A Wedge is a widely used chart pattern in trading that helps traders understand price compression and potential future breakouts. It forms when price movements are confined between two converging trendlines, showing that the market is gradually tightening and preparing for a decisive move.

This pattern appears across many markets, including forex, stocks, crypto, and commodities, which makes it especially valuable for technical analysis. Traders rely on wedges because they visually reflect changes in momentum and market balance between buyers and sellers.

What Is a Wedge Pattern?

A wedge pattern is a technical chart formation where price moves within narrowing boundaries that slope either upward or downward. Unlike channels, the trendlines in a wedge converge, indicating that volatility decreases as the price moves higher.

This price action contraction often suggests that the current trend is losing strength. As a result, wedges are closely watched because they frequently precede sharp breakouts or reversals.

Key Characteristics of a Wedge Pattern

Every wedge pattern shares a few defining traits that help traders identify it correctly. Recognizing these features reduces the risk of confusing a wedge with similar-looking patterns.

- Two converging trendlines that contain price action

- A visible narrowing range over time

- At least two clear touches on each trendline

- A breakout that usually occurs before the lines fully meet

These characteristics highlight the idea of market pressure building as buyers and sellers struggle for control.

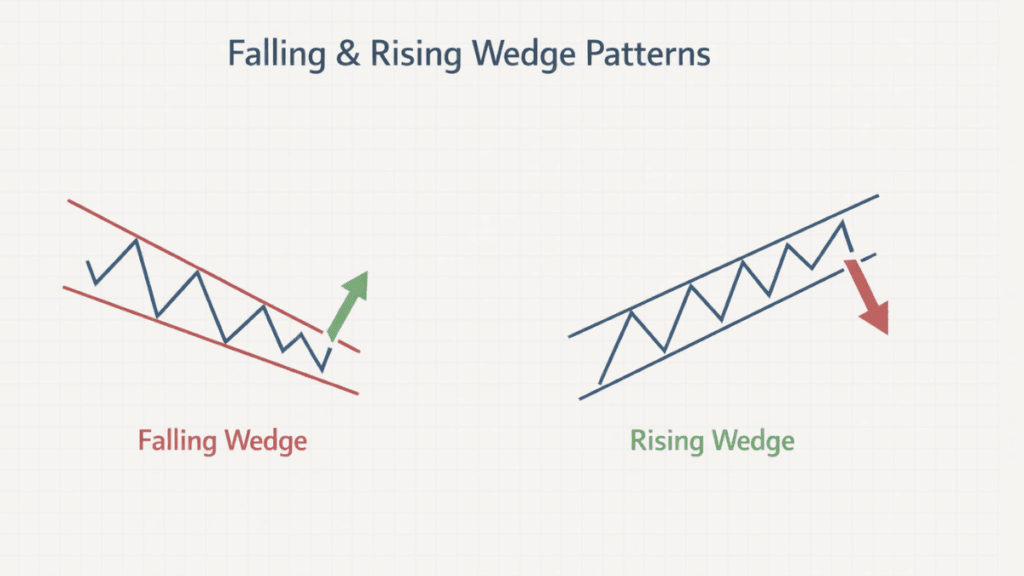

Types of Wedge Patterns in Trading

Wedge patterns are generally divided into two main types based on their direction and market implications. Each type sends a different message about trend strength and possible future price movement.

Understanding these differences is essential, as trading a wedge incorrectly can lead to poor timing and unnecessary losses.

Rising Wedge Pattern

A Rising Wedge forms when the price is making higher highs and higher lows, but the upward movement is gradually weakening. Both trendlines slope upward, with the lower trendline rising faster than the upper one.

This pattern often signals bearish pressure building beneath the surface. Even though the price is moving up, buyers are losing momentum, and sellers are slowly gaining control.

What a Rising Wedge Indicates

A rising wedge typically acts as a bearish reversal pattern, especially when it appears after a strong uptrend. It can also act as a continuation pattern in a downtrend, reinforcing existing bearish sentiment.

The key message of a rising wedge is that upward progress is becoming harder to sustain. When the breakdown happens, it often leads to a sharp and fast decline.

How Traders Trade a Rising Wedge

Traders usually wait for confirmation before acting on a rising wedge. Confirmation often comes when price breaks below the lower trendline with strong momentum.

Many traders look for supporting signals, such as declining volume during formation or bearish candlestick patterns near the breakout. These elements increase confidence that the breakdown is genuine and not a false move.

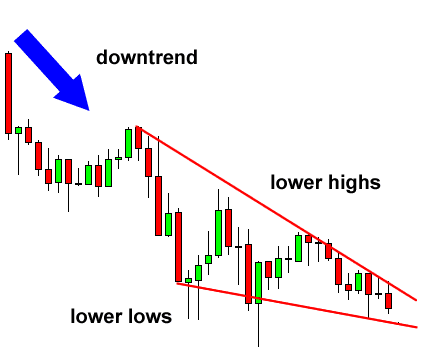

Falling Wedge Pattern

A Falling Wedge forms when the price creates lower highs and lower lows, but the downward momentum weakens over time. Both trendlines slope downward, with the upper trendline falling faster than the lower one.

This pattern suggests that sellers are losing strength, and buyers may soon step in. As a result, falling wedges are commonly associated with bullish outcomes.

What a Falling Wedge Indicates

A falling wedge is most often considered a bullish reversal pattern, especially when it forms after a prolonged downtrend. It can also appear as a continuation pattern during an uptrend, signaling a temporary pause before higher prices.

The narrowing price range reflects reduced selling pressure. When price breaks above the upper trendline, it often marks the start of a strong upward move.

How Traders Trade a Falling Wedge

Traders typically wait for a clear breakout above the upper trendline before entering a trade. This approach helps avoid entering too early while the price is still compressing.

Volume expansion during the breakout and bullish confirmation from other indicators can strengthen the trade setup. Risk management remains important, as false breakouts can still occur in low-liquidity conditions.

Wedge Patterns vs Similar Chart Patterns

Wedges are sometimes confused with triangles or channels due to their similar appearance. However, the slope and converging nature of wedges set them apart.

Triangles usually have at least one flat trendline, while channels maintain a consistent width. Wedges, by contrast, always show narrowing price action, which is central to their interpretation.

Common Mistakes When Trading Wedge Patterns

One common mistake is trading a wedge before a confirmed breakout. Entering too early exposes traders to prolonged consolidation and unexpected reversals.

Another frequent error is ignoring the broader trend and market context. Wedges work best when aligned with overall price structure, support and resistance levels, and volume behavior.

Why Wedge Patterns Matter to Traders

Wedge patterns matter because they visually capture the struggle between buyers and sellers as momentum fades. They offer traders early clues about potential trend changes or continuation moves.

When used correctly, wedges can improve timing, risk control, and overall trade confidence. They are especially effective when combined with other forms of technical analysis rather than used in isolation.

Final Thoughts

The Wedge pattern remains a powerful and reliable tool in trading when properly understood and patiently applied. By learning how rising and falling wedges form and what they signal, traders gain deeper insight into market psychology.

Consistency, confirmation, and disciplined risk management are key to using wedge patterns effectively. With practice, they can become an important part of a well-rounded trading strategy.