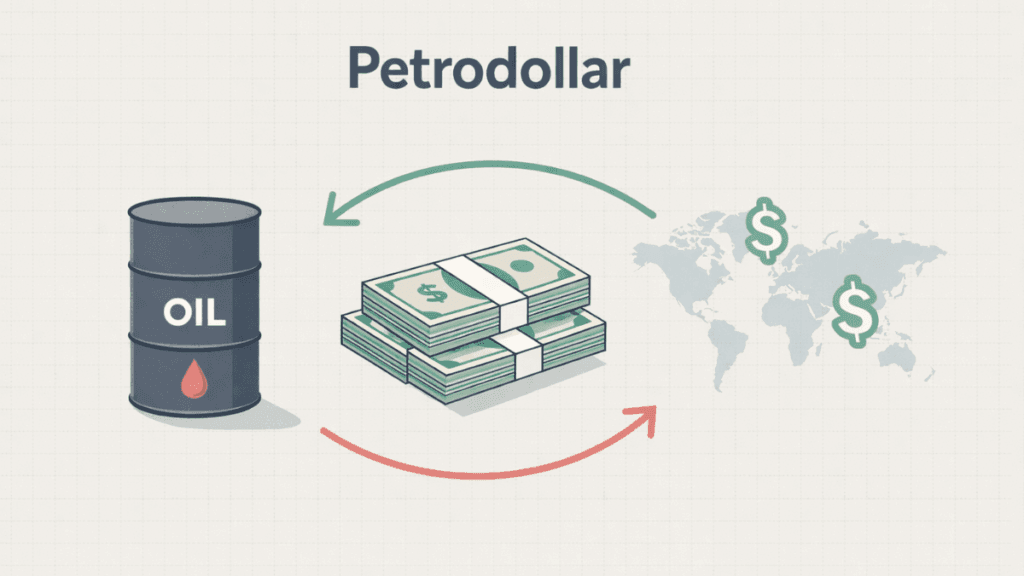

The Petrodollar is a term used to describe the system in which oil is traded globally using the US dollar as the primary settlement currency. From the very first oil invoice priced in dollars, this arrangement reshaped international trade, global finance, and geopolitical power in ways that still affect everyday life today.

At its core, the petrodollar system links energy markets to currency dominance. Countries that need oil must first obtain US dollars, creating constant global demand for the currency and reinforcing the United States’ central role in the world economy.

What is the Petrodollar?

The petrodollar refers to US dollars earned by oil-exporting countries through crude oil sales. These dollars often return to global financial markets through investments, trade, and reserves, forming a powerful economic loop.

This system matters because oil remains a foundational input for transportation, manufacturing, agriculture, and electricity generation. When the most critical commodity is priced in one currency, that currency gains unmatched global relevance.

How the Petrodollar System Began

The petrodollar system did not emerge by accident. It was a strategic response to economic shocks and changing global monetary rules.

The End of the Gold Standard

The modern petrodollar system traces back to the early 1970s, when the United States ended the gold-backed dollar system. Once the dollar was no longer convertible to gold, global confidence needed a new anchor.

Oil provided that anchor. Energy demand was rising fast, and oil-producing nations held increasing influence over global supply.

The US–Saudi Arabia Agreement

A pivotal agreement between the United States and Saudi Arabia cemented the petrodollar system. Saudi Arabia agreed to price oil exports exclusively in US dollars, while the US offered military support and security guarantees.

Over time, other OPEC nations followed the same model. This arrangement locked the dollar into the global energy trade and reshaped international finance for decades.

How the Petrodollar System Works Today

The petrodollar system functions through a continuous cycle of trade, reserves, and reinvestment. Each step reinforces dollar demand and financial stability for participating nations.

Oil-importing countries earn or buy US dollars through exports or financial markets. They then use those dollars to purchase oil from producing nations, which in turn reinvest surplus dollars into global assets.

Why Oil Is Priced in US Dollars

Oil is priced in US dollars primarily because of trust, liquidity, and market depth. The dollar offers stability, deep financial markets, and ease of global settlement.

Pricing oil in a single, widely accepted currency reduces transaction costs and currency risk. This consistency benefits both buyers and sellers, even when geopolitical tensions rise.

Benefits of the Petrodollar System

The petrodollar system delivers advantages to both the United States and the global economy, although these benefits are not evenly distributed.

Advantages for the United States

The United States benefits from constant global demand for its currency. This allows the US government to borrow at lower interest rates and maintain a strong financial influence.

Dollar dominance also gives the US powerful financial tools, including sanctions and monetary policy reach, that few other nations possess.

Advantages for Oil-Producing Nations

Oil exporters benefit from stable pricing and access to deep US financial markets. Holding dollar reserves allows them to invest globally with minimal liquidity constraints.

Many oil-producing countries use petrodollars to fund infrastructure, sovereign wealth funds, and long-term development projects.

Advantages for the Global Economy

A single pricing currency simplifies global oil trade. It reduces exchange rate uncertainty and supports smoother cross-border transactions.

This system has historically provided predictability during periods of economic stress, helping stabilize energy markets.

Petrodollar Recycling

Petrodollar recycling refers to the process by which oil-exporting nations reinvest surplus dollars into global financial markets. These investments often include government bonds, equities, infrastructure, and international trade projects.

This recycling supports global liquidity and helps finance deficits in oil-importing nations. It also ties oil producers closely to global economic stability.

Criticisms and Risks of the Petrodollar System

Despite its benefits, the petrodollar system faces significant criticism. Many economists argue that it creates imbalances and concentrates financial power.

Economic Imbalances

The system encourages persistent trade deficits in the United States. Since global demand for dollars remains high, the US can import more than it exports without immediate consequences.

Over time, this can weaken domestic manufacturing and increase reliance on debt financing.

Geopolitical Tensions

The petrodollar system ties energy markets to political alliances. Countries that challenge dollar dominance may face economic pressure or sanctions.

This dynamic has contributed to geopolitical conflicts and strained international relations in energy-rich regions.

Exposure to Oil Market Volatility

Oil price fluctuations directly affect dollar flows. Sharp declines in oil prices can destabilize oil-dependent economies and reduce global liquidity.

This volatility highlights the risks of linking global finance so closely to a single commodity.

Challenges to the Petrodollar System

In recent years, the petrodollar system has faced growing challenges from economic shifts, political changes, and technological innovation.

Alternative Currencies in Oil Trade

Some countries have explored trading oil in currencies other than the US dollar. These efforts aim to reduce reliance on dollar reserves and financial exposure.

While such initiatives remain limited, they signal a desire for a more multipolar currency system.

The Rise of Energy Diversification

Renewable energy and alternative fuels are reducing long-term dependence on oil. As energy demand evolves, the central role of oil in global trade may decline.

A reduced oil footprint could weaken the structural support that underpins the petrodollar system.

Digital Currencies and Payment Systems

Digital payment systems and central bank digital currencies introduce new ways to settle international trade. These technologies may gradually reduce dependence on traditional currency frameworks.

However, trust, scale, and regulatory acceptance remain key hurdles.

Is the Petrodollar System Ending?

Claims about the collapse of the petrodollar system often appear in headlines, but reality is more nuanced. The system faces pressure, yet it remains deeply entrenched.

Oil markets, financial infrastructure, and global reserves still rely heavily on the US dollar. Shifting away from such a system requires decades, not years.

What a Decline of the Petrodollar Would Mean

If the petrodollar system were to weaken significantly, the global economy would undergo major changes. Currency markets, trade flows, and geopolitical power balances would all shift.

The US could face higher borrowing costs, while oil exporters might diversify reserves more aggressively. Global markets would likely become more fragmented and complex.

The Petrodollar and Inflation

The petrodollar system influences inflation by shaping currency flows and energy prices. A strong dollar can reduce imported inflation, while oil price shocks can drive global price increases.

Energy remains a key input cost, making the petrodollar indirectly relevant to household expenses worldwide.

How the Petrodollar Affects Everyday Life

Although abstract, the petrodollar system impacts daily life through fuel prices, interest rates, and global trade stability. Transportation costs, food prices, and consumer goods all reflect energy pricing dynamics.

Understanding the petrodollar helps explain why global events often ripple into local economies.

Petrodollar vs Petro-Yuan and Other Alternatives

The dominance of the petrodollar has encouraged exploration of alternatives, most notably the Petroyuan, which refers to oil trade settled in China’s currency instead of the US dollar. This concept reflects a gradual move toward currency diversification in global energy markets.

The Petroyuan gained traction as China became the world’s largest oil importer and sought to reduce exposure to dollar-based trade. While some bilateral oil deals now use yuan, adoption remains limited due to lower liquidity and tighter capital controls compared to the US dollar.

Other alternatives include pricing oil in euros or using multi-currency settlement systems. These models aim to add flexibility rather than replace the petrodollar, which continues to dominate global oil transactions.

Why the Petrodollar Still Matters Today

The petrodollar remains relevant because oil continues to power much of the global economy. Until energy markets undergo a complete transformation, the link between oil and the dollar will persist.

Its influence extends beyond energy into finance, diplomacy, and global economic stability.

Final Thoughts

The petrodollar is more than a currency arrangement; it is a cornerstone of modern global economics. Its rise reflects strategic decisions, market realities, and political alliances formed over decades.

While challenges are real and change is inevitable, the petrodollar system continues to shape how nations trade, invest, and interact. Understanding it offers valuable insight into the forces that quietly drive the global economy.