The Petroyuan refers to China’s effort to price and settle oil trades in its own currency, the Chinese yuan, rather than the U.S. dollar. This idea sits at the intersection of energy markets, geopolitics, and international finance, and it reflects a broader push by China to increase the global role of its currency.

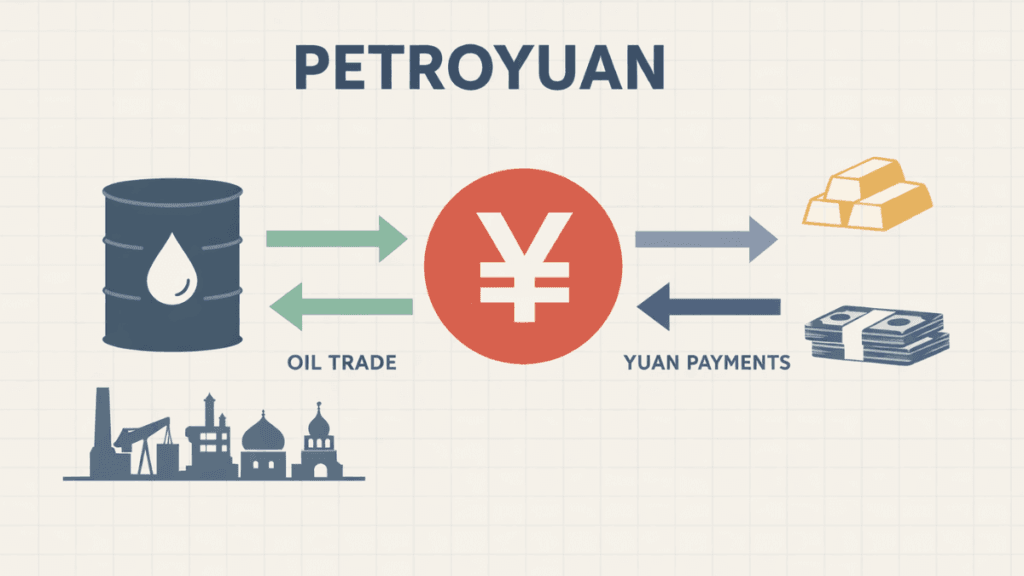

Unlike a single law or treaty, the Petroyuan is a system that combines oil trade agreements, yuan-based pricing, and financial infrastructure that allows exporters to convert yuan into other assets. Understanding it requires looking at how oil has traditionally been traded, why China wants change, and what that change could mean for the global financial order.

What Is Petroyuan?

The Petroyuan is best understood as a framework rather than a standalone currency or product. It describes oil sales that are priced and settled in Chinese yuan, often through contracts traded on Chinese exchanges or via bilateral agreements between China and oil-exporting countries.

This concept challenges the long-standing dominance of the U.S. dollar in global oil markets. For decades, most oil trades have been priced in dollars, giving rise to the term “petrodollar.” The Petroyuan aims to offer an alternative settlement option, especially for countries that trade heavily with China.

How the Petroyuan Differs from the Petrodollar

The petrodollar system emerged in the 1970s when major oil exporters agreed to price oil in U.S. dollars. In return, those dollars were often recycled into U.S. financial markets, reinforcing the dollar’s global role.

The Petroyuan differs in several important ways:

- It is centered on trade with China, the world’s largest oil importer.

- It allows settlement in yuan, with options to convert proceeds into gold or other assets.

- It operates alongside the dollar system rather than fully replacing it.

This distinction matters because it shows the Petroyuan as a complementary system, at least for now, rather than an outright replacement.

Why China Is Promoting the Petroyuan

China’s push for the Petroyuan is driven by economic strategy, financial security, and geopolitical considerations. Each of these factors plays a role in shaping Beijing’s long-term goals.

China imports more oil than any other country, which exposes it to currency risk when purchases are priced in dollars. Paying in yuan reduces that exposure and strengthens the international use of China’s currency.

Reducing Dependence on the U.S. Dollar

One of the clearest motivations behind the Petroyuan is reducing reliance on the dollar-based financial system. Dollar dominance gives the United States significant influence over global finance, including the ability to impose sanctions.

By encouraging yuan-based oil trade, China creates alternative payment channels. This approach is particularly appealing to countries that face U.S. sanctions or want to diversify their financial relationships.

Supporting Yuan Internationalization

The Petroyuan also supports China’s broader goal of making the yuan a global currency. International trade settlement is a key step in that process.

When oil exporters accept yuan, they may:

- Use it to buy Chinese goods and services

- Invest it in the Chinese financial markets

- Convert it into other assets through Chinese exchanges

Each option increases the yuan’s circulation outside China.

How the Petroyuan System Works in Practice

The Petroyuan operates through a combination of energy contracts, financial infrastructure, and bilateral agreements. It is not a single pipeline but a network of mechanisms that support yuan-based oil trade.

At the center of this system is China’s domestic energy market and its growing influence over global oil demand.

Yuan-Denominated Oil Futures

A key pillar of the Petroyuan is yuan-priced oil futures traded on the Shanghai International Energy Exchange (INE). These contracts allow oil to be priced and settled in yuan rather than dollars.

For exporters, these futures provide price discovery and hedging tools similar to those offered by established benchmarks like Brent or WTI. Over time, increased trading volume improves liquidity and credibility.

Settlement and Convertibility Options

Oil exporters are more likely to accept the yuan if they can easily use or convert it. China has addressed this concern by offering multiple pathways.

These include:

- Using the yuan for trade with Chinese companies

- Investing in Chinese bonds or equities

- Converting yuan into gold through Chinese exchanges

The gold conversion option is especially important for exporters who prefer hard assets over fiat currencies.

Countries Involved in Petroyuan Oil Trade

The success of the Petroyuan depends heavily on participation by oil-exporting nations. China’s position as a major buyer gives it leverage, but acceptance still varies by country.

Participation tends to be strongest among countries with strong trade ties to China or strained relations with the United States.

Major Oil Exporters and China

Several large oil exporters already sell significant volumes to China. For these countries, yuan settlement can be a practical option rather than a political statement.

Examples include:

- Russia, which has increased yuan-based trade amid Western sanctions

- Iran, which seeks alternatives to dollar settlement

- Some Middle Eastern exporters are exploring partial yuan pricing

These arrangements often begin with bilateral agreements before expanding into broader market usage.

The Role of Emerging Markets

Emerging market exporters may see the Petroyuan as a way to diversify currency exposure. Holding reserves in multiple currencies can reduce risk and improve financial flexibility.

That said, many still prefer the dollar for its liquidity and global acceptance. This balance explains why Petroyuan adoption is gradual rather than sudden.

Impact on Global Oil Markets

The Petroyuan introduces new dynamics into global oil pricing and settlement. While the dollar remains dominant, even small shifts can have meaningful long-term effects.

Oil markets are sensitive to liquidity, trust, and infrastructure. Any alternative pricing system must meet high standards to gain widespread acceptance.

Pricing Power and Benchmarks

Established benchmarks like Brent and WTI benefit from deep liquidity and long-standing trust. The Petroyuan challenges this dominance by offering an alternative tied to Chinese demand.

If yuan-based benchmarks gain traction, they could influence regional pricing, especially in Asia. Over time, this could lead to a more multipolar pricing system.

Market Fragmentation Risks

Multiple pricing currencies can also create complexity. Traders may face higher hedging costs or increased volatility if markets fragment.

For now, most participants view the Petroyuan as an additional option rather than a replacement, which helps limit disruption.

Implications for the U.S. Dollar

The rise of the Petroyuan naturally raises questions about the future of the U.S. dollar. While some headlines predict a rapid decline, reality is more nuanced.

Deep financial markets, legal stability, and global trust support the dollar’s dominance. These factors are not easily replicated.

Is the Petrodollar Under Threat?

The Petroyuan does not immediately threaten the petrodollar system. Most oil trades are still settled in dollars, and many exporters prefer dollar assets.

However, incremental changes matter. Even a modest shift toward yuan settlement reduces exclusive reliance on the dollar and introduces competition.

Long-Term Currency Competition

In the long run, the Petroyuan contributes to a more diversified global currency system. This does not mean the dollar disappears, but its share may gradually decline.

Currency systems often evolve slowly, shaped by trade patterns and political relationships rather than sudden policy decisions.

Petroyuan and Geopolitics

Energy and geopolitics are closely linked, and the Petroyuan is no exception. Currency choices can reflect alliances, strategic interests, and responses to global power shifts.

For some countries, adopting yuan settlement is as much a political signal as an economic one.

Sanctions and Financial Autonomy

Countries facing sanctions often look for ways to bypass dollar-based systems. The Petroyuan offers one such pathway, especially when combined with Chinese financial infrastructure.

This does not eliminate all risks, but it can reduce exposure to certain restrictions.

Strategic Influence in Energy Trade

By shaping how oil is traded, China increases its influence over global energy flows. This influence extends beyond pricing into logistics, finance, and long-term supply agreements.

Over time, this integration strengthens China’s role as both a consumer and a rule-setter.

Risks and Limitations of the Petroyuan

Despite its potential, the Petroyuan faces real constraints. These limitations explain why adoption remains selective rather than universal.

Understanding these challenges is essential for a balanced view.

Capital Controls and Convertibility

China maintains capital controls that limit the free movement of the yuan. While this provides domestic stability, it can deter foreign holders who value unrestricted access.

Full currency convertibility remains a key concern for many exporters and investors.

Trust and Transparency Issues

Global markets rely on trust, clear regulation, and transparent data. China has made progress in these areas, but perceptions still vary.

Building long-term confidence takes time, especially in markets as large and sensitive as oil.

What the Petroyuan Means for Investors

For investors, the Petroyuan is less about immediate profit and more about long-term structural change. It signals shifts in trade patterns, currency usage, and geopolitical influence.

Energy investors, currency traders, and policymakers all watch these developments closely.

Opportunities to Watch

Investors may find indirect exposure through:

- Chinese energy exchanges and related instruments

- Companies involved in the China-focused oil trade

- Assets linked to the yuan internationalization

These opportunities depend heavily on regulatory access and risk tolerance.

Risks to Consider

As with any structural shift, uncertainty is high. Policy changes, geopolitical tensions, and market reactions can all influence outcomes.

A cautious, diversified approach is often more appropriate than speculative bets.

The Future Outlook for the Petroyuan

The future of the Petroyuan is likely to be evolutionary rather than revolutionary. Gradual adoption, selective use, and regional influence define its current trajectory.

China’s continued growth as an energy importer gives it leverage, but global acceptance depends on trust and flexibility.

Gradual Expansion, Not Sudden Dominance

Most analysts expect the Petroyuan to expand slowly, especially in Asia and among politically aligned exporters. This expansion may coexist with dollar pricing for decades.

Such coexistence reflects a more multipolar financial system rather than a zero-sum outcome.

A Symbol of a Changing World Order

Beyond mechanics, the Petroyuan symbolizes shifting economic power. It highlights how trade relationships can reshape financial norms over time.

Whether it becomes a major pillar or remains a niche alternative, it has already influenced global conversations about currency and energy.

Final Thoughts

The Petroyuan represents a meaningful attempt by China to reshape how oil is traded and how currencies are used in global commerce. It is not a sudden overthrow of the dollar system, but it is a clear signal of long-term change.

For readers, investors, and policymakers, understanding the Petroyuan means understanding the slow but steady evolution of global finance. Its real impact will be measured not in headlines, but in how trade habits and currency preferences shift over the coming years.