Understanding the types of taxes in Kenya is important for anyone who earns an income, runs a business, or buys goods and services. Kenya’s tax structure is designed to help the government provide public services like healthcare, infrastructure, security, and education. This guide explains every major tax category in simple language so you always know what you are paying for and why.

Overview of Kenya’s Tax System

Kenya’s tax system is managed by the Kenya Revenue Authority (KRA). Taxes are grouped into three main categories:

- Income Taxes

- Indirect Taxes

- Other Government Levies and Duties

Each category covers different types of payments required from individuals or businesses.

1. Income Taxes in Kenya

Income taxes are charged on money earned by individuals or companies. Below are the major types.

a) Pay As You Earn (PAYE)

PAYE is a tax deducted from salaries and wages for employed individuals. Employers deduct and remit it to the KRA every month. The tax is charged based on income brackets, meaning higher earners pay higher rates.

Who Pays PAYE?

- Employees earning a monthly salary.

- Individuals with employment benefits (allowances, bonuses, commissions)

b) Corporate Tax

Corporate tax is charged on profits made by registered companies in Kenya.

Rates include:

- Resident companies: 30%

- Non-resident companies: 37.5%

- Newly listed companies on the NSE (for a limited period): reduced rates, depending on compliance requirements

This tax ensures businesses contribute fairly to national development.

c) Withholding Tax (WHT)

Withholding Tax is deducted at the source before the payment is made to the beneficiary. It applies to certain types of income, such as:

- Professional fees

- Consultancy services

- Rent on commercial property

- Dividends

- Interest income

- Royalties

- Commissions

The rate varies depending on the nature of the payment and the residency of the recipient.

d) Instalment Tax

This is paid by businesses or individuals with non-salaried income. They pay tax in advance based on estimated annual income. Payments are made in four installments during the year.

e) Turnover Tax (TOT)

TOT is a simplified tax for small businesses with an annual turnover between KES 1 million and KES 25 million. The rate is 3% of gross sales, and filing is done monthly.

f) Capital Gains Tax (CGT)

CGT applies when you sell property, land, shares, or other investments and make a profit. The current tax rate is 15% of the gain.

2. Indirect Taxes in Kenya

Indirect taxes are charged on goods and services rather than income. These are included in the price you pay.

a) Value Added Tax (VAT)

VAT is the most common indirect tax. It is applied when you buy goods or services. Businesses collect VAT on behalf of KRA.

VAT categories include:

- Standard rate: 16%

- Zero-rated: 0%

- Exempt goods/services (no VAT charged)

Examples of taxable items include electronics, restaurant meals, fuel, and clothing.

b) Excise Duty

Excise duty is charged on specific goods and services considered harmful or luxurious. It applies to both locally produced and imported items.

Examples include:

- Alcohol and cigarettes

- Fuel and petroleum products

- Soft drinks and bottled water

- Telecommunication services

- Motor vehicles

Excise duty helps regulate consumption and generate revenue.

c) Import Duty

Import duty is charged on goods brought into Kenya. The rate depends on the commodity and is applied at the point of entry.

The duty protects local industries and generates government revenue.

3. Other Taxes, Fees, and Levies

In addition to income and indirect taxes, there are several other levies that individuals and businesses may encounter.

a) Digital Service Tax (DST)

DST applies to income earned from digital services provided within Kenya.

It primarily targets foreign digital platforms offering services like streaming, digital advertising, and online marketplaces.

b) Minimum Tax (Suspended)

Minimum tax was intended to apply to businesses with low or no profit, but it is currently suspended by a court ruling. It is not being collected at the moment.

c) Stamp Duty

Stamp duty is charged on legal documents, especially those related to property transactions and share transfers. The rate varies depending on the type and location of the property.

d) Railway Development Levy (RDL)

RDL is charged on imported goods at 2% of the customs value. The levy helps fund railway infrastructure. More especially with introduction Standard Gauge Railway (SGR) it its used to maintain it.

e) Import Declaration Fee (IDF)

The IDF is charged during the importation process at 3.5% of the customs value. It supports customs handling and processing.

f) Advance Tax

This tax applies to commercial vehicles, such as matatus, buses, and lorries. It is paid annually based on:

- Engine capacity

- Vehicle type

Advance tax is paid regardless of profit or income level.

Why Taxes Matter to Kenyans

Taxes play a major role in supporting Kenya’s development. They fund:

- Public hospitals and healthcare systems

- Road construction and transport networks

- Education programs and schools

- Security and national defense

- Government salaries and public services

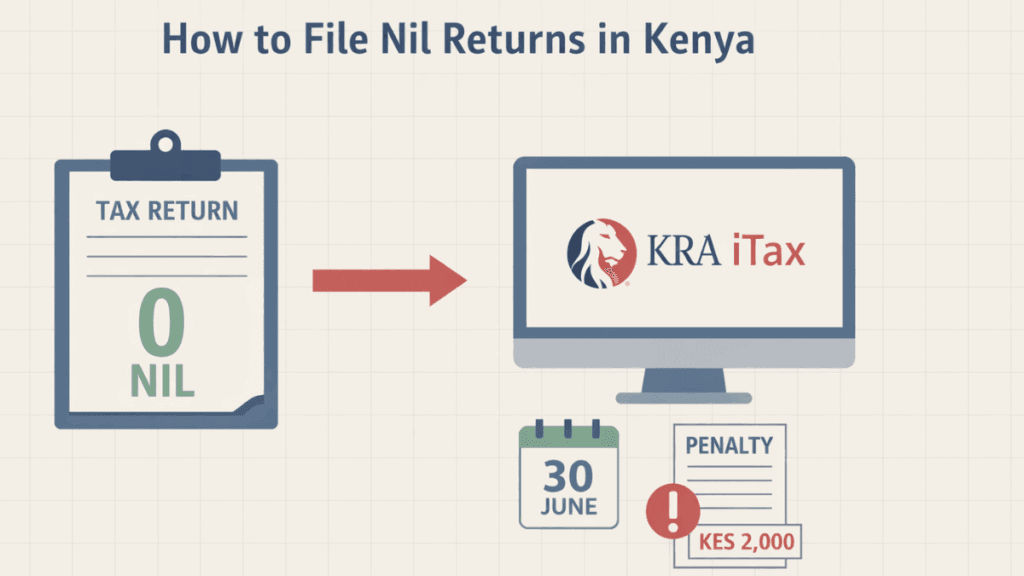

Understanding different taxes helps you stay compliant and avoid penalties.

Final Thoughts

Kenya has a well-structured tax system designed to support national development while ensuring fairness. By understanding the types of taxes in Kenya, individuals and businesses can plan better, file correctly, and meet their obligations with confidence.

Whether you are a salaried employee, a business owner, or a consumer, knowing how each tax works gives you control and helps avoid unnecessary fines.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.