If you’re looking for the simplest way to move money from M-Pesa to your Standard Chartered Bank account, the Standard Chartered Paybill (also known as the Stanchart Paybill) is the fastest and most reliable method. Many customers in Kenya prefer using M-Pesa because it’s instant, convenient, and works 24/7—even when the bank is offline.

This guide gives you a full breakdown of the paybill number, the step-by-step deposit process, charges, alternatives, and common issues you may face.

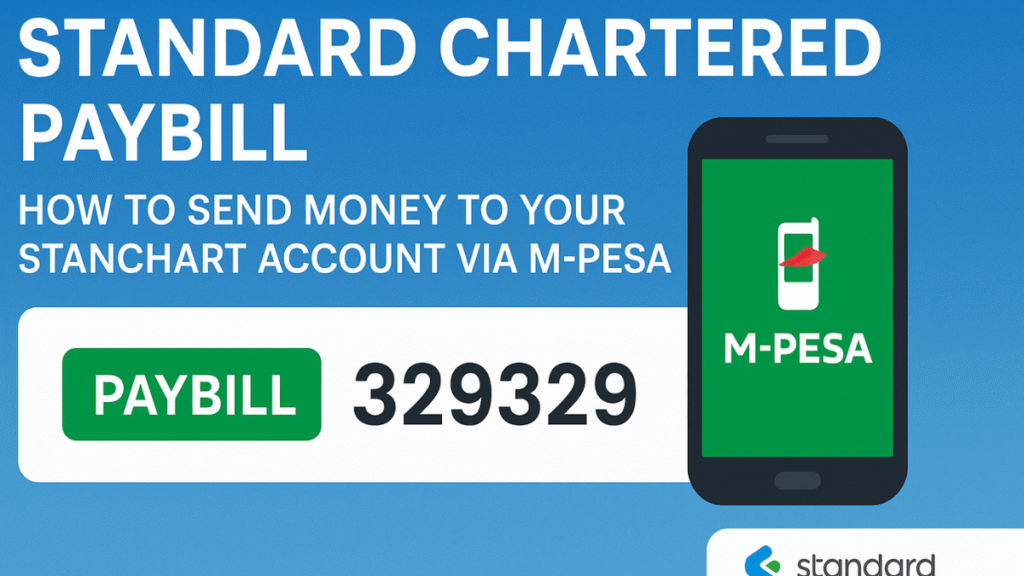

What Is the Standard Chartered Paybill Number?

The official Standard Chartered Paybill number is 329329.

This is the number you enter under “Business Number” when depositing funds from your M-Pesa account to your Standard Chartered (Stanchart) bank account.

Why Use the Stanchart Paybill?

Depositing money using the Standard Chartered Paybill offers several advantages:

- Money reflects instantly in most cases

- Safe and secure channel approved by Safaricom

- Available 24 hours a day

- Works for all Standard Chartered current and savings accounts

- No need to visit a branch or ATM

It’s especially helpful if you need to top up quickly before making payments or securing transactions.

How to Deposit Money to Standard Chartered Using M-Pesa Paybill

Below is the exact process you should follow on your phone:

Step-by-Step Guide

- Go to your M-Pesa Menu

- Tap Lipa na M-Pesa

- Select Paybill

- Choose Enter Business Number

- Type 329329 (Standard Chartered Paybill Number)

- Enter your Standard Chartered Account Number as the Account Number

- Type the amount you want to deposit

- Confirm and enter your M-Pesa PIN

- You’ll receive an M-Pesa confirmation SMS

- Standard Chartered will also send an SMS when the money reflects

Your deposit should reflect instantly unless there is a temporary network delay.

Available Accounts You Can Fund Using Standard Chartered Paybill

You can use the Stanchart Paybill to top up the following:

- Savings accounts

- Current/transactional accounts

- Joint accounts

- Foreign currency accounts (converted automatically at bank rates)

- Credit card accounts (via the card payment option inside the SC Mobile App)

Standard Chartered Paybill Charges

Standard Chartered does not charge any additional fee for receiving money via Paybill. However, M-Pesa will charge you a transaction fee depending on the amount you send.

Here’s what affects the cost:

- The amount you are depositing

- Your current M-Pesa tariff plan

- Weekly transaction limits

For most deposits, the fee is relatively small and paid directly to Safaricom.

Standard Chartered Deposit Limits

Below are Standard Chartered Daily and Monthly Deposit Limits, like all the amounts of transactions:

- Maximum per transaction: KSh 250,000

- Maximum per day: KSh 500,000

- Maximum M-Pesa wallet limit: KSh 500,000

If you want to deposit more than this, the bank will require a transfer through EFT, RTGS, or a cash deposit at the branch.

How Long Does It Take for Money to Reflect?

Most deposits reflect:

- Instantly

- Occasionally within 1–5 minutes during network congestion

- Rarely up to 30 minutes during system delays

If it takes longer, reach out to Standard Chartered customer support with your M-Pesa transaction code.

Common Mistakes to Avoid When Using Standard Chartered Paybill

Even though the process is simple, mistakes happen. Here are things to watch out for:

1. Wrong Account Number

Double-check your account number to avoid delays or failed deposits.

2. Using the Old Paybill Number

Always use the current official paybill: 329329.

3. Sending Above Your M-Pesa Limit

Split large payments if needed.

4. Sending Money During System Downtime

Although rare, bank maintenance may delay confirmation.

How to Confirm Your Deposit in the SC Mobile App

Once you deposit, you can verify the transaction in a few seconds:

- Open SC Mobile Kenya App

- Log in

- Go to Accounts

- Select your account

- Check your latest transactions

If the deposit doesn’t appear yet, give it a few minutes.

Can You Pay Standard Chartered Credit Card Using M-Pesa Paybill?

Yes—but NOT using the standard paybill number.

Instead:

- Log in to SC Mobile App

- Choose Payments

- Select your Credit Card

- Make the payment from your Stanchart account

To fund your Stanchart account, however, you can still use the Standard Chartered Paybill (329329).

What If Your Money doesn’t Reflect?

If your deposit is delayed:

- Wait at least 10 minutes

- Check your account balance on the SC Mobile App

- CoStandard Charteredndard Chartered support

Support Contacts

- Phone: +254 703 093 000

- Email: ke.contactcentre@sc.com

Have your M-Pesa transaction code ready for faster assistance.

Alternative Ways to Deposit Money to Standard Chartered

If Paybill isn’t convenient at the moment, here are other ways:

1. Bank-to-Bank Transfer

From any bank via EFT or RTGS.

2. ATM Cash Deposit

Selected Standard Chartered ATMs support cash deposits.

3. Over-the-Counter Deposit

Visit any Standard Chartered branch countrywide.

4. Mobile Money Transfers Within App

If you have another account linked inside SC Mobile, you can transfer internally.

Benefits of Using Standard Chartered Paybill for Deposits

Choosing the Stanchart Paybill offers many advantages:

- Fast and always available

- Works from any phone

- No paperwork or queueing

- Good for emergencies

- Secure and encrypted

- Instant payment records from both M-Pesa and the bank

This is why most Stanchart customers rely on it daily.

Final Thoughts

Using the Standard Chartered Paybill (also known as the Stanchart Paybill) is the easiest and most convenient way to deposit money into your bank account in Kenya. It’s fast, secure, and accessible to everyone using M-Pesa. Whether you’re paying bills, topping up your bank account, or moving funds urgently, paybill 329329 gets it done smoothly.

If you follow the steps above and double-check details like your account number, your deposit will always reflect without any issues.

I hope this article helped you make payments using the Standard Chartered Paybill number. You may also want to explore our Family Bank Paybill guide or see how to transact quickly through the NCBA Bank Paybill.

Vincent Nyagaka is the founder of Chweya, where he breaks down complex financial topics into simple insights. A trader since 2015, he uses his market experience to help readers better understand investing, trading, and personal finance.