife.”

The idea is simple but powerful: prices can fall much further than expected. What looks cheap today can become significantly cheaper tomorrow if the underlying pressure remains.

Why the Falling Knife Concept Matters

The falling knife matters because it addresses one of the most common psychological mistakes in markets. Many traders believe that sharp declines automatically create buying opportunities, even when no evidence supports a reversal. This mindset can turn small losses into large ones.

Markets are not required to bounce simply because they have fallen. Recognizing a falling knife helps traders step back, manage risk, and avoid emotional decisions based on hope rather than confirmation.

Common Causes of a Falling Knife

A falling knife rarely happens without strong reasons behind it. Understanding these causes helps traders judge whether a decline is likely to continue.

Negative Fundamental News

A sharp price drop often follows earnings misses, profit warnings, regulatory actions, or economic shocks. When fundamentals deteriorate quickly, buyers step aside, and sellers dominate the market.

In these cases, the price decline reflects new information rather than temporary panic. Catching such a move without understanding the fundamentals is especially risky.

Breakdown of Key Technical Levels

Technical traders watch support levels closely. When major support breaks with high volume, it can trigger stop-loss orders and algorithmic selling, accelerating the decline.

This type of breakdown often leads to a falling knife because selling feeds on itself. The absence of nearby support makes it difficult for the price to stabilize.

Forced Liquidation and Panic Selling

In leveraged markets, margin calls and forced liquidations can push prices down rapidly. As positions are closed automatically, selling pressure increases regardless of price.

Panic selling by retail traders can add to the momentum. Fear replaces analysis, and prices can overshoot fair value before eventually stabilizing.

Why Traders Try to Catch a Falling Knife

Despite the risks, many traders are drawn to falling knives for understandable reasons. The main attraction is the potential for a fast and dramatic rebound.

Buying near the bottom can feel like a smart and bold move. However, without confirmation, this approach often relies more on emotion than evidence.

Common motivations include:

- The belief that the asset is “oversold.”

- Fear of missing a sharp bounce

- Anchoring to a previous higher price

These motivations can cloud judgment and lead to poor timing.

The Risks of Catching a Falling Knife

The biggest danger of a falling knife is that losses can grow quickly. What starts as a small position can turn into a significant drawdown if the price continues to fall.

Another risk is opportunity cost. Capital tied up in a losing trade cannot be used for clearer, higher-probability setups elsewhere in the market.

How to Identify a Falling Knife on a Chart

A falling knife often has clear visual characteristics that traders can learn to recognize. These features signal strong downside momentum rather than a healthy pullback.

Steep Downward Price Movement

Prices typically fall in large candles with minimal pauses. Attempts at small rebounds are quickly sold into, showing that buyers lack control.

This pattern suggests that selling pressure remains dominant and that patience is required.

Expanding Volume on Down Moves

High or rising volume during declines indicates strong conviction from sellers. This reduces the likelihood of an immediate reversal.

Volume confirms whether the move is driven by real participation rather than low-liquidity noise.

Lack of a Base or Consolidation

A true bottom usually forms after price stabilizes and trades sideways. A falling knife shows no such base, only continued lower lows.

Without consolidation, there is little evidence that supply and demand are balancing.

Safer Alternatives to Catching a Falling Knife

Avoiding a falling knife does not mean missing every opportunity. It means waiting for clearer signals that risk has reduced.

Wait for Confirmation of a Reversal

Confirmation may include a higher low, a break above short-term resistance, or a clear change in market structure. These signs suggest that sellers are losing control.

While this approach may miss the exact bottom, it often results in better risk-to-reward trades.

Use Defined Risk and Position Sizing

If a trader chooses to participate, strict risk management is essential. Small position sizes and clearly defined stop-loss levels limit potential damage.

This approach treats the trade as speculative rather than a high-conviction setup.

Focus on Stronger Market Context

A falling knife in a weak market is more dangerous than one in a strong overall trend. Broader market conditions provide important context for any individual decline.

Aligning trades with the dominant market environment improves consistency over time.

Falling Knife vs. Healthy Pullback

Not every sharp move lower is a falling knife. Distinguishing between a dangerous decline and a normal pullback is a key skill.

A healthy pullback typically occurs within an established uptrend and respects major support levels. A falling knife, by contrast, breaks structure and accelerates downward with little support.

Long-Term Investing and the Falling Knife

For long-term investors, the falling knife concept still applies. Buying too early into a structural decline can lead to years of underperformance.

Investors benefit from focusing on fundamentals, balance sheets, and long-term trends rather than trying to time short-term bottoms. Patience often provides better entry points than urgency.

Key Takeaways on the Falling Knife

The falling knife is a warning, not a strategy. It reminds traders and investors that sharp declines can continue far longer than expected.

By understanding the causes, recognizing the signs, and waiting for confirmation, market participants can avoid unnecessary losses. In trading, staying safe is often more important than being early.