If you want a simple and fast way to fund your Absa account using M-Pesa, the Absa Paybill number makes the process smooth and convenient. Absa Bank Kenya allows customers to deposit money 24/7 using its official Absa Bank Paybill, which is secure, instant, and widely used by millions of Kenyans.

Whether you want to send money to your own account or someone else’s, this guide explains everything in clear, simple language.

What Is Absa Paybill?

The Absa Paybill is a Safaricom Paybill number that customers use to deposit money from M-Pesa directly into an Absa Bank account. Transactions are processed instantly, making it one of the easiest ways to fund your bank account.

Using the Paybill is especially useful when:

- You cannot access a physical branch or ATM.

- You want instant deposits.

- You’re sending money to another Absa customer.

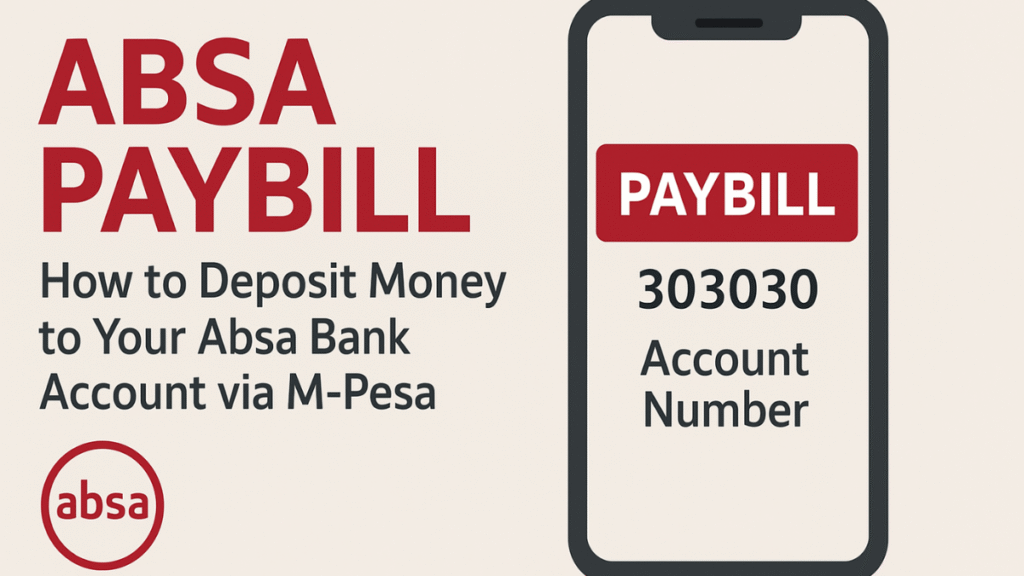

What Is the Official Absa Bank Paybill Number?

The official Absa Bank Paybill number is:

Paybill: 303030

Account Number: Your Absa Bank account number

This is the only recognized Paybill for deposits into Absa Bank accounts in Kenya.

How to Deposit Money into Absa Bank Using M-Pesa Paybill

Depositing money to Absa via M-Pesa only takes a few seconds. Here’s the step-by-step process on how to deposit to Absa Bank:

- Open the M-Pesa Menu (SIM Toolkit or M-Pesa App).

- Select Lipa na M-Pesa.

- Choose Paybill.

- Select Enter Business Number and type 303030.

- Enter Account Number (your Absa account number).

- Enter the Amount you want to deposit.

- Input your M-Pesa PIN.

- Confirm and send.

You will receive two SMS messages:

- One from M-Pesa confirming the payment

- One from Absa Bank confirming the deposit

Example (For Clarity)

If your Absa account number is 123456789, then use:

- Business Number: 303030

- Account Number: 123456789

Absa Paybill Charges

Absa does not charge to receive money via Paybill. However, M-Pesa charges apply depending on the amount you send.

Typical M-Pesa charges include:

- Small deposits may cost a few shillings

- Larger deposits cost slightly more

For the most accurate rates, always check the latest M-Pesa tariff on the Safaricom website or M-Pesa app.

Absa Paybill Limits

Absa follows standard M-Pesa limits:

M-Pesa Transaction Limits

- Maximum per transaction: KES 250,000

- Daily limit: KES 500,000

- Minimum deposit: KES 1

These limits automatically apply to all Paybill payments, including Absa Bank.

Common Reasons Absa Paybill Deposits Fail

Sometimes deposits can fail due to simple issues. Here are the most common causes:

- Indicate a wrong Business Number: If you mistype 303030, the money may go to the wrong Paybill.

- Input of a wrong Account Number: single-digit error may lead to failed or misdirected deposits.

- In case you exceed M-Pesa Limits: If you surpass daily limits, the transaction will be rejected.

- Insufficient M-Pesa Balance: Always confirm your M-Pesa balance before paying.

If money is sent to the wrong account, contact Safaricom or Absa immediately.

Advantages of Using Absa Paybill

Depositing money via M-Pesa is reliable and fast. Some top benefits include:

✔ Instant deposits

Payments reflect in your Absa account almost immediately.

✔ Convenient for remote users

You don’t need to visit a branch.

✔ Safe and secure

Transactions are fully encrypted through M-Pesa and Absa systems.

✔ Available 24/7

You can deposit anytime — even on weekends and holidays.

Can You Deposit to Another Person’s Absa Account Using Paybill?

Yes.

Simply enter the recipient’s Absa account number instead of yours. The money will be reflected in their account instantly.

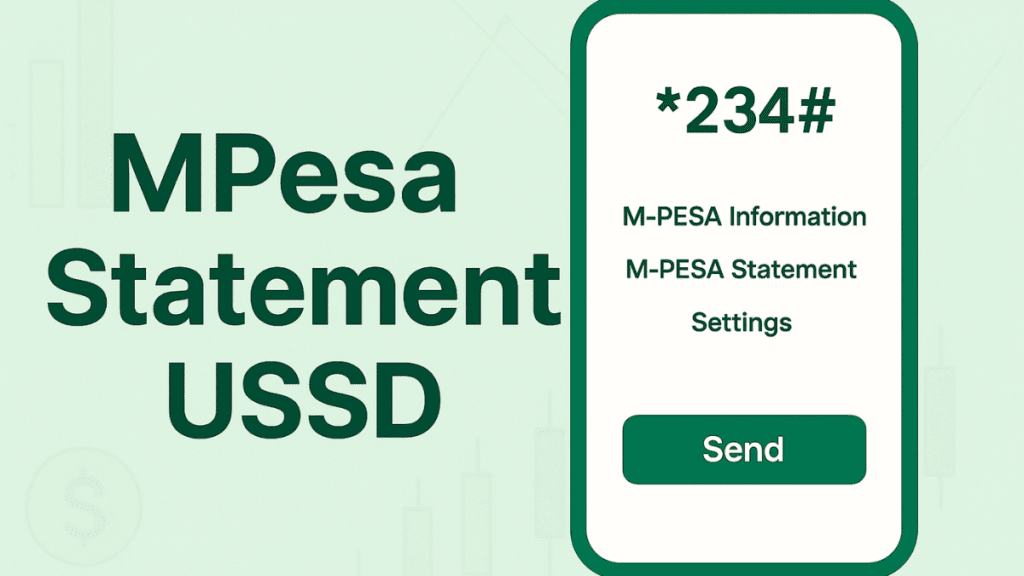

How to Check If Your Absa Paybill Deposit Reflected

After sending money, confirm through:

1. Absa Mobile Banking App

Check your account balance instantly.

2. Absa Internet Banking

Log in and view your statement.

3. USSD Code *224#

This works on any phone without internet.

4. SMS Alerts

You will receive automatic confirmations from Absa.

Frequently Asked Questions About Absa Paybill

1. What is the official Absa Bank Paybill number?

303030.

2. Does Absa charge for Paybill deposits?

No. Absa deposits are free — only M-Pesa charges apply.

3. Can I deposit money using someone else’s phone?

Yes. As long as the account number is correct.

4. How long does it take for the money to reflect?

Almost instantly — usually within seconds.

5. Is Paybill safe for sending money?

Yes. It is secure and widely trusted.

Final Thoughts

Using the Absa Paybill number is one of the easiest and most convenient ways to deposit money into an Absa Bank account in Kenya. Whether you’re topping up your own account or sending money to someone else, the Absa Bank Paybill makes the process smooth, fast, and reliable.

Just remember the two key details:

- Paybill: 303030

- Account Number: Your Absa account number

With this guide, you’re fully set to make secure deposits anytime. I hope this Absa Bank Paybill guide helped you complete your payments smoothly. You may also want to check out our Stanbic Bank Paybill tutorial or discover how to pay using the Kenya Commercial Bank (KCB) Paybill.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.