The Kenya Commercial Bank Paybill (also known as the KCB Bank Paybill) makes it easy for customers to send money directly from MPesa to their KCB accounts. Whether you want to deposit cash, pay a loan, or fund your savings account, this Paybill number allows fast, secure, and convenient mobile banking.

In this guide, you’ll learn everything about using the Paybill number, common mistakes to avoid, fees, processing times, and tips to keep your transactions safe.

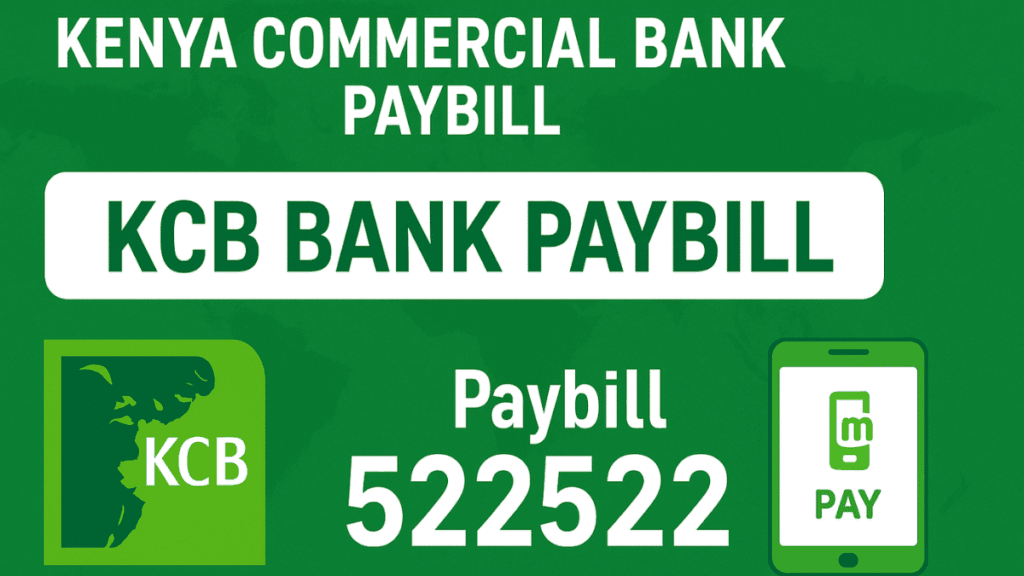

What Is the Kenya Commercial Bank Paybill Number?

The KCB Bank Paybill number is 522522.

This MPesa Paybill allows you to deposit money into any KCB Bank account instantly from your phone. It works for personal accounts, business accounts, loans, and savings products.

You can use it through the MPesa menu, the MySafaricom App, or STK push when available.

Why Use KCB Bank Paybill?

KCB designed its Paybill service to make everyday banking easier. Some key benefits include:

1. Convenience

You don’t need to visit a branch or ATM. You can send money to your account anytime from anywhere.

2. Instant Processing

Most deposits reflect within seconds, making it ideal for urgent payments.

3. Security

Funds are transferred through MPesa, which uses encrypted systems and PIN verification.

4. Works for All KCB Services

You can pay loans, deposit money, or support business transactions using the same number.

How to Deposit Money Using KCB Paybill (522522)

Depositing money to your KCB account through MPesa is simple. Here is the step-by-step process:

Steps to Deposit:

- Open the MPesa menu.

- Select Lipa na MPesa.

- Tap Paybill.

- Enter Business Number: 522522.

- Enter Account Number (your KCB account number).

- Enter the amount you want to deposit.

- Enter your MPesa PIN.

- Confirm and submit.

You will receive two SMS messages—one from MPesa and one from KCB—confirming the transaction.

How to Pay a KCB Loan Using the Paybill Number

If you have a KCB personal loan, business loan, or a credit facility, you can repay using the same Paybill.

Steps:

- Go to MPesa > Lipa na MPesa > Paybill.

- Business Number: 522522.

- Account Number: Enter your loan account number.

- Enter amount.

- Enter PIN and confirm.

Always confirm the correct account number to avoid misdirected payments.

How to Fund a KCB M-Benki or KCB Mobi Account

KCB mobile products like M-Benki and KCB Mobi also accept Paybill deposits.

For M-Benki:

- Use account number registered during M-Benki sign-up.

For KCB Mobi:

- Use your linked KCB account number.

Deposits reflect instantly.

KCB Paybill Charges and MPesa Fees

KCB does not charge customers for Paybill deposits.

However, MPesa fees apply based on Safaricom’s tariff.

The cost depends on the amount you are sending. Always check the updated MPesa charge list on the Safaricom website or app.

Common KCB Paybill Errors and How to Fix Them

Even though the Paybill service is reliable, errors can still happen. Here are the common ones:

1. Wrong Account Number

If you type the wrong account number, the money may go to another account.

Fix: Call KCB customer care immediately.

2. Delayed SMS

Sometimes you may receive the bank confirmation late.

Fix: Wait a few minutes or check your balance via USSD (*522#).

3. Insufficient MPesa Balance

If your funds are not enough, MPesa will reject the transaction.

Fix: Ensure you have enough money plus MPesa transaction fees.

4. MPesa Network Downtime

Rare but possible during peak hours.

Fix: Try again after a short period.

How to Check Your KCB Account Balance After Depositing

You can confirm that your money has reached KCB using several methods:

*1. USSD – 522#

Dial and follow prompts to check your balance.

2. KCB App

Log in and see your real-time balance.

3. ATM

Insert your card and view your account balance.

4. Branch visit

Only needed if there is a transaction issue.

Is the KCB Bank Paybill Safe?

Yes. The service is secure and reliable. MPesa transactions go through encrypted systems, plus you authorize every transaction with your PIN. As long as you keep your PIN private, your account remains safe.

KCB also monitors transactions for any suspicious activity.

Frequently Asked Questions (FAQs)

1. What is the official KCB Paybill number?

The official KCB Paybill number is 522522.

2. Can I deposit it to another person’s KCB account?

Yes, as long as you enter their correct account number.

3. How long does a Paybill deposit take to reflect?

Usually instantly, but it can take a few minutes during high-traffic periods.

4. Can I reverse a wrong KCB Paybill transaction?

Yes. Contact KCB customer care immediately for assistance.

5. Is there a limit on how much I can deposit?

Limits follow MPesa transaction rules, including daily caps.

Final Thoughts

The Kenya Commercial Bank Paybill (KCB Bank Paybill 522522) is one of the most convenient ways to deposit money, pay loans, support businesses, and manage your account directly from MPesa. It is fast, secure, and reliable, making everyday banking easier for millions of customers.

By understanding how it works and following the steps in this guide, you can make smooth transactions every time.

I hope this article helped you complete your payments with the KCB Paybill number. You may also want to check out our Absa Bank Paybill guide or explore how to make payments using the Equity Bank Paybill.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.