The Falling Three Methods is a classic bearish candlestick pattern that helps traders understand how a downtrend can pause without losing strength. It appears during an existing decline and signals that sellers remain in control despite a brief period of consolidation.

This pattern is widely used in technical analysis because it combines trend structure, price behavior, and market psychology in a clear and readable way. When understood properly, it can help traders avoid premature exits and stay aligned with the dominant trend.

What Is the Falling Three Methods Pattern?

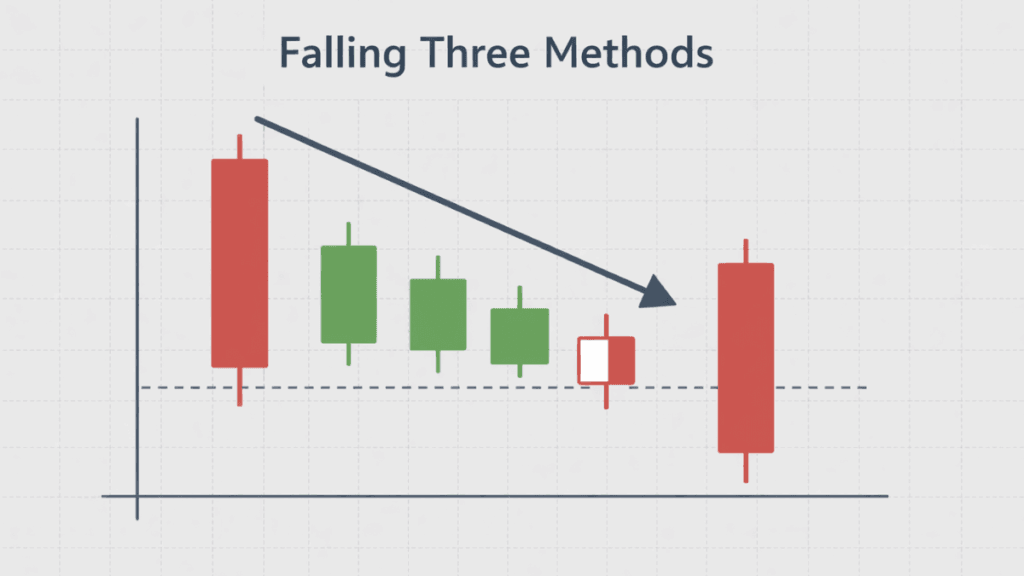

The Falling Three Methods is a five-candlestick continuation pattern that forms during a bearish trend. It shows a temporary pause where buyers attempt to push prices higher, but ultimately fail as sellers regain control.

The pattern consists of one strong bearish candle, followed by three smaller bullish or neutral candles, and then another decisive bearish candle. Together, these candles tell a story of hesitation rather than reversal.

The Structure of the Pattern

The structure of the Falling Three Methods is precise, which is why it is considered a reliable continuation signal. Each candle plays a specific role in confirming the strength of the prevailing trend.

Key structural characteristics include:

- A long bearish candle that confirms strong downward momentum

- Three smaller candles that stay within the range of the first candle

- A final bearish candle that closes below the first candle’s close

This structure shows that upward attempts are contained and lack conviction.

Why the Pattern Matters

The Falling Three Methods matters because it helps traders distinguish between a true trend reversal and a healthy pause. Many traders exit positions too early when they see small bullish candles, but this pattern warns that the downtrend may resume.

By recognizing this formation, traders can maintain confidence in bearish setups and avoid reacting emotionally to short-term price noise.

The Psychology Behind The Falling Three Methods

Every candlestick pattern reflects market psychology, and the Falling Three Methods is no exception. It represents a moment where sellers briefly step back, allowing buyers to test higher prices.

However, the inability of buyers to break above the first candle’s range reveals weakness. When sellers return with force, it confirms that bearish sentiment remains dominant and that the trend is likely to continue.

How to Identify Falling Three Methods on a Chart

Identifying the Falling Three Methods requires attention to both trend context and candle size. The pattern is only valid when it appears during an established downtrend.

Traders should look for a strong bearish move followed by a tight consolidation of smaller candles. The final bearish candle must clearly resume the downward direction to confirm the pattern.

Common Identification Mistakes

Misidentification often occurs when traders ignore trend context or candle proportions. Without a prior downtrend, the pattern loses much of its meaning.

Another common mistake is allowing the middle candles to break above the first candle’s high. When that happens, the pattern no longer reflects controlled consolidation.

Falling Three Methods vs Similar Candlestick Patterns

The Falling Three Methods is sometimes confused with other multi-candle patterns, but key differences set it apart. Understanding these differences improves accuracy and confidence.

Unlike reversal patterns such as Morning Stars, the Falling Three Methods does not signal a change in direction. Instead, it confirms that the existing bearish trend is intact.

Falling Three Methods vs Rising Three Methods

The Rising Three Methods is the bullish counterpart of this pattern. While the Falling Three Methods appear in downtrends, the Rising Three Methods form during uptrends.

Both patterns share the same logic of consolidation followed by continuation, but they operate in opposite market directions.

How Traders Use Falling Three Methods in Practice

Traders often use the Falling Three Methods as a confirmation tool rather than a standalone signal. It works best when combined with trendlines, moving averages, or resistance levels.

Many traders look to enter short positions after the final bearish candle closes. Others use the pattern to hold existing positions with greater confidence instead of exiting during consolidation.

Risk Management Considerations

Risk management remains essential even with reliable patterns. Traders typically place stop-loss orders above the high of the consolidation candles to protect against unexpected reversals.

Position sizing should reflect overall market conditions, volatility, and the trader’s risk tolerance. The pattern improves probability, not certainty.

Strengths and Limitations of the Pattern

The Falling Three Methods is valued for its clarity and strong trend-following nature. It helps traders stay disciplined during periods of market hesitation.

However, it can be less effective in choppy or range-bound markets. When trends lack strength, the pattern may fail or produce false signals.

Best Markets and Timeframes for Falling Three Methods

The pattern works across many markets, including stocks, forex, and cryptocurrencies. It is especially effective in liquid markets where trends develop cleanly.

Higher timeframes, such as daily and four-hour charts, tend to produce more reliable signals. On very short timeframes, market noise can reduce its effectiveness.

Final Thoughts

The Falling Three Methods is a powerful candlestick pattern for traders who want to understand trend continuation more clearly. It highlights how temporary pauses can strengthen, rather than weaken, a bearish move.

When used with proper context, confirmation tools, and disciplined risk management, this pattern can become a valuable part of a trader’s technical analysis toolkit.