The Ziidi Money Market Fund is one of Safaricom’s newest financial products designed to help Kenyans invest easily and grow their savings. In a market where people want simple, safe, and accessible investment options, this fund aims to provide steady returns with minimal effort. This guide explains what it is, how it works, expected returns, fees, benefits, risks, and whether it is worth your money.

What Is the Ziidi Money Market Fund?

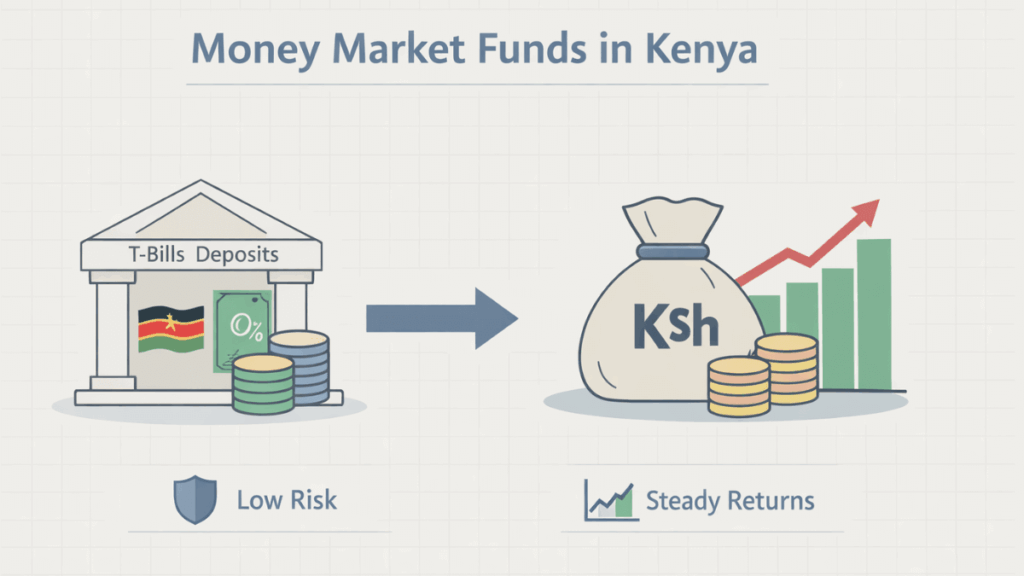

The Ziidi Money Market Fund (MMF) is a low-risk investment product offered by Safaricom that allows users to earn interest on their savings. Like other money market funds in Kenya, Zidii invests in:

- Treasury bills

- Short-term government securities

- High-quality corporate debt

- Fixed deposits with RBY banks

That allows you to deliver stable returns while protecting your capital.

Although Safaricom provides the platform, the fund is managed by a licensed fund manager under the Capital Markets Authority (CMA) regulations. This ensures transparency and investor protection.

How the Ziidi Money Market Fund Works

Zidii MMF operates like a market fund in Kenya, with the added convenience of integration into Safaricom’s ecosystem.

1. You deposit money into the fund

Users can invest through their Safaricom app or M-Pesa interface (depending on rollout). Your deposited amount is pooled with other investors’ funds.

2. The fund manager invests it in low-risk assets

Your money is placed in secure, short-term financial instruments. These are chosen to generate predictable returns.

3. You earn daily interest

Interest is calculated daily and added to your account balance. Withdrawals are flexible, meaning you can access your money whenever you need it.

4. You track your investment inside the Safaricom app

Users can view returns in real time, monitor growth, and withdraw instantly.

Expected Returns from the Ziidi Money Market Fund

Since the fund is new, its long-term performance will become clearer over time. However, Kenyan MMFs generally deliver 8%–12% annual returns, depending on market conditions.

Zidii’s competitive advantage lies in:

- Safaricom’s brand trust

- Simple onboarding

- Fast withdrawals

- High accessibility

If its returns align with or exceed the market average, it will become a strong competitor to existing funds like:

- NCBA Money Market Fund

- CIC Money Market Fund

- Britam Money Market Fund

- Old Mutual MMF

Features of the Ziidi Money Market Fund

1. Low-Risk Investment Product

MMFs focus on secure financial instruments backed by the government or strong institutions.

2. Daily Compounded Returns

Your interest grows every day, allowing your money to compound over time.

3. High Liquidity

You can withdraw anytime, making Zidii one of the most flexible options for short-term savings.

4. Simple Sign-Up Process

Being integrated into the Safaricom ecosystem makes onboarding fast and accessible to millions of Kenyans.

5. Low Minimum Investment

MMFs are known for allowing small deposits, and Zidii follows the same approach, making it ideal for beginners.

Who Should Invest in the Ziidi Money Market Fund?

The Zidii MMF is suitable for:

- Beginners who want a safe starting point

- People saving for short-term goals like school fees, rent, or emergencies

- Business owners who want a safe place to store extra cash

- M-Pesa users who want better returns than standard mobile savings

- Anyone seeking stability with low-risk returns

Benefits of the Ziidi Money Market Fund

1. Easy Access Through Safaricom

No complex forms. No visiting offices. Everything is done through your phone.

2. Better Returns Than Bank Savings

Traditional bank accounts offer low interest. A money market fund generally performs better.

3. Your Money Stays Liquid

You can withdraw anytime without penalties.

4. Ideal for Emergency Funds

Since withdrawals are instant, you can store your emergency savings in the fund and earn interest while keeping your money accessible.

5. Professional Fund Management

Your investments are handled by experts licensed by the Capital Markets Authority.

Risks of the Ziidi Money Market Fund

Even though money market funds are low-risk, they are not risk-free.

1. Returns May Fluctuate

Market conditions change. Interest rates may go up or down.

2. Inflation Risk

Your returns might not always keep up with rising living costs.

3. No Guaranteed Interest

Unlike fixed deposits, MMFs do not guarantee a fixed return.

4. Regulatory Delays

Being a relatively new product, updates or changes could affect rollouts and accessibility.

However, the risk level is still much lower than most other investment products.

Ziidi MMF vs Other Kenyan Money Market Funds

| Feature | Zidii MMF | Other MMFs |

| Platform | Safaricom | Banks/Asset managers |

| Access | Via phone (app) | App, USSD, bank visits |

| Withdrawals | Likely instant | Same-day to 72 hours |

| Minimum investment | Very low | Low–moderate |

| Target market | Mass market | Moderate to broad |

Zidii’s strongest advantage is convenience. Safaricom already has millions of users, which makes entry extremely easy.

How to Invest in the Zidii Money Market Fund (Step-by-Step)

Safaricom may update this process depending on rollout, but these are the expected steps:

Step 1: Open your Safaricom App

Look for the Zidii or “Invest” section.

Step 2: Register for the Fund

Enter your details and accept the terms.

Step 3: Deposit Money

Use M-Pesa or your Safaricom balance to fund your account.

Step 4: Track Returns Daily

See your balance grow inside the app.

Step 5: Withdraw Anytime

Withdraw to M-Pesa or linked accounts instantly.

Is the Zidii Money Market Fund Safe?

Yes. Money market funds are among the safest investment products in Kenya because they invest mainly in government-backed securities and highly-rated financial institutions.

Additionally:

- Safaricom is a trusted company

- The fund manager is licensed by the CMA

- Returns are predictable and stable

It still carries some risk, but it is primarily much safer than stocks, crypto, and highly rated schemes.

Is the Zidii Money Market Fund Worth It?

For most Kenyans, yes.

The fund offers:

- Ease of use

- Consistent returns

- High liquidity

- Low entry requirements

- Trusted brand backing

If you want a reliable place to grow your money with minimal risk, Zidii MMF is a great option.

Final Thoughts

The Zidii Money Market Fund by Safaricom is set to transform how Kenyans save and invest. By combining the stability of money market investments with the accessibility of the Safaricom ecosystem, it delivers professional-grade financial growth to the average user. Whether you want to build an emergency fund, save for upcoming expenses, or earn passive income, Zidii gives you a simple and secure way to grow your wealth.

If you’re looking for a flexible, low-risk investment product with good returns and instant access, Zidii MMF is worth considering.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.