If you are looking for a simple way to send money to your Consolidated Bank account, the Consolidated Bank Paybill number allows you to deposit funds instantly from M-Pesa. This method is fast, secure, and available 24/7, making it convenient for both personal and business banking.

This guide explains everything you need to know about the Consolidated Bank Paybill number, how to use it, transaction timelines, charges, and common mistakes to avoid.

What Is the Consolidated Bank Paybill?

The Consolidated Bank Paybill is a unique M-Pesa business number that allows customers to transfer funds directly into their Consolidated Bank accounts through Safaricom M-Pesa.

Instead of visiting a physical branch, you can deposit money anytime from your phone. This is especially useful for:

- Cash deposits into your own bank account

- Paying loan installments

- Transferring business payments

- Sending money to another person’s Consolidated Bank account

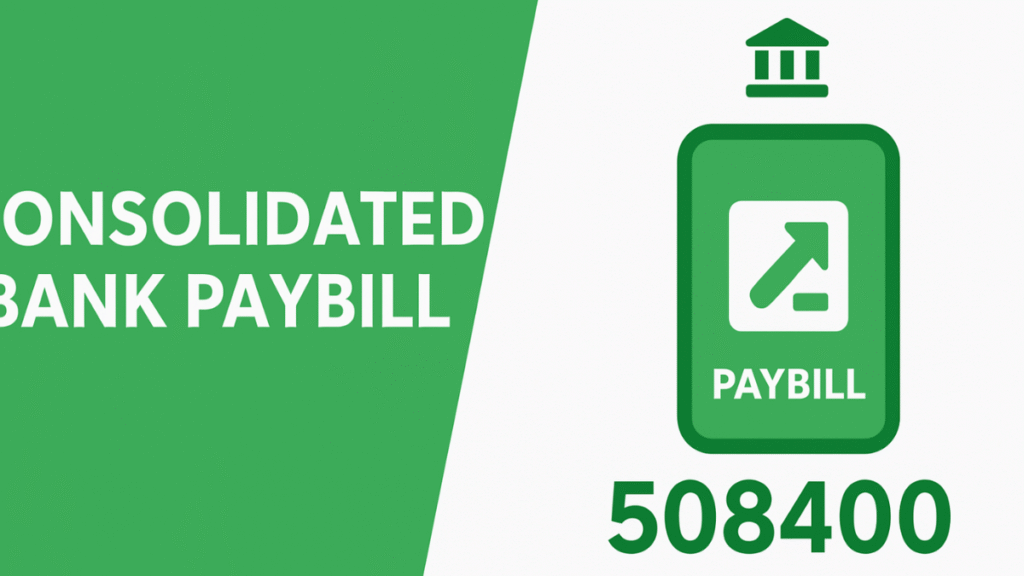

Consolidated Bank Paybill Number

The official Consolidated Bank Paybill number is: 508400

You will need your Consolidated Bank account number as the Account Number when making the transaction.

How to Deposit Money to Consolidated Bank via M-Pesa Paybill

Follow these steps:

- Go to the M-Pesa Menu on your phone

- Select Lipa Na M-Pesa

- Choose Paybill

- Enter Business Number: 508400

- Enter Account Number: Your Consolidated Bank account number

- Enter the Amount to deposit

- Enter your M-Pesa PIN

- Confirm and press OK

You will receive two SMS confirmations — one from M-Pesa and one from Consolidated Bank.

How Long Does It Take for Money to Reflect?

Deposits made via Paybill reflect immediately in most cases.

However, delays may occur during:

- System maintenance

- Network issues

- High transaction volume

If your deposit delays for more than 30 minutes, contact Consolidated Bank customer care with the M-Pesa transaction code.

Why Use Consolidated Bank Paybill?

1. Fast and Convenient

No need to queue at the bank — just use your phone.

2. Available 24/7

Deposits can be made even during weekends and holidays.

3. Safe and Secure

Funds move directly into your bank account. No middlemen.

4. Simple and Accessible

Anyone with an M-Pesa SIM card can deposit funds.

M-Pesa Charges for Consolidated Bank Paybill

The cost depends on the amount sent to the paybill. Typical M-Pesa charges for Paybill ranges are as follows:

- KSh 1 – 100: Free

- KSh 101 – 500: Around 7 KSh

- KSh 501 – 1,000: Around 10 KSh

- KSh 1,001 – 2,500: Around 15 KSh

- KSh 2,501 – 5,000: Around 20 KSh

- KSh 5,001 – 10,000: Around 28 KSh

Note: These are standard M-Pesa Paybill rates. Check the latest Safaricom tariff for updated charges.

Common Mistakes When Using Consolidated Bank Paybill

- Entering the wrong account number

- Using the wrong Business Number

- Sending to the wrong bank account type

- Ignoring confirmation messages

Always verify details before pressing OK.

How to Confirm Your Consolidated Bank Deposit

You can confirm if the money has reflected by:

- Checking your Consolidated Bank mobile banking app

- Dialing USSD service if available

- Visiting a branch

- Calling customer support

What If Money Goes to the Wrong Account?

If you sent money to the wrong Consolidated Bank account:

- Save the M-Pesa transaction code

- Contact Consolidated Bank immediately

- Provide your ID and transaction details

- The bank will start a reversal process

Always act fast to improve your chances of recovery.

Consolidated Bank Customer Care Contacts

- Phone: +254 709 168 000

- Email: customerservice@consolidated-bank.com

- Website: consolidated-bank.com

- Social Media: Available on Twitter and Facebook

You may also visit any branch countrywide.

Can You Withdraw From Consolidated Bank Using Paybill?

No. The Paybill number is for deposit only.

To withdraw, you must:

- Use an ATM

- Visit a branch

- Use Consolidated Bank agency banking

Final Thoughts

The Consolidated Bank Paybill number makes it easy to deposit funds from M-Pesa directly into your bank account without visiting a branch. It is fast, secure, and available every day, making it ideal for personal and business transactions.

Whether you are paying a loan, funding your business account, or sending money to a family member, the Paybill method is one of the most convenient ways to handle your banking.

I hope this walkthrough made your Consolidated Bank Paybill payments simple and stress-free. You may also want to see our National Bank Paybill guide or learn how to make fast transactions using the I&M Bank Paybill.