Asian Session Forex Time in Kenya is one of the most searched topics among traders who want to understand when the global forex market is active and how to trade it profitably. The Asian session is the first major trading session of the forex day, and it sets the tone for price action that continues into the London and New York sessions. For Kenyan traders, knowing the exact timing, market behavior, and suitable strategies is essential for making informed trading decisions.

This guide explains the Asian forex session in Kenyan time, how it works, which currency pairs perform best, and whether it is suitable for beginners or experienced traders. Everything is written in simple, practical language to help you trade with confidence.

What Is the Asian Forex Trading Session?

The Asian forex session is the period when major financial centers in Asia are open and actively trading currencies. It marks the official opening of the global forex market after the weekend and begins the daily trading cycle.

During this session, banks, institutions, and traders from countries such as Japan, Australia, China, and Singapore participate in the market. While trading volume is generally lower than in later sessions, the Asian session plays an important role in shaping early market direction.

Asian Session Forex Time in Kenya

Understanding the exact Asian Session Forex Time in Kenya helps traders plan their charts, alerts, and strategies accurately. Kenya operates on East Africa Time (EAT), which is UTC+3.

Official Asian Session Time in Kenya

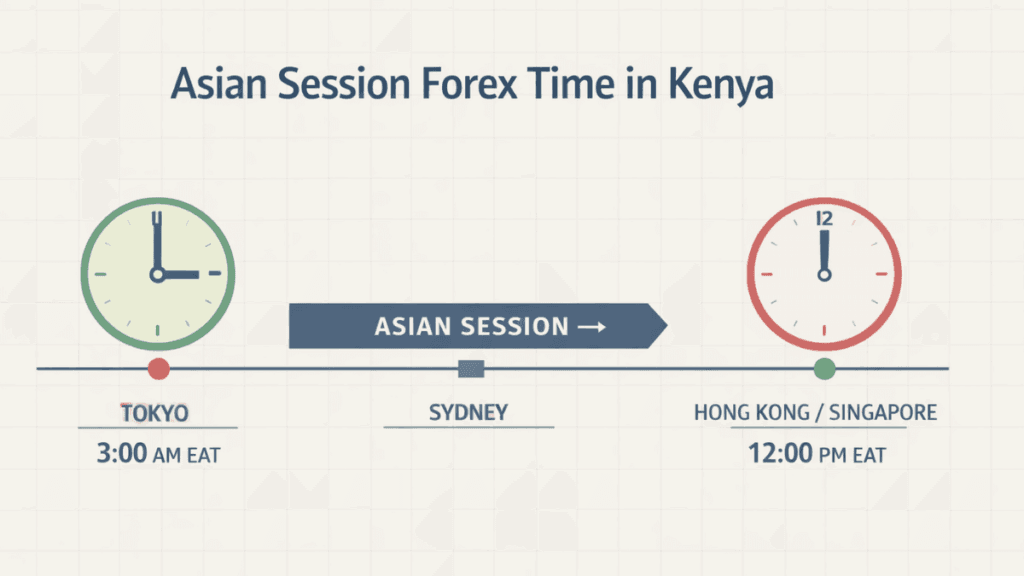

The Asian forex session runs during the following hours in Kenyan time:

- Start: 3:00 AM EAT

- End: 12:00 PM EAT

This timeframe may shift slightly during daylight saving changes in some Asian countries, but Kenya itself does not observe daylight saving time. As a result, the Asian session remains consistent throughout the year for Kenyan traders.

Major Asian Market Opens Within the Session

The Asian session is not driven by one single market. Instead, several regional markets open at different times and contribute to overall liquidity.

Tokyo Market Open (Japan)

Tokyo is the most influential market in the Asian session. It opens at around 3:00 AM EAT and drives much of the early price action, especially in yen-related pairs.

Sydney Market Open (Australia)

Sydney opens slightly earlier and overlaps with Tokyo. While it is smaller in volume, it often influences Australian dollar pairs during the early hours.

Hong Kong and Singapore Markets

These markets open later in the session and contribute additional liquidity, particularly for Asian currency pairs and commodities linked to Asia.

Why the Asian Session Matters to Kenyan Forex Traders

The Asian session is often overlooked by traders who focus only on London or New York hours. However, it offers unique advantages that can suit specific trading styles and schedules.

For Kenyan traders who wake up early or prefer quieter markets, the Asian session can provide structured and predictable price behavior. It is also important for identifying key support and resistance levels that influence later sessions.

Market Characteristics of the Asian Forex Session

Each forex session has its own personality, and the Asian session behaves very differently from London or New York. Understanding these characteristics helps traders avoid unrealistic expectations.

Lower Volatility Compared to London and New York

The Asian session generally experiences smaller price movements. This happens because fewer global institutions are active, and major economic announcements are less frequent.

Lower volatility can be beneficial for traders who prefer stable conditions, but it may frustrate those seeking large, fast-moving trades.

Range-Bound Price Action

Many currency pairs tend to move within clear ranges during the Asian session. Prices often respect previous support and resistance levels, making the session suitable for range-based strategies.

Breakouts do occur, but they are less common unless triggered by major news from Asia.

Best Currency Pairs to Trade During the Asian Session

Choosing the right currency pairs is critical when trading the Asian Session Forex Time in Kenya. Some pairs perform much better than others during these hours.

JPY Currency Pairs

Japanese yen pairs are the most active during the Asian session because Japan is the region’s largest financial center.

Popular options include:

- USD/JPY

- EUR/JPY

- GBP/JPY

- AUD/JPY

These pairs often show cleaner price action and better liquidity compared to non-Asian pairs.

AUD and NZD Pairs

The Australian and New Zealand dollars are also active due to regional economic releases and market participation.

Commonly traded pairs include:

- AUD/USD

- NZD/USD

- AUD/JPY

These pairs can respond strongly to economic data from Australia, New Zealand, or China.

Currency Pairs to Avoid During the Asian Session

Not all currency pairs are suitable during Asian hours. Some pairs tend to move very slowly and produce unreliable signals.

Pairs involving the British pound or the euro often lack momentum during this session. Examples include GBP/USD and EUR/GBP, which usually perform better during the London session.

Best Trading Strategies for the Asian Session

The Asian session rewards patience and discipline more than aggressive trading. Strategies should align with the session’s lower volatility and structured price movement.

Range Trading Strategy

Range trading works well because prices often move between clearly defined support and resistance levels.

Traders identify the high and low of the Asian range and look for price reactions near those levels. This approach focuses on smaller, consistent profits rather than large breakouts.

Breakout Preparation Strategy

While breakouts are less frequent during the Asian session, the price range formed during this time is extremely useful.

Many traders use the Asian session range to prepare for London breakouts later in the day. The high and low of the Asian session often act as key levels during the London open.

Is the Asian Session Suitable for Beginner Traders?

The Asian session can be a good learning environment for beginners, but it depends on expectations and discipline.

Lower volatility means reduced emotional pressure and fewer sudden price spikes. This allows beginners to practice technical analysis and trade management without extreme market stress.

However, beginners must understand that profits may be smaller and trades may take longer to develop compared to London or New York sessions.

Asian Session vs London Session for Kenyan Traders

Many Kenyan traders compare the Asian session with the London session to decide which one fits their lifestyle and goals.

The Asian session offers calm, controlled price action and suits early risers. The London session, which starts in the afternoon Kenyan time, provides higher volatility and more trading opportunities.

Some experienced traders combine both by using the Asian session for analysis and the London session for execution.

Common Mistakes Traders Make During the Asian Session

Trading during the Asian Session Forex Time in Kenya requires adjusting expectations. Many losses come from applying the wrong mindset.

One common mistake is expecting large price movements similar to London or New York. This often leads to overtrading and frustration.

Another mistake is trading non-Asian currency pairs that lack volume, resulting in false signals and slow-moving trades.

Risk Management During the Asian Session

Risk management is especially important during quieter market hours. Tight risk controls help protect capital and improve consistency.

Traders should use reasonable stop-loss levels that account for smaller price ranges. Overly tight stops can lead to unnecessary losses due to minor price fluctuations.

Position sizing should also reflect the session’s lower volatility, avoiding excessive leverage in slow-moving markets.

Economic News That Affects the Asian Session

Although the Asian session is quieter, important economic releases can still impact price action.

Key events include:

- Japanese interest rate decisions

- Australian employment data

- Chinese economic reports

These announcements can cause sudden volatility, especially in JPY, AUD, and NZD pairs. Kenyan traders should always check an economic calendar before trading.

How the Asian Session Influences the Rest of the Trading Day

The Asian session often sets the foundation for the rest of the forex day. Highs and lows formed during this period are closely watched by traders in London and New York.

When price breaks out of the Asian range during the London session, the move is often strong and sustained. This makes Asian session levels valuable even for traders who do not trade during those hours.

Best Tools for Trading the Asian Session

Having the right tools improves decision-making and execution.

A reliable forex broker with stable spreads during low-liquidity hours is essential. Charting platforms that allow session marking and time zone adjustments are also helpful for tracking Asian session ranges accurately.

Final Thoughts

Asian Session Forex Time in Kenya offers a unique trading environment that suits disciplined and patient traders. While it may not provide the excitement of high volatility, it plays a crucial role in the global forex market.

By understanding the exact timing, choosing the right currency pairs, and applying session-appropriate strategies, Kenyan traders can use the Asian session effectively. Whether you trade it directly or use it for analysis, mastering this session adds depth and structure to your overall forex trading approach.

Our financial editorial team covers global markets, economic policy, and investment trends. We combine real-time research with AI-powered writing assistants to deliver accurate, timely, and easy-to-read articles. Our editors review all content to ensure quality, neutrality, and clarity for our readers.