The Marubozu candlestick pattern is one of the clearest signals in technical analysis because it shows strong buying or selling pressure without hesitation. When traders see a Marubozu on a price chart, it often suggests that one side of the market is in full control.

This pattern is popular among beginners and professional traders because it is easy to identify and reliable when used correctly. Understanding how Marubozu works can help traders read market sentiment with more confidence.

Before diving into strategies, it is important to understand what the Marubozu pattern really represents and why it matters in trading.

What Is a Marubozu Candlestick Pattern?

A Marubozu candlestick is a single candle with no upper or lower shadows, or very tiny ones that are barely visible. This means the price opened at one extreme and closed at the opposite extreme during that trading session.

In simple terms, a Marubozu shows that buyers or sellers dominated the entire period without meaningful resistance. There was no pullback strong enough to create shadows on the candle.

This clear price behavior is what makes the Marubozu pattern powerful and easy to interpret.

Why the Marubozu Pattern Is Important in Technical Analysis

The importance of the Marubozu pattern lies in its ability to reflect strong market conviction. Unlike candles with long wicks that show indecision, Marubozu candles show commitment.

Traders use this pattern to:

- Confirm the strength of a trend

- Identify potential trend continuation

- Spot possible trend reversals when they appear at key levels

Because it reflects pure buying or selling pressure, the Marubozu pattern often attracts high trading volume and attention.

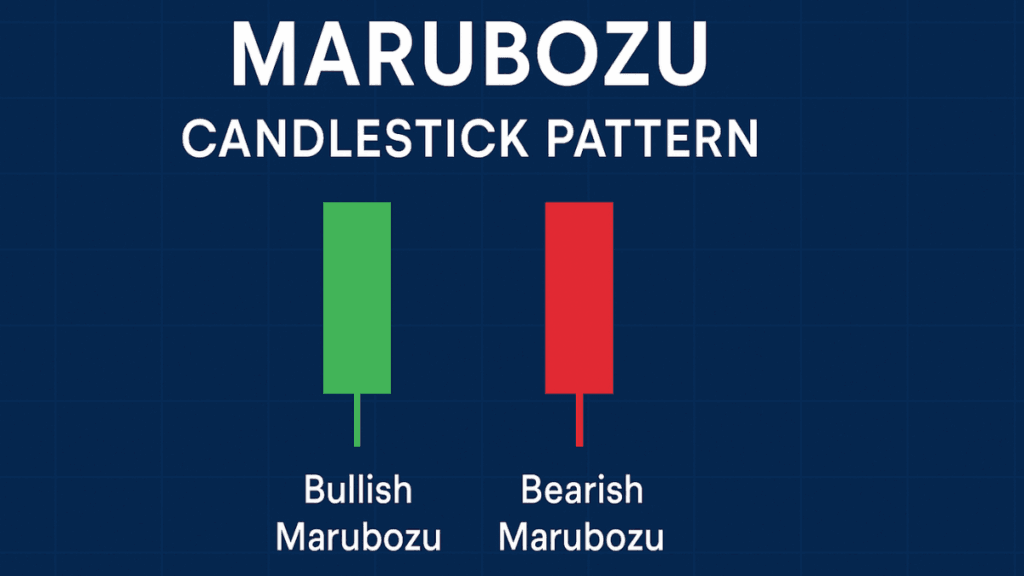

Types of Marubozu Candlestick Patterns

There are two main types of Marubozu candlestick patterns. Each type sends a different message depending on market direction.

Bullish Marubozu

A Bullish Marubozu occurs when the price opens at the lowest point and closes at the highest point of the session. The candle has a long green or white body with no shadows.

This pattern signals strong buying pressure and suggests that buyers were in control from start to finish. It often appears during uptrends or at the beginning of a bullish move.

Bearish Marubozu

A Bearish Marubozu occurs when the price opens at the highest point and closes at the lowest point of the session. The candle has a long red or black body with no shadows.

This pattern indicates strong selling pressure and shows that sellers dominated the market throughout the session. It commonly appears in downtrends or near the start of bearish momentum.

Psychology Behind the Marubozu Pattern

Understanding the psychology behind the Marubozu candlestick helps traders trust the signal more confidently. A Marubozu forms when one side of the market overwhelms the other without resistance.

In a bullish Marubozu, buyers are confident and aggressive. Sellers either step aside or are unable to push prices lower. In a bearish Marubozu, sellers are confident, and buyers fail to create any meaningful bounce.

This strong emotional commitment is why Marubozu candles often lead to follow-through price movement.

How to Identify a Valid Marubozu Candlestick

Although Marubozu candles look simple, traders should be careful to identify them correctly. Not every long candle qualifies as a true Marubozu.

A valid Marubozu should have:

- A long real body

- No visible shadows or extremely small ones

- A clear opening at one extreme and a close at the other

Some platforms allow tiny shadows due to price gaps or data differences, but the key idea is dominance without rejection.

How Traders Use the Marubozu Pattern in Trading

The Marubozu pattern is rarely used alone. Skilled traders combine it with other technical tools to improve accuracy.

Using Marubozu for Trend Confirmation

When a Marubozu appears in the direction of an existing trend, it often confirms trend strength. For example, a bullish Marubozu in an uptrend suggests that buyers remain in control.

This confirmation can give traders confidence to hold positions or add to trades.

Using Marubozu at Support and Resistance Levels

A Marubozu that forms near support or resistance levels can signal important price reactions. A bullish Marubozu near support may indicate a strong bounce, while a bearish Marubozu near resistance may suggest rejection.

This context makes the pattern far more reliable than trading it in isolation.

Combining Marubozu with Indicators

Many traders combine Marubozu with indicators such as moving averages, RSI, or volume. High volume during a Marubozu candle strengthens its signal and suggests real market participation.

Indicators help filter out false signals and improve trade timing.

Strengths and Limitations of the Marubozu Pattern

Like all technical patterns, Marubozu has strengths and weaknesses that traders must understand.

Strengths of the Marubozu Pattern

- Clear and easy to identify

- Shows strong market conviction

- Works well in trending markets

Limitations of the Marubozu Pattern

- Can fail in sideways or low-volume markets

- Needs confirmation from context or indicators

- Not ideal for predicting exact entry points alone

Understanding these limitations helps traders avoid overconfidence.

Common Mistakes Traders Make with Marubozu

Many beginners assume that every Marubozu leads to a big price move. This is not always true. Market conditions, volume, and location matter.

Another common mistake is ignoring higher-timeframe trends. A Marubozu against the main trend often produces weaker results.

Discipline and confirmation are essential when trading this pattern.

Final Thoughts

The Marubozu candlestick pattern is one of the most powerful single-candle signals in technical analysis. It clearly shows who is in control of the market and often signals strong momentum.

When used with proper context, volume, and confirmation tools, Marubozu can become a valuable part of any trader’s strategy. Like all patterns, it works best when combined with sound risk management and patience.

Understanding Marubozu is not about predicting the market perfectly, but about reading price behavior more clearly and making informed trading decisions.