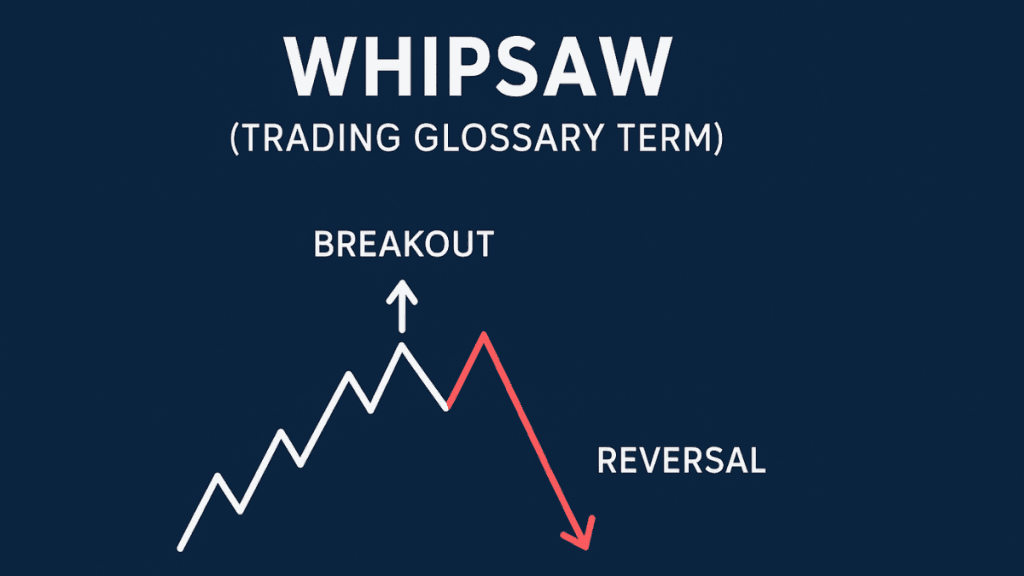

A whipsaw happens when the price of an asset moves strongly in one direction but quickly reverses, causing traders to take unexpected losses. This price behavior is common in volatile markets and often affects traders who rely on breakouts or trend-following strategies.

A whipsaw usually results in entering a trade based on a strong signal—only for the market to reverse sharply.

How a Whipsaw Works

In simple terms, a whipsaw has two parts:

- The price breaks out or moves sharply in one direction, appearing to start a new trend.

- The price reverses unexpectedly, going the opposite way and invalidating the initial signal.

This “fake move followed by reversal” creates the whipsaw effect.

Types of Whipsaws

1. Bullish Whipsaw

A bullish whipsaw happens when:

- Price breaks above a resistance level.

- Traders expect a strong upward trend.

- Price reverses downward shortly after, trapping long positions.

2. Bearish Whipsaw

A bearish whipsaw happens when:

- Price breaks below a support level.

- Traders expect further downward momentum.

- Price reverses upward, causing losses to short sellers.

Both types mislead traders into taking positions that quickly become unprofitable.

Why Whipsaws Happen

Several market conditions can cause whipsaws:

High Volatility

Fast price movements create false breakouts and unpredictable reversals.

Low Liquidity

Thin markets—where fewer buyers and sellers are active—can create unstable price swings.

News and Economic Events

Unexpected announcements often cause sharp reactions followed by immediate corrections.

Stop-Loss Clusters

When many traders place stop orders around similar levels, price can spike through these levels before snapping back.

Whipsaw vs. False Breakout

These terms are related, but not identical.

- A false breakout is a failed move beyond support/resistance.

- A whipsaw includes both the failed breakout and a sharp reversal that hits traders on the wrong side.

In other words, all whipsaws include false breakouts, but not all false breakouts develop into full whipsaws.

How Traders Reduce Whipsaw Risk

Whipsaws cannot be eliminated completely, but they can be reduced through disciplined risk management and confirmation techniques.

1. Wait for Confirmation

Instead of entering immediately after a breakout, traders often wait for:

- A candle close beyond the breakout level

- Retests that hold

- Volume confirmation

2. Use Wider Stop-Losses in Volatile Markets

A slightly wider stop-loss can prevent the trade from being shaken out by normal volatility.

3. Combine Indicators

Using more than one signal reduces the risk of reacting to noise.

Common combinations include:

- Moving averages with RSI

- Support/resistance with volume

- Trendlines with MACD

4. Trade Higher Timeframes

Whipsaws are common on smaller timeframes.

Daily or 4-hour charts often show more stable trends.

5. Avoid Major News Events

Traders sometimes stay out of the market during central bank announcements, inflation releases, or unexpected political events.

Real Market Example of a Whipsaw

Imagine gold breaks above a strong resistance level at $2,000.

Traders see this as a bullish move and enter buy positions.

However, minutes later:

- A news release strengthens the U.S. dollar

- Gold reverses below $2,000

- Buyers are trapped, creating a whipsaw

This is the classic pattern—initial breakout, then a sudden reversal.

Is a Whipsaw Always Negative?

Not always.

Although whipsaws are frustrating for breakout traders, they can create opportunities for contrarian traders who like to trade reversals.

But this requires experience and strong discipline.

FAQs About Whipsaw in Trading

1. What does whipsaw mean in trading?

A whipsaw refers to a price movement that starts in one direction but suddenly reverses, causing traders to get caught on the wrong side of the market.

2. What causes a whipsaw?

Whipsaws often occur due to high volatility, low liquidity, unexpected news events, or false breakouts around key support and resistance levels.

3. How can I avoid getting whipsawed?

You can reduce whipsaw risk by waiting for confirmation after breakouts, combining indicators, avoiding major news events, and using proper risk management.

4. Is a whipsaw the same as a false breakout?

No. A false breakout is when price fails to continue past a support or resistance level, while a whipsaw includes both the failed breakout and a quick reversal that causes losses.

5. Do whipsaws happen more on lower timeframes?

Yes. Lower timeframes are more sensitive to noise and volatility, which makes whipsaws more frequent compared to higher timeframes like 4H or daily charts.

Final Thoughts

A whipsaw is one of the most challenging price behaviors in trading. It misleads traders with a strong initial move and then reverses sharply. Understanding market conditions, avoiding impulsive entries, and using confirmation techniques can reduce risk significantly.

While whipsaws are part of every market, disciplined strategy and proper risk management help traders navigate them with confidence.