The Nairobi Stock Exchange (NSE) is Kenya’s principal securities exchange where stocks, bonds, and other financial instruments are bought and sold. It serves as the main platform for companies to raise capital and for investors to buy ownership stakes in those companies. The NSE plays a vital role in Kenya’s economic growth by connecting businesses seeking funding with investors seeking profitable opportunities.

What Is the Nairobi Stock Exchange (NSE)?

The Nairobi Stock Exchange, officially known as the Nairobi Securities Exchange Plc, is Kenya’s leading stock market and one of the most vibrant in Sub-Saharan Africa. It provides a regulated, transparent marketplace for trading securities such as shares, bonds, exchange-traded funds (ETFs), and derivatives.

It is founded in 1954, the NSE has evolved from a small, manually operated market to a fully digital exchange offering real-time electronic trading. It is licensed and regulated by the Capital Markets Authority (CMA) of Kenya.

The exchange’s main function is to facilitate capital formation, liquidity, and price discovery in the financial markets crucial elements that drive economic development.

Brief History of the Nairobi Stock Exchange

The history of the Nairobi Stock Exchange reflects Kenya’s broader economic journey from colonial times to a modern digital economy.

- 1954 – Establishment:

The NSE was founded as a voluntary association of stockbrokers under the British colonial government. It operated as an informal market where securities of foreign-owned companies were traded. - 1963 – Independence Era:

After Kenya gained independence, the government promoted African participation in the economy. The NSE began listing local companies and promoting local ownership. - 1990s – Liberalization:

During Kenya’s economic reforms, the NSE underwent modernization and introduced electronic trading, automated clearing, and settlement systems. - 2006 – Regional Growth:

The NSE joined the African Securities Exchanges Association (ASEA), expanding its influence in Africa. - 2011 – Demutualization:

The NSE became a public limited company in 2014, separating ownership from management and listing its own shares on the exchange under the ticker symbol NSE. - Present Day:

Today, the NSE operates as a fully automated trading platform, integrating global standards and technology to attract both local and international investors.

How the Nairobi Stock Exchange Works

The NSE operates as a secondary market, where investors buy and sell securities that were initially issued in the primary market (for example, during an Initial Public Offering — IPO).

Here’s a simplified look at how it functions:

- Listing of Securities:

Companies seeking to raise capital can list their shares or bonds on the NSE. Before listing, they must meet specific financial, governance, and disclosure requirements set by the CMA. - Trading of Shares:

Once listed, shares can be bought and sold through licensed stockbrokers and investment banks. Investors place buy or sell orders via the NSE’s electronic trading system, known as ATS (Automated Trading System). - Clearing and Settlement:

Transactions are processed and settled through the Central Depository and Settlement Corporation (CDSC), ensuring secure transfer of securities and funds. - Price Determination:

Prices are determined by market forces, supply, and demand. The NSE publishes daily market reports showing price movements and trading volumes. - Regulation and Oversight:

The CMA oversees market integrity and investor protection. The NSE also enforces compliance rules for brokers and listed companies.

Market Segments of the Nairobi Stock Exchange

The NSE is structured into different segments to cater to various types of companies and investors.

1. Main Investment Market Segment (MIMS)

This segment is designed for large, established companies with a proven track record of profitability, corporate governance, and financial stability.

Requirements:

- Minimum share capital of KSh 50 million

- At least 1,000 shareholders

- Three years of profitability records

2. Alternative Investment Market Segment (AIMS)

Targeted at small and medium-sized enterprises (SMEs) that are growing but may not meet MIMS requirements.

Requirements:

- Minimum share capital of KSh 20 million

- At least 100 shareholders

- Less stringent listing conditions

3. Fixed Income Securities Market Segment (FISMS)

This segment focuses on bonds and debt securities including government treasury bonds and corporate bonds offering safer investment options with steady returns.

4. Growth and Enterprise Market Segment (GEMS)

Launched in 2013, GEMS allows startups and high-growth companies to list and access funding with lighter regulatory requirements. It aims to promote entrepreneurship and innovation.

5. Derivatives Market (NEXT)

The NSE NEXT platform, launched in 2019, enables investors to trade equity index futures and single stock futures, offering opportunities for hedging and speculation.

Key Players in the Nairobi Stock Exchange

Several entities work together to ensure the smooth operation of Kenya’s capital markets:

- Capital Markets Authority (CMA): Regulates and supervises market participants.

- Central Depository and Settlement Corporation (CDSC): Handles clearing and settlement of transactions.

- Stockbrokers and Investment Banks: Facilitate buying and selling of securities.

- Listed Companies: Provide investment products by offering shares and bonds.

- Investors: Individuals and institutions who trade securities to earn returns.

Importance of the Nairobi Stock Exchange

The NSE contributes significantly to Kenya’s economic growth and financial stability. Its importance can be viewed from multiple perspectives:

1. Capital Mobilization

The NSE helps companies raise funds for expansion and innovation through the sale of shares and bonds.

2. Wealth Creation

Investors can grow their wealth by buying shares that appreciate in value or pay dividends.

3. Economic Indicator

The NSE serves as a barometer of economic performance, reflecting investor confidence and business growth trends.

4. Promotes Good Corporate Governance

Listed companies are required to follow transparency, disclosure, and governance standards — building investor trust.

5. Job Creation and Financial Literacy

Through its operations, the NSE supports financial institutions, analysts, and brokers while also educating the public on investment opportunities.

6. Attracts Foreign Investment

The NSE’s modernization and adherence to international standards make it attractive to foreign portfolio investors.

Examples of Securities Traded on the NSE

- Equities (Shares):

Example — Safaricom Plc, Equity Group Holdings, KCB Group, and East African Breweries Ltd. - Corporate Bonds:

Example — Centum Investment Company and Acorn Holdings. - Government Bonds:

Issued by the Government of Kenya through the Central Bank to finance national projects. - Exchange-Traded Funds (ETFs):

Example — ABSA NewGold ETF that tracks the price of gold. - Derivatives:

Example — Equity Index Futures (based on NSE 25 Share Index).

Advantages of Investing in the Nairobi Stock Exchange

- Portfolio Diversification: Investors can spread risk across multiple asset classes.

- Liquidity: Shares can be quickly bought or sold through the exchange.

- Transparency: Strict regulation ensures fair trading and investor protection.

- Potential for High Returns: Equity investments can generate capital gains and dividends.

- Accessibility: With online platforms, even small investors can participate in the market.

Challenges and Risks of the Nairobi Stock Exchange

While the NSE offers numerous opportunities, it also faces several challenges:

1. Market Volatility

Prices of securities fluctuate based on economic and political conditions, which can lead to investor losses.

2. Low Liquidity for Some Stocks

Not all listed companies have active trading, limiting the ease of buying or selling.

3. Limited Public Awareness

Many Kenyans still have a limited understanding of stock market investing.

4. Regulatory Hurdles

Compliance requirements may discourage some small firms from listing.

5. Political and Economic Instability

Changes in fiscal policy, inflation, or political tensions can impact investor confidence and market performance.

The Role of Technology in the Nairobi Stock Exchange

Technology has revolutionized the NSE’s operations, enhancing efficiency and accessibility.

- Automated Trading System (ATS): Allows real-time electronic trading.

- Online and Mobile Platforms: Enable investors to trade from anywhere.

- Market Data Services: Provide live updates on stock prices and market indices.

- Digital Investor Education: NSE runs webinars and virtual programs to educate the public.

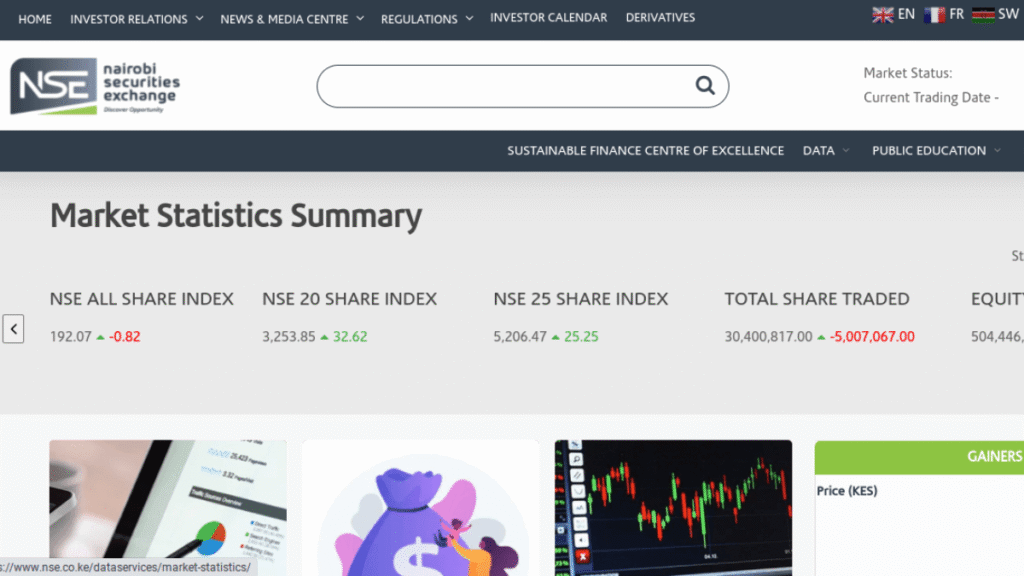

Major Indices of the Nairobi Stock Exchange

Indices measure the performance of a specific group of stocks, helping investors track market trends.

- NSE 20 Share Index: Tracks 20 top-performing companies.

- NSE 25 Share Index: Includes 25 most liquid and representative stocks.

- NSE All Share Index (NASI): Reflects the overall market performance.

- FTSE NSE Kenya 15 & 25 Index: Jointly developed with the FTSE Group to attract global investors.

How to Invest in the Nairobi Stock Exchange

Investing in the NSE is straightforward for both local and foreign investors:

- Open a CDS Account:

Register with a stockbroker or investment bank to open a Central Depository System (CDS) account for holding securities electronically. - Choose a Licensed Broker:

Select a CMA-licensed broker to execute trades. - Deposit Funds:

Transfer funds into your trading account. - Place Orders:

Decide whether to buy or sell shares based on market research. - Monitor Your Portfolio:

Keep track of market trends, company performance, and dividends. - Diversify Investments:

Spread investments across sectors such as banking, telecommunications, energy, and manufacturing.

Future Outlook of the Nairobi Stock Exchange

The future of the NSE looks promising as it embraces innovation, regional integration, and sustainability.

- Digital Transformation: Ongoing efforts to expand online and mobile trading.

- Green Bonds and ESG Investing: Growing focus on environmentally sustainable investments.

- Regional Integration: Plans to link East African stock exchanges to create a larger market.

- Financial Inclusion: Encouraging more retail investors and SMEs to participate.

With continued regulatory reforms, technology adoption, and investor education, the NSE is poised to strengthen its position as East Africa’s financial hub.

Conclusion

The Nairobi Stock Exchange (NSE) is the heartbeat of Kenya’s financial system fostering investment, growth, and innovation. From its humble beginnings in 1954 to its current status as a leading African exchange, the NSE continues to play a pivotal role in mobilizing capital and building investor confidence.

For investors and learners alike, understanding how the NSE works is key to unlocking opportunities within Kenya’s growing economy. As the exchange continues to modernize, it stands not only as a marketplace for securities but also as a cornerstone of Kenya’s financial future.