The Weighted Moving Average (WMA) is a technical analysis indicator that helps traders and investors understand price trends by giving more importance to recent data. Unlike simple averages that treat all prices equally, the WMA responds faster to price changes because newer prices carry greater weight. This makes it especially useful in markets where timing and trend shifts matter.

At its core, the WMA smooths out price data while staying more sensitive to recent movements. This balance between clarity and responsiveness is why it is widely used in trading strategies across stocks, forex, commodities, and cryptocurrencies.

Understanding Weighted Moving Average

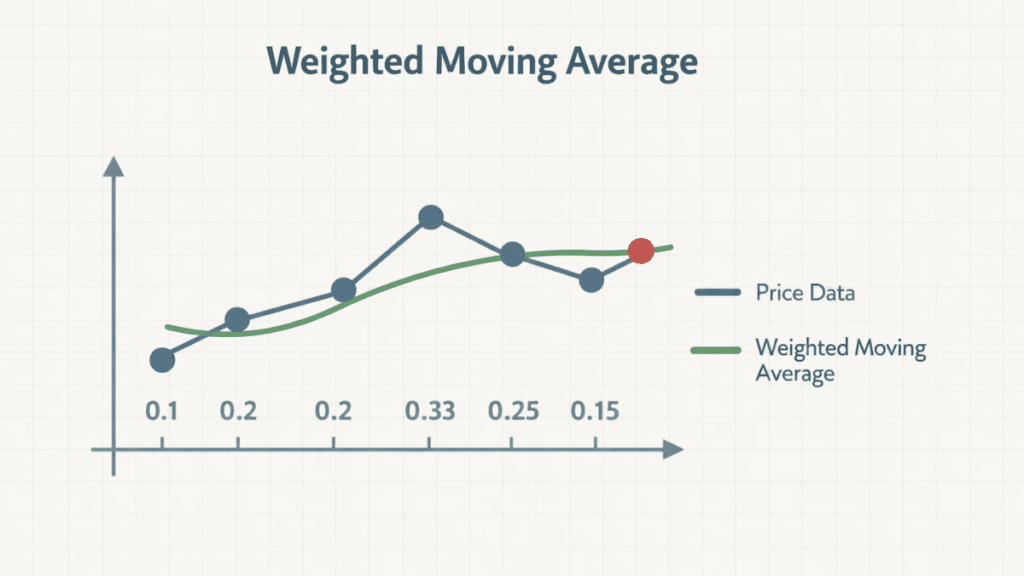

The Weighted Moving Average is a type of moving average that assigns different weights to each price in the selected period. The most recent price receives the highest weight, while older prices receive progressively smaller weights.

This structure reflects a simple idea: recent market activity is often more relevant than older data. As a result, the WMA adapts more quickly to changing market conditions than slower-moving averages.

How the Weighted Moving Average Works

The WMA works by multiplying each price in the lookback period by a specific weight. These weighted prices are then added together and divided by the sum of the weights.

For example, in a 5-period WMA, the most recent price might be multiplied by 5, the previous one by 4, and so on until the oldest price is multiplied by 1. This calculation ensures that the latest data has the strongest influence on the final value.

How to Calculate the Weighted Moving Average

Understanding the calculation helps traders trust and interpret the indicator correctly. While most charting platforms calculate it automatically, the logic behind it is straightforward.

Step-by-Step WMA Calculation

To calculate a WMA manually, follow these steps:

- Choose a time period, such as 5 days or 10 candles

- Assign increasing weights from the oldest price to the newest

- Multiply each price by its assigned weight

- Add all the weighted values together

- Divide the total by the sum of the weights

This process produces a smoother line that closely follows recent price action without ignoring past data entirely.

WMA vs Simple Moving Average (SMA)

The Weighted Moving Average is often compared to the Simple Moving Average because both aim to smooth price data. The key difference lies in how they treat historical prices.

An SMA gives equal importance to all prices in the selected period, which can make it slower to react to sudden changes. In contrast, the WMA places more emphasis on recent prices, allowing it to respond more quickly when trends begin or end.

WMA vs Exponential Moving Average (EMA)

Another common comparison is between the WMA and the Exponential Moving Average. Both indicators prioritize recent prices, but they do so differently.

The EMA uses a mathematical formula that applies exponential weighting, while the WMA applies linear weights. In practice, EMAs tend to react slightly faster than WMAs, but some traders prefer the transparency and simplicity of the WMA’s weighting system.

Why Traders Use the Weighted Moving Average

Traders use the WMA because it offers a practical balance between smoothness and responsiveness. It reduces market noise while still reacting quickly enough to capture meaningful trend changes.

This makes the WMA suitable for traders who want clearer signals without excessive lag. It is often favored in short-term and medium-term trading strategies.

Common Trading Strategies Using WMA

The Weighted Moving Average can be used in several practical ways. Each approach depends on how traders interpret price behavior around the moving average.

Trend Identification

One of the most common uses of the WMA is identifying the overall market trend. When the price stays above the WMA, it often suggests an uptrend. When the price remains below it, a downtrend may be in place.

This simple observation helps traders align their trades with the prevailing direction of the market.

WMA Crossovers

Crossover strategies involve using two WMAs with different periods. A shorter-period WMA crossing above a longer-period WMA can signal a potential buying opportunity. A downward crossover may suggest a selling or exit signal.

These signals are popular because they are easy to identify and apply across different markets.

Dynamic Support and Resistance

The WMA can also act as a dynamic support or resistance level. Prices often pull back toward the moving average before continuing in the direction of the trend.

Traders watch these interactions closely to time entries and exits more effectively.

Best Timeframes for Using WMA

The effectiveness of the Weighted Moving Average depends on the chosen timeframe. Shorter WMAs work well for intraday and swing traders who need quick responses to price changes.

Longer WMAs are better suited for investors and position traders who focus on broader trends. The key is to match the WMA period with your trading style and objectives.

Advantages of the Weighted Moving Average

The WMA offers several benefits that make it appealing to many traders. Its design naturally emphasizes recent market behavior without ignoring historical context.

Some of its main advantages include:

- Faster reaction to price changes than SMA

- Clear and transparent weighting method

- Useful for both trend-following and timing entries

These strengths make it a reliable tool when used thoughtfully.

Limitations of the Weighted Moving Average

Despite its usefulness, the WMA is not perfect. Like all moving averages, it is still a lagging indicator based on past prices.

In choppy or sideways markets, the WMA can generate false signals. It is also less adaptive than indicators that adjust weights dynamically, such as the EMA.

How to Combine WMA With Other Indicators

The Weighted Moving Average works best when combined with other technical tools. Pairing it with momentum indicators like RSI or MACD can help confirm signals.

Volume analysis and support-resistance levels also complement the WMA well. This combination approach reduces reliance on a single indicator and improves decision-making.

Is the Weighted Moving Average Suitable for Beginners?

The WMA is beginner-friendly because its logic is easy to understand. New traders can quickly learn how it reacts to price and how it differs from other moving averages.

At the same time, experienced traders appreciate its balance and clarity. This makes the WMA a versatile indicator for different skill levels.

Final Thoughts

The Weighted Moving Average (WMA) is a powerful yet simple indicator that highlights recent price action without excessive complexity. By assigning greater importance to newer data, it offers clearer insight into evolving market trends.

When used correctly and combined with other tools, the WMA can enhance trend analysis and improve trading decisions. Its transparency, flexibility, and responsiveness explain why it remains a staple in technical analysis.